Markets give back yesterdays rally as reporting ratchets up (EHL, DMP, WTC, CTD, A2M, CAR, BAP, APA, SGP, CWN)

WHAT MATTERED TODAY

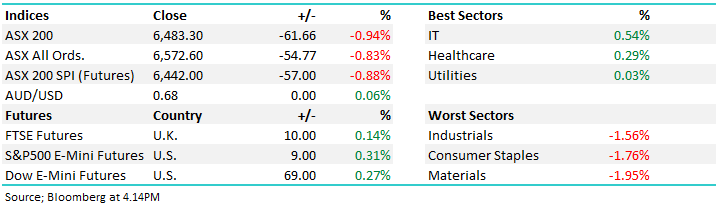

A fairly stark about turn by the market today giving back yesterday’s gains as stock volatility reigned supreme. A barrage of companies reported results today with some big hits and some equally big misses while continued weakness in the Iron Ore price (-4% in Asia) put pressure on the Iron Ore stocks, Fortescue (FMG) at the pointy end of the sector down by -4.09% while RIO lost -2.48% & BHP was off by -2.89% to $35.25. We bought back into BHP today…

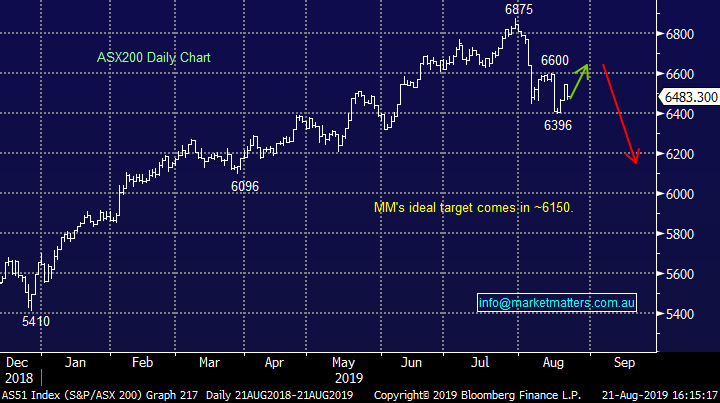

This morning we saw stronger than expected data with Westpac’s leading economic indicator along with skilled vacancies up on the month – that prompted a decent move higher in the AUD which is now trading at 67.80c. A higher AUD often prompts futures led selling of the local market and that seemed to play out today – particularly during the morning session with no real catalyst to entice the buyers thereafter.

Economic data this AM

Asian market were largely flat today while US Futures ticked higher throughout our time zone

Overall, the ASX 200 lost -61pts today or -0.94% to 6483. Dow Futures are now trading up +66pts /+0.28%.

