Markets higher on positive G20 outcome (APT)

WHAT MATTERED TODAY

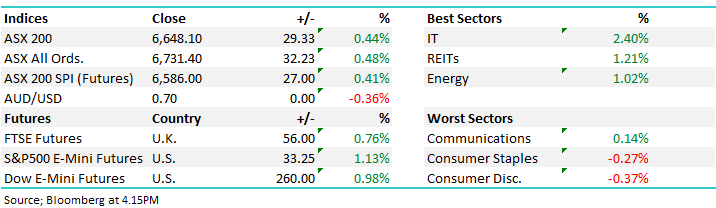

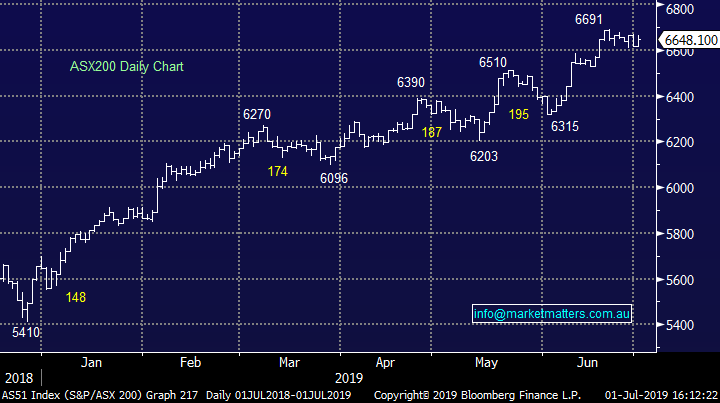

The ‘Trump bump’ happened early with the ASX keying off strength in US Futures which opened +1% higher before our open, the ASX 200 trading up to a 6664 high (+43pts) early in the session before tracking lower into the close. Clearly most were positioned for a positive outcome from US/China talks at the G20 over the weekend and while no firm resolution was penned a conciliatory stance was obvious from both sides – the market now focussing on ‘what next’ after end of financial year, Trump & Xi are friends again and interest rates are low – but that’s priced in. Earnings the next major catalyst with earnings season in the US just around the corner while our own full year results will be upon us in the next few weeks.

To date the market has been focussed on low rates being supportive of stocks, which is right unless we see the reason for low rates come out this reporting season i.e. weak earnings. That said it seems to me there is a degree of expectation around this outcome – earnings are weak hence rates are low but what if earnings actually come in okay. That’s the non-consensus view right now and with a backdrop of low interest rates and reasonable earnings stocks would clearly trade meaningfully higher. So while we’re conscious that markets have run hot and are due a pause, even the selling today was on low volume and without conviction implying the market could easily continue to move simply thanks to a lack of sellers more than anything.

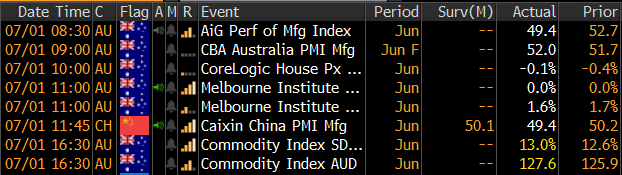

On the economic front today, house price declines have bottomed by the look and activity is picking up while Chinese manufacturing data was better than expected which supported the material stocks locally.

US Futures traded up and stayed up for most of our session, Dow Futures +277pts & S&P Futures +1.10% on our close implying a positive open overseas tonight, while Asian markets were strong across the board today, mostly up around ~2.5%.

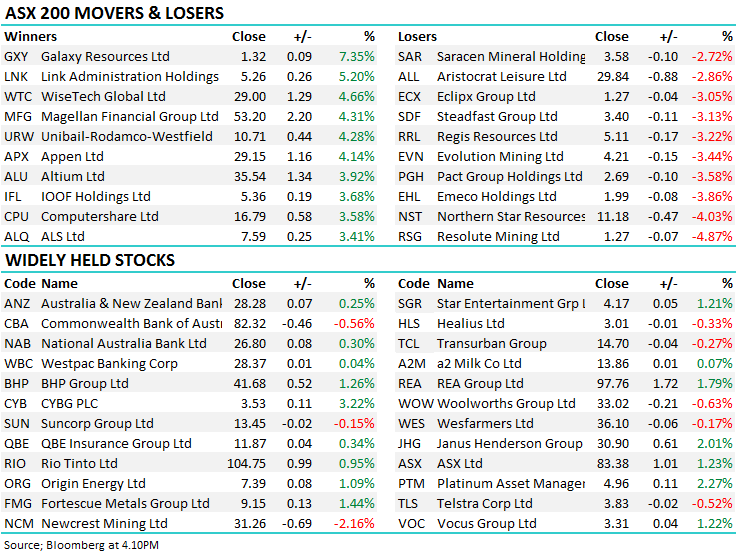

Overall, the ASX 200 added +29 points or +0.44% to 6648. Dow Futures are trading up +277pts / +1.05%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Buy now pay later: After a stellar FY19 performance, shares in the buy now pay later (BNPL) space have started the new financial year off on the back foot. Both Z1P and APT traded lower today on the back of news Visa will look at pushing into the space. Zip & AfterPay were up 283% and 168% respectively for FY19, some of the best across the ASX. The card provider released a press statement late in the session on Friday that threw prices in the two local providers into disarray.

Although Visa is not a product provider, it plans to introduce options to pay in instalments through the issuers that offer their cards. Clearly Visa has the upper hand in terms of customer access, with millions in Australia, and billions of customers already using their products globally. The announcement though is very light on detail, and only targets 2020 as the launch of trial options but any suggestion that a company of this size and reach would be eyeing off the plunge into BNPL should have investors nervous. In saying this, Visa aren’t the first big name to threaten entry and will add noise to the already volatile stocks – aggressive traders could look to buy the big dips in each name. For now we expect weakness to persist in both.

Afterpay touch (APT) Chart

Data on loan growth & housing: Some interest stats from recent RBA & APRA Data on housing thanks to Brett Le Mesurier

· The RBA data showed the following:

· Total credit growth has slowed to 3.6% for the year ending 31/5/19 which comprised 3.7% growth for housing and 4.5% for business;

· Housing credit growth continues to be solely supported by owner/occupiers which provided growth of 5.3% for the year ending 31/5/19; and

· The annualised credit growth for the month of May, 2019 was 2% p.a. with home loan growth being 3%.

· The APRA data showed:

· Major bank monthly home loan growth has been increasing from the low point in January this year;

· Major banks reported 2% loan growth for the year ended 31/5/19. Housing loan growth was 2.1% and business loans were 2.4%;

· All home loan growth comes from owner/occupiers;

· Major bank household deposit growth was 3% for the year ending 31/5/19 which means that 82% of home loan growth in the past year was funded by household deposits.

· Individually:

· ANZ is faring the worst because it has the lowest loan growth and they had the greatest reduction in the Australian loan to deposit spread last year;

· Both CBA and WBC have accelerated owner/occupier and investor home loan growth;

· CBA continues to reduce corporate loan exposures in an attempt to reduce low ROE assets.

Source: Shaw Research

Broker moves; Clearly private school holidays in NSW have started with the amount of broker moves today.

- Nine Entertainment Reinstated at Goldman With Buy; PT A$2.35

- Seven West Reinstated at Goldman With Neutral; PT A$0.50

OUR CALLS

**No changes across domestic or international portfolios today**

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 1/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence