Markets hit on virus concerns, although buyers again prevalent into weakness (FPH, JIN)

WHAT MATTERED TODAY

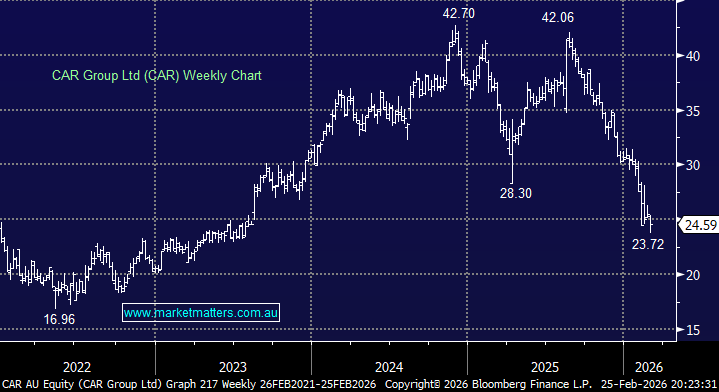

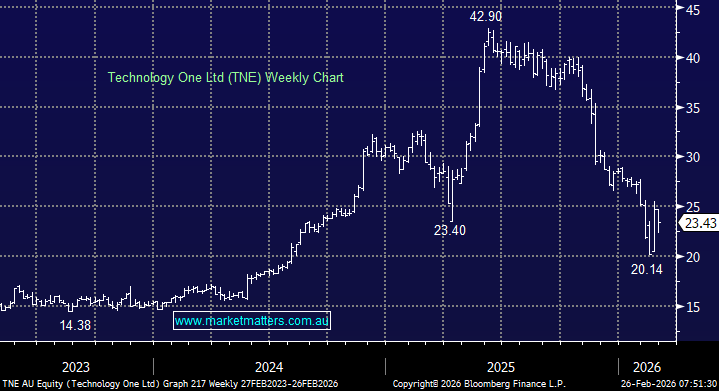

While it was clearly a risk off session following the -730pt slide by the Dow Jones on Friday, the selling wasn’t aggressive and Futures have rallied strongly into / after the close of cash trading to be up around the daily highs. The rise in COVID-19 cases has clearly accelerated which is generating a lot of negative headlines internationally, particularly in the US, and although I never want to be accused of being a ‘Trump mouthpiece’, the rise does correlate with increased testing. In any case, the stats are concerning, hence the market is on edge, however I get the feeling that the easy call of cases rising / sell equities will prove too simplistic this time around. As we suggested this morning, the stock markets largest fear is often uncertainty and if the COVID-19 journey while tough and unpredictable doesn’t throw up too many nasty surprises it might just ”get used to it” in its own optimistic way, an outcome we’ve seen before and will see again.

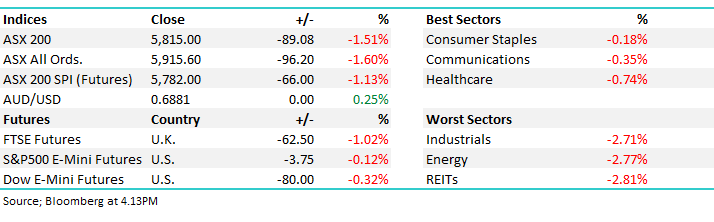

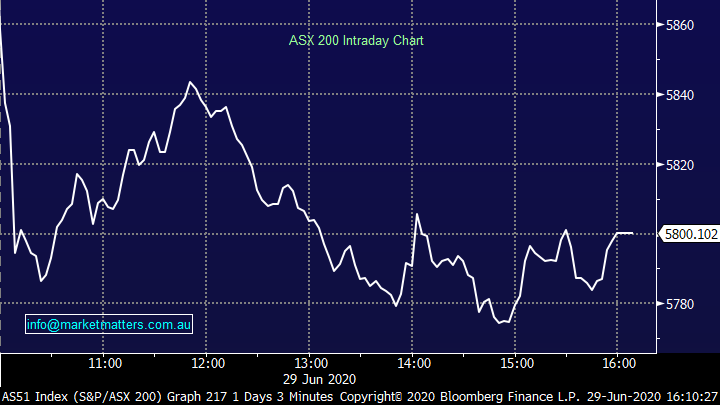

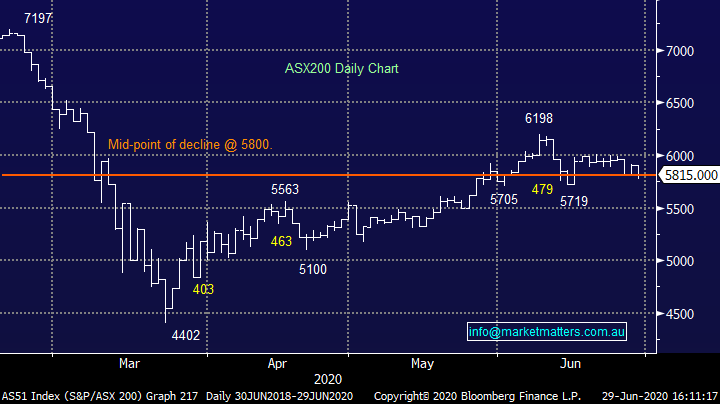

It was a choppy session overall today with early weakness bought into only for the sellers to get the upper hand by midday. Property stocks hit hardest, although a number of them traded ex-dividend making the Energy stocks the weakest overall. While the cash market closed at 5800, futures have rallied since. Asian market all traded lower today while US Futures have been in and out of positive territory, currently trading flat.

