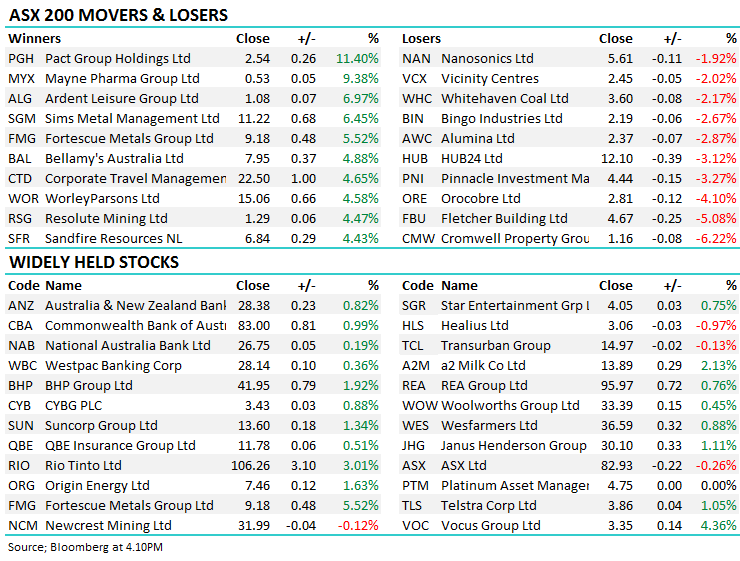

Markets grind up again into year end (BIN, PGH)

WHAT MATTERED TODAY

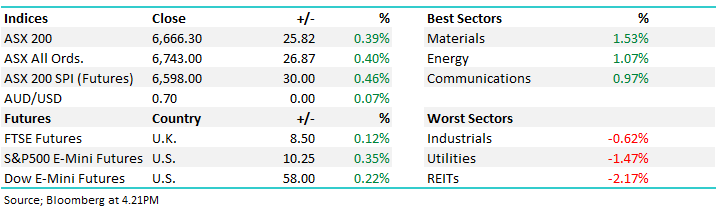

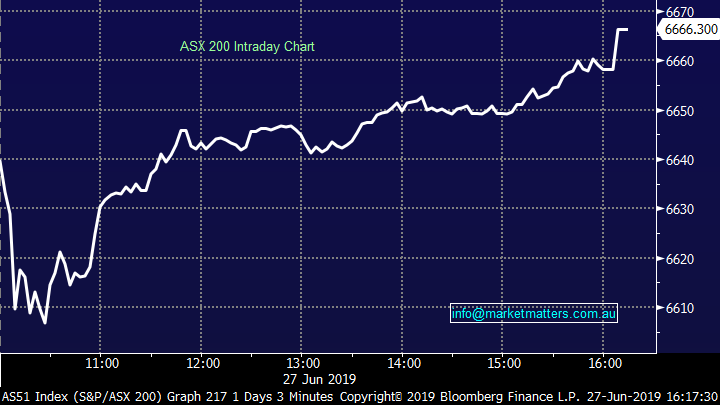

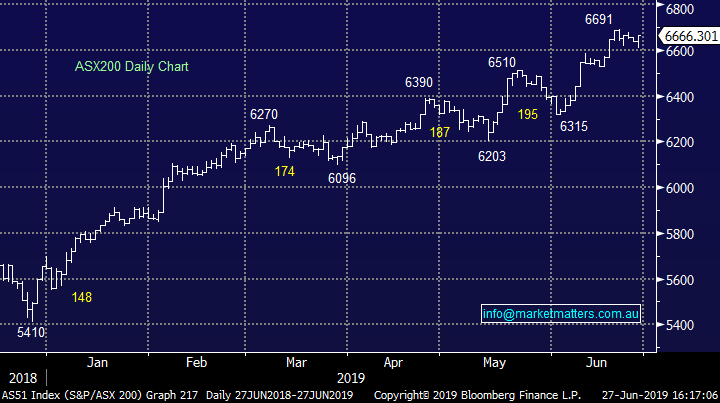

A strong session today for stocks with the market closing +25pts higher, however it was more than +50pts from the session lows after sellers capitulated shortly after the open with strong buying across the material stocks the main driver. Tomorrow marks the end of the financial year and June has been a particularly strong month – the ASX 200 up around 4% with the market now up +7.6% this financial year. The G20 the main focus this week with Trump-Xi set to meet on the weekend.

US Futures were well bid today as were Asian markets as the world positions for a trade war resolution on the weekend – seems a crowded trade!

Overall, the ASX 200 added +25 points or +0.39% to 6666. Dow Futures are trading up +97pts / +0.37%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

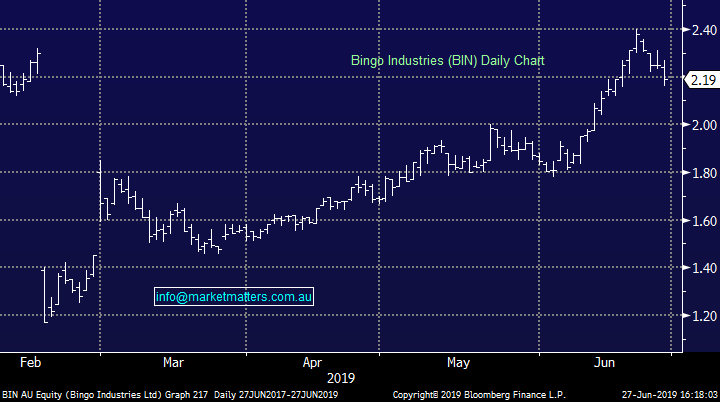

Bingo (BIN) -2.67%: We’ll focus more on BIN today than we normally do given 1. It’s been a solid performer for us & 2. We ultimately like the company / and want to own it medium term (hence the obvious question – why sell?)