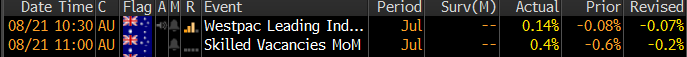

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

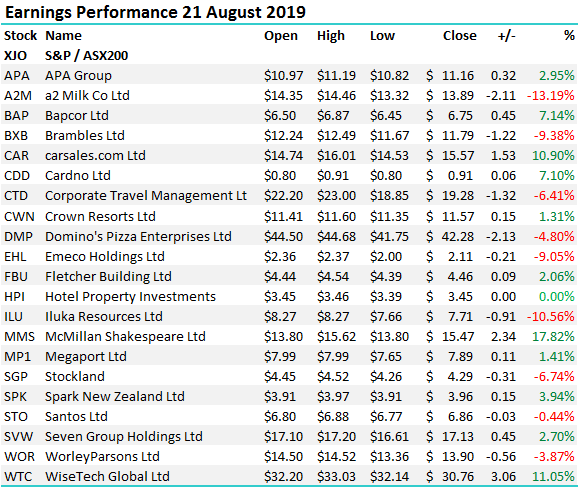

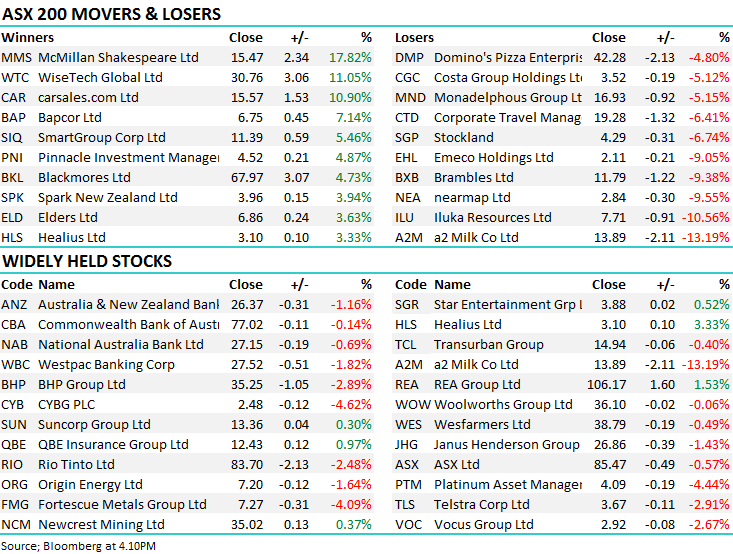

Stocks today: The table below looks at the share price performance of those companies that reported today. Some very big moves under the hood. Companies exposed to China A2M, ILU, CWN doing it tough.

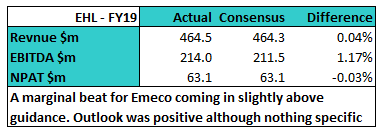

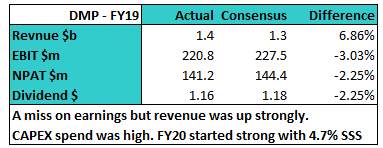

Emeco (EHL) -9.05%: Whacked on a result that looked inline or a beat. EBITDA better than guidance and better than mkt expectations, profit inline, gearing better, guidance okay. The stock did rally hard into the result but gave back that and some today. No surprises on the conference call this AM – not sure what we’re missing here. Maybe mkt getting it wrong like they have with a number of stocks to date or simply too much optimism over the last two session. The stock testing $2 again.

Emeco (EHL) Chart

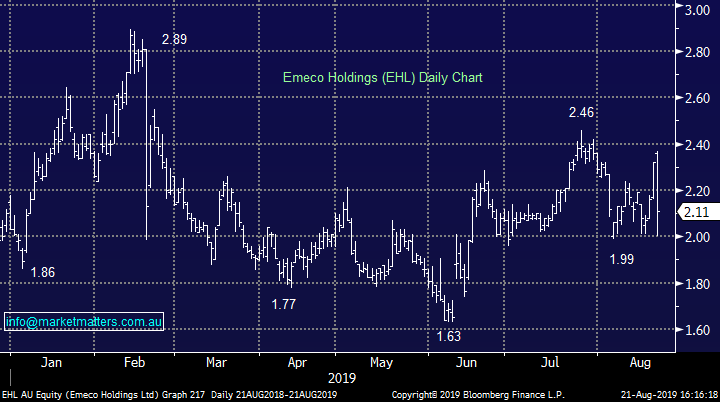

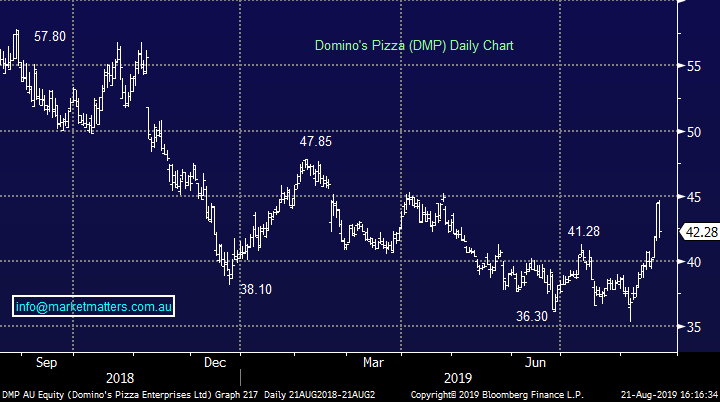

Domino's (DMP) -4.80% Like EHL, DMP rallied +6% into the result yesterday in what looked like short covering ahead of the numbers. While the stock was down today, it closed above yesterday’s low. The profit result was below expectations + the companies own guidance, however the top line numbers were pretty solid. Same Store Sales (SSS)was better than expected at 3.6%, which is good, Japan the main driver while ANZ operations were a touch soft. DMP is a heavily shorted stock and today’s result is actually a reasonable one. No financial guidance provided which is now the norm however consensus sits at 255m EBITDA for FY20.

Domino's (DMP) Chart

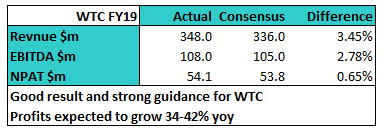

Wisetech (WTC) +11.05%: Another decent beat from WTC on pretty much as metrics as outlined below. FY20 Revenue guidance of $440-$460m v consensus of $448m was strong and implies 26-32% growth dropping down to profit of $145m-$153m / +34-42% growth v current consensus of $145m. A good result and stock was rightly up on the session.

