Markets meander into the weekend

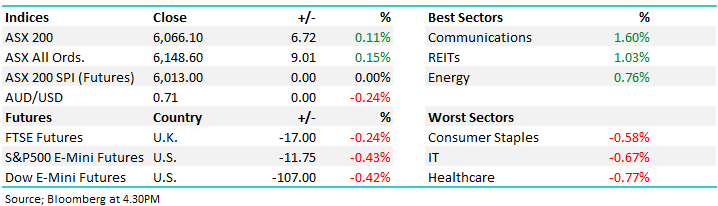

WHAT MATTERED TODAY

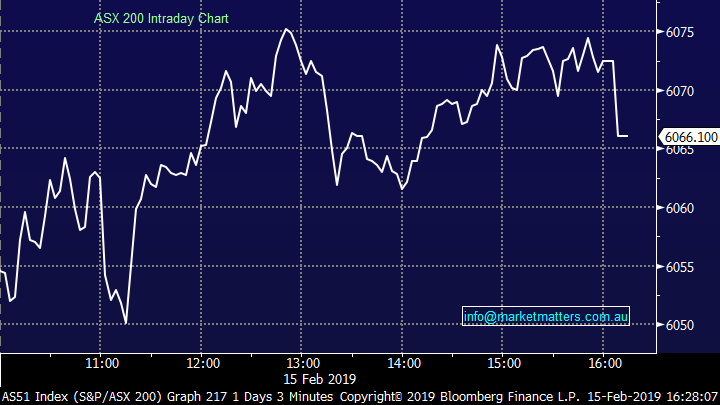

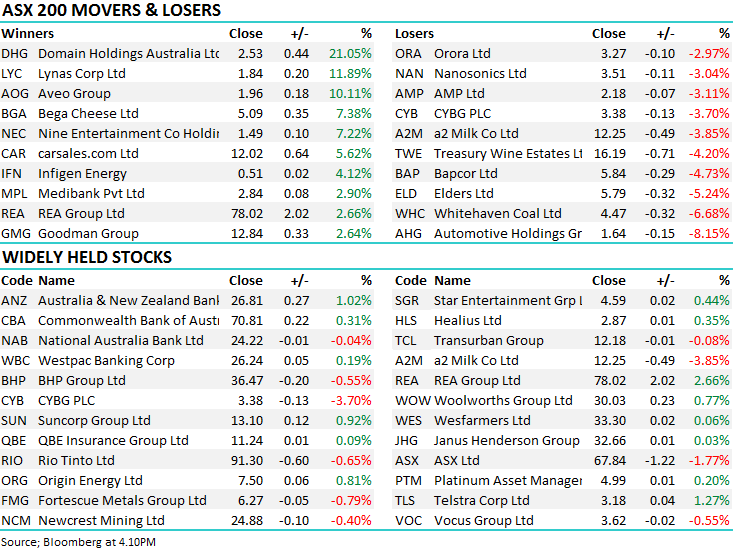

The market chopped around par today and was once again dominated by company results….US Futures were lower but our market simply ran its own race – it’s been doing it all week and what’s more, weakness in US futures has typically been leading to strength locally implying that the long SPI / short S&P has been playing out during our time zone.

It’s been a huge week on the desk, and another one coming up next week as reporting rolls on. I’m off to see Xaviar Rudd at Taronga Zoo tonight with the bride and a few friends – (i.e no kids!!). A blue bell afternoon in Sydney at the moment leading to a cracking night.

Overall today, the index closed up +6pts or +0.11% today to 6066 and was up down -0.09% for the week. Dow Futures are trading down -97 points / -0.39%.

ASX 200 Chart

ASX 200 Chart

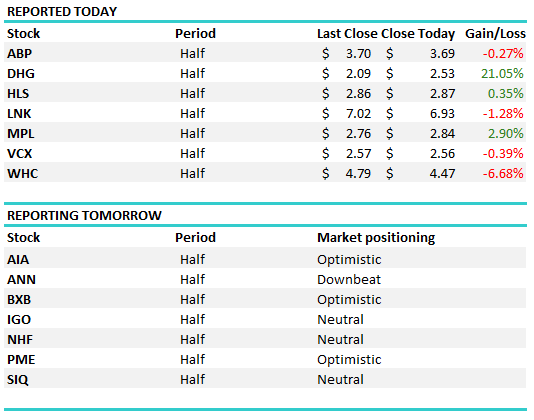

Reporting; Another solid week or reporting and we’re now at the midpoint – next week has a similar volume of companies out with Wednesday being a huge day.

Whitehaven Coal (ASX:WHC); While they printed strong numbers on all financial parameters (NPAT, EBITDA CF up 11%, 12% and 5% respectively) they missed the lofty market expectations of the market at the NPAT, Sales and EBITDA line by 20%, 2% and ~10% respectively – which is big on the flipside, the Board has proposed to pay an unfranked dividend of 20 cents per share to shareholders to be comprised of an interim dividend of 15 cents and a special dividend of 5 cents – Market expectation was 20c so inline; and this takes total shareholder return over the past 18 months to 80 cents per share, or almost $800 million. Nice. We are looking at WHC more closely after today’s 6% drop

Whitehaven Coal (ASX:WHC)

Vicinity Group (ASX:VCX) -0.39%, 1H19 result was lower than expected with funds from operations -2.3% on pcp to $349.5m vs expectations of ~$360m. The issue looking like more of a timing one around asset divestments rather than anything more sinister as well the impact of the share buy-back. FY19 guidance was reiterated at FFO/share of 18.0-18.2¢ which is a positive. The other interesting aspect was around some positive momentum in retail sales, consistent with what we witnessed at VCX’s 1Q FY19 update. Given the delay in asset sales, coupled with the impact of the share buy-back, the lack of upgrade to guidance is surprising – not sure why however this is on our radar.

Domain Holdings (ASX:DHG) +21.05% - a cracking day for the listing company with net profit coming in at $21.1m which was around 10% above expectations. The market was negative this stock with the shorts going to town recently - rising to 6% of issued capita. . NEC now also worth watching given their DHG holding.

Domain (ASX:DHG)

Other companies reporting today…

Sectors this week; A mixed bag – CSL had weighed on Healthcare

Stocks this week;

Some of the stock specific events we covered during the week…

Telstra Result; Dividend was cut again however stock now in a more sustainable footing. Click here

CarSales; Why the stock should trade lower. Click here

Macquarie Group; Another strong update from Macquarie, but is the market too optimistic? Click here

Bendigo Bank; A poor result highlighting the challenges faced by Australia’s second tier lenders. Click here

Medibank Private: Result today a good one. Click here

NAB Hybrid: A new hybrid was put to market from NAB this week and there was very strong demand – we penned this note before the broker book build closed on Wednesday. Click here

OUR CALLS

No changes to the portfolios today.

Watch out for the weekend report. Have a great night,

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/02/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.