It’s also a good case study for our new subscribers into EOFY around how we look / think about positions in the portfolio.

As a recap, we bought BIN into extreme weakness at $1.20 and added to it around $1.60 – we’ve sold today above $2.20 for a ~57% profit for a few key reasons. Firstly, we like the company, believe it will do well in the medium term and we will likely own it again, however the short term picture in our view has too many ‘what if’s’ for its current valuation. (26x)

Feedback from the BIN site tour yesterday was overall positive and it was incredibly well attended – about 100pax on two coaches which shows a lot of interest in this stock (normally these tours get around 30pax), however not all are positive on the stock given an 11% short position – which has been going up. The short thesis revolves around BINs exposure to residential construction where the outlook is weak, however we don’t put too much weight into this thinking (shorts have been pushing this line since the stock was $1.50!) – to me, weakness associated with this is most likely in the price.

On the positive side, BIN now hold truly strategic assets in growth corridors of Sydney and management are doing a very good job on integrating Dial-a-Dump. The combination of businesses and the cross section of recycling / waste management facilities that tap into infrastructure spend in Australia will ultimately be a positive for earnings – but it’s more a FY21/22 and beyond story.

The near term negatives are around residential construction volumes (which everyone knows about) but more importantly BIN are about to amend their benchmark pricing across the book and it seems likely that they’ll forgo volumes to push through these increases. These increases have been a long time coming and joining the dots one could assume that margins may well have been under some pressure in the meantime which may come through at their 21st August full year result . Throw the ACCC in the mix, a reasonably young management team + significant changes in customer pricing at a time when a large acquisition is being bedded down and the risks are building– hence our decision to book profit.

Bingo (BIN) Chart

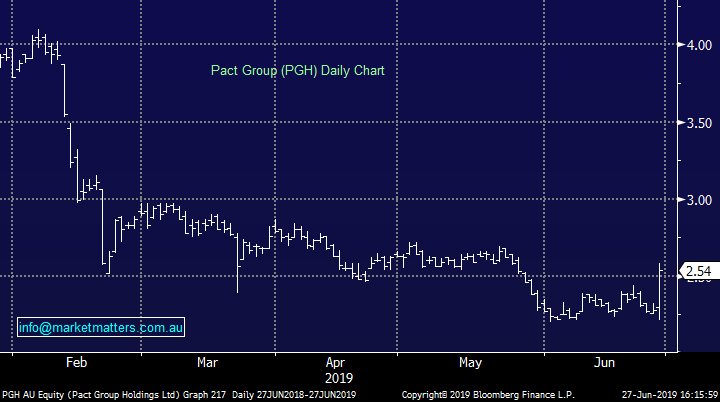

Pact Group Holdings (PGH) +11.4%; Shares rallied today despite talking earnings lower in an announcement saying they expect EBITDA “at the low end” of the $230m to $245m guidance range. Analyst consensus was already sitting at $232m and many pundits were calling this conservative so the positive spin was taken on the back of today’s release. Along with the earnings update, Pact also announced debt refinancing that has reduced the need for a capital raise. The company has secured $50m in unsecured funding for the next 6 years, while also extending $380m worth of loans by 2 years out to 2022.

These were the two big fears from a market perspective – earnings were likely to miss given both demand troubles and input price pressure, while climbing debt would force the company into a capital raise. With these risks off the table in the short term at least, it’s understandable that

The stocks popped today. We added to our position today and now have a $2.73 average price.

Pact Group (PGH) Chart

Broker moves

ELSEWHERE…

- Northern Star Downgraded to Sell at UBS; PT A$10.60

- Goodman Property Downgraded to Sell at UBS; PT NZ$1.76

- Precinct Properties Upgraded to Buy at UBS; PT NZ$1.90

- Iluka Downgraded to Neutral at Citi; PT A$11.40

- Alumina Downgraded to Neutral at Citi; Price Target A$2.50

- Syrah Downgraded to Neutral at UBS; PT A$0.90

- Galaxy Resources Downgraded to Neutral at UBS; PT A$1.40

- Orocobre Downgraded to Neutral at UBS; PT A$3.50

- Bingo Industries Downgraded to Neutral at Macquarie; PT A$2.35

- NRW Holdings Upgraded to Hold at Deutsche Bank

- APA Group Rated New Sector Perform at RBC; PT A$11.50

- Bendigo & Adelaide Cut to Negative at Evans and Partners

- Magellan Financial Cut to Underweight at Morgan Stanley; PT A$38

- Newcrest Cut to Neutral at Citi; PT Set to A$33.25

- Bionmoics Downgraded to Neutral at HC Wainwright

- Caltex Australia Raised to Equal-weight at Morgan Stanley

- Monash IVF Downgraded to Hold at Morgans Financial; PT A$1.37

OUR CALLS

We sold BIN & Added to PGH today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence