Markets rebound as RBNZ releases revised capital requirements (WHC, MFG)

WHAT MATTERED TODAY

Cooler heads prevailed across the market today with the index opening higher and despite being choppy, it stayed higher throughout the session buoyed by positive whispers around trade. As we suggested this morning, Trump wants / needs a trade resolution with China – a full-blown trade war with the world’s second largest economic superpower will almost inevitably lead to a global recession which is no good for his election prospects. That said, it’s clear from the last few days that the market had priced in a done deal and anything less than that will be seen as a disappointment.

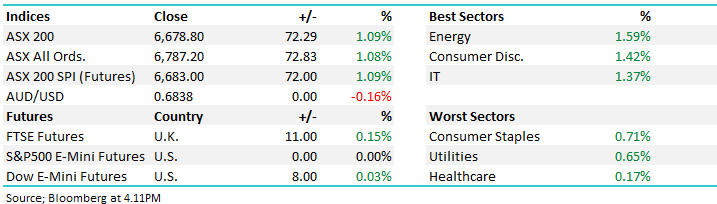

At a sector levels today, we had strongest buying across the energy stocks thanks to falling stockpiles overnight, while consumer discretionary and IT also rallied hard. Healthcare lagged but still managed finish in the black, US Futures were again muted through our time zone while Asian markets followed our market higher.

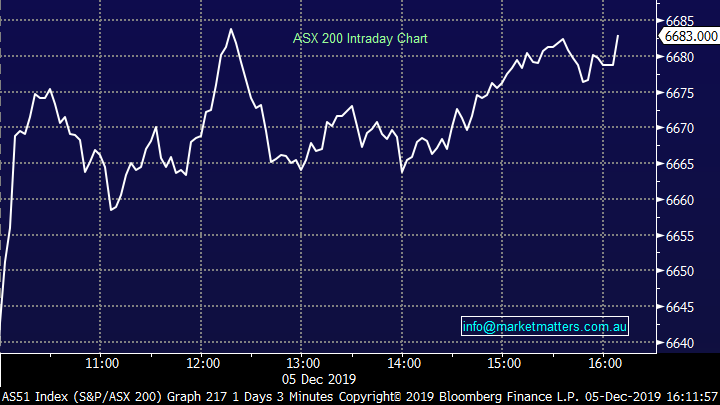

Overall, the ASX 200 gained +76pts /+1.16% today to close at 6683. Dow Futures are trading marginally higher by 8pts/0.03%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

RBNZ Capital requirements: ANZ was in a trading halt on open this morning while the RBNZ announced their final determination around capital requirements. As expected, they increased Tier 1 capital requirements to 16% (banks currently holding 13.8%) however they increased the time frame for compliance to 7 years up from the 5 years that was expected. This is a better result for the banks, and they all rallied on the back of it, ANZ most influenced here and they topped the gains for the sector today closing up 2.11%.

There was concern that more onerous capital requirements would force ANZ to raise capital, however that now seems unlikely. According to ANZ, they need additional capital of $3bn over the 7 years which can be generated organically. Many in the mkt were expecting a capital call upwards of ~$5bn which has proved overzealous. All in all, some ‘less bad’ news for the banks than it could have been.

Magellan (MFG) +3.6%; no surprise that Magellan closed higher today on the market’s rebound, but the stock was also out with their FUM flow update for November and the big fundie once again posted some significant growth. FUM is nearing the $A100b mark after adding another $4.2b in the month with $97.7b as at the end of November. The bulk of the gain came from market moves while retail and institutional investors tipped in an additional $410m. It’s a quality name ingrained in many portfolios and a great way to leverage a positive move in the markets – particularly the US Nasdaq.

Magellan (MFG) Chart

Whitehaven Coal (WHC) -11.03%; downgraded guidance today on labour issues and drought impacts to their Maules Creek mine set to squeeze production and increase costs. Maules Creek is their biggest operation by volume, producing around half Whitehaven’s output. Run of mine (ROM) production expectations for FY20 here were cut ~8% to 10-11Mt, impacting total production by around 5%. Unit costs for the group are expected to climb to $A 73-75/t, up nearly 6%. So, costs up, revenue down and stock smashed as a result. Whitehaven will start to look interesting when all of these flushes out, although broker coal price estimates remain well above the current spot.

Whitehaven Coal (WHC) Chart

Broker moves;

· SeaLink Rated New Buy at Canaccord; PT A$5.58

· Telstra Raised to Buy at UBS; PT A$4

· Janus Henderson Rated New Inline at Evercore ISI; PT $26

· Viva Energy REIT Rated New Buy at Shaw and Partners; PT A$2.93 – I’ll cover this one in the income note soon, worth a look

· BHP Reinstated Equal-Weight at Morgan Stanley; PT A$39.40

· Santos Raised to Buy at Morningstar

· GrainCorp Raised to Buy at Morningstar

· NAB Raised to Buy at Morningstar

· oOh!media Cut to Hold at Morningstar

· Bapcor Raised to Buy at Morningstar

· CSL Cut to Neutral at JPMorgan; PT A$270

· Dexus Raised to Outperform at Credit Suisse; PT A$12.32

· Perenti Global Raised to Buy at Argonaut Securities; PT A$2.20

· WiseTech Raised to Hold at Bell Potter; PT A$25

OUR CALLS

No changes to the portfolios today, yesterday we sold the BBOZ and bought Computershare.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.