Overall, the ASX 200 down -90pts / -1.51% today to close at 5815 - Dow Futures are trading flat

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

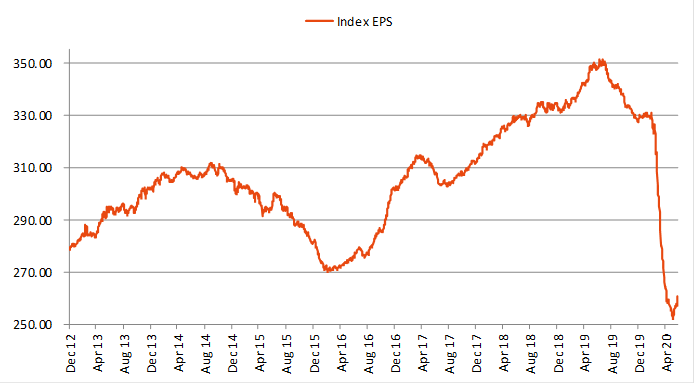

Earnings Expectations: This chart caught my eye this morning which looks at index earnings per share (EPS) estimates, in other words, what analysts expect the index as a whole to earn on a per share basis. The large deterioration in EPS expectations has underpinned the rise in valuations, hence the growing calls that the market is very overpriced given prevailing conditions. That argument relies on analysts getting earnings right, and from what I can tell, analysts have cut hard on the back of companies pulling guidance (i.e. companies don’t have a handle on what it means, let along analysts!) The chart below shows a slight uptick here which is stemming from a number of larger caps coming out with reinstated guidance which has been better than feared (retailers an example). In any case, we can clearly see that EPS expectations are bearish, but are showing some tentative signs of bottoming / moving higher.

Source: Shaw and Partner

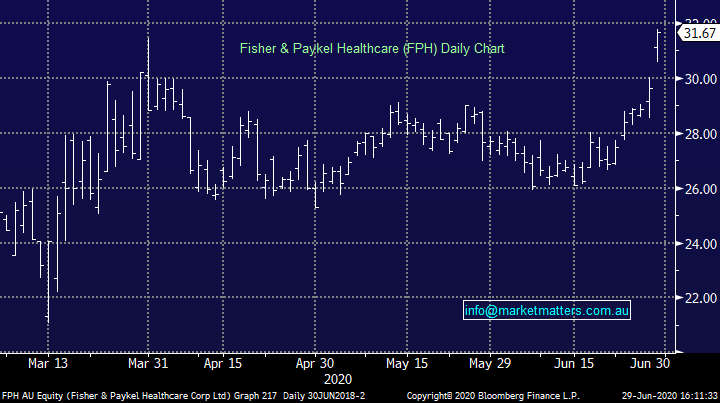

Fisher & Paykel (FPH) +6.88%:After a period of consolidation, FPH traded strongly higher today + broke out of its range on the back of a strong full year update (31st March yearend). Revenue was up 18% on last year to $NZ1.26b, ahead of the $NZ1.24b expected while after tax profit was also a beat at $NZ 287m v $NZ 277m expected by the market. They put in all the usual caveats about uncertainty for FY21 then guided to $NZ1.48b revenue dropping to $NZ 340m in after tax profit, which was in-line with current expectations.

Fisher & Paykel Healthcare (FPH) Chart

Jumbo Interactive (JIN) -13.23%: Hit hard after resuming from a prolonged suspension following a new 10-year reseller agreement with Tabcorp, the terms mean more for TAH, less for JIN hence the sell-off in JIN (TAH added +0.91%). It seems to me there was a lot of back and forth here in a deal that is important for JIN and while it provides some certainly, the terms are clearly less attractive that the mkt implied. Hard to get excited about JIN.

Jumbo Interactive (JIN) Chart

BROKER MOVES:

· Altium Rated New Buy at Jefferies; PT A$40.66

· 3P Learning Raised to Overweight at Morgan Stanley; PT A$1.10

· Galaxy Resources Cut to Neutral at Credit Suisse

· QBE Insurance Raised to Buy at Bell Potter; PT A$9.70

OUR CALLS

No changes today

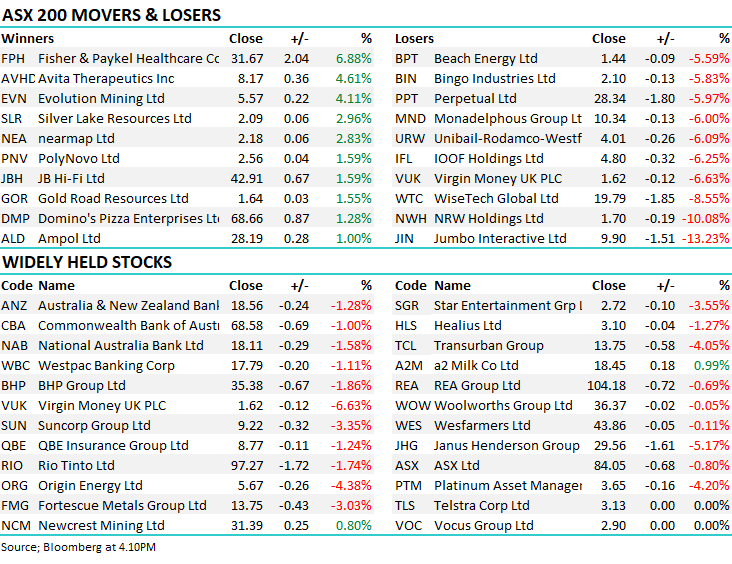

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.