Wisetech (WTC) Chart

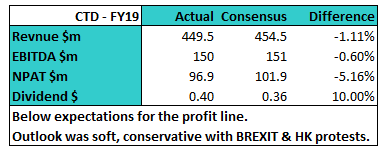

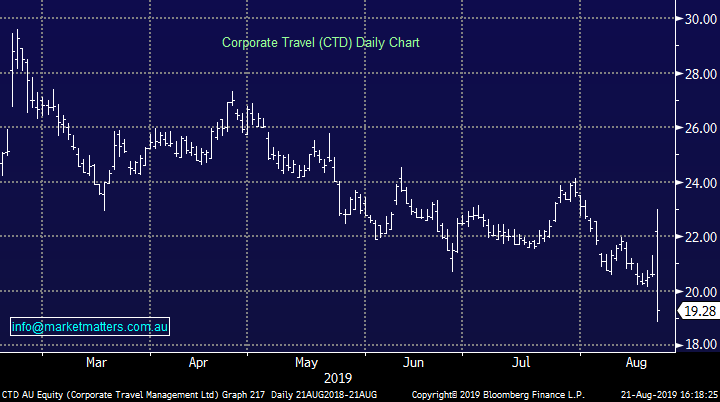

Corporate Travel (CTD) –6.41% A lot of focus on this result today as a number of parties calling this stock a house of cards. The result was a miss at the profit line and guidance was below expectations, although they note some conservatism given prevailing macro factors like Brexit & HK

Corporate Travel (CTD) Chart

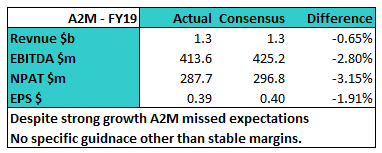

A2 Milk (A2M) -13.19%: Saw sales climb 41.4% dropping down to a 47% lift in profits, however it still fell shy of the street’s expectations, missing NPAT forecasts by 3%. The company said they expected EBITDA margins “to be broadly consistent with 2H19” at 28.2%. Based on consensus FY20 sales of $NZ 1.66b, this would drop down to an EBITDA number for $NZ 468m, 12% below the current average forecast at $NZ 532m. Growth for next year now looking like it will be closer to 10% rather than 20%, hence the mkt’s negative reaction.

A2 Milk (A2M) Chart

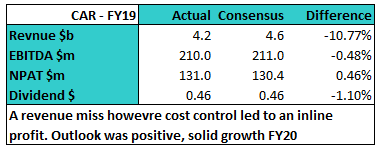

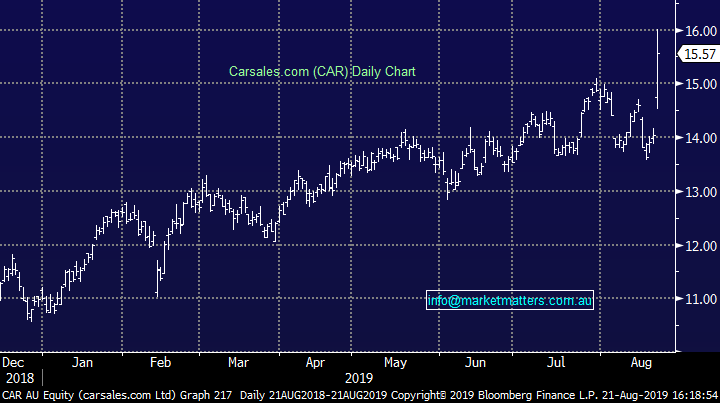

Carsales (CAR) +10.90%: Revenue miss but all else looked strong. Growth expected to be solid in FY20, the market was at +10% growth so definition of ‘solid’ important.

Carsales (CAR) Chart

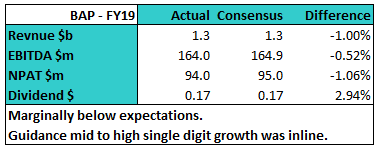

Bapcor (BAP) +7.14%: Similar to CAR, the result was inline and the company guided to mid/high single digit profit growth for FY20- the mkt was already at +9.5% for the next 12 months however the market clearly likes a business growing at a decent clip, trading on a decent multiple while paying a dividend yield of 3.4%.

Bapcor (BAP) Chart

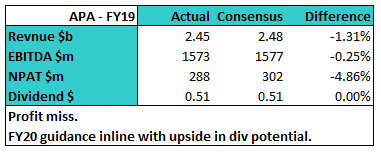

APA Group (APA) +2.95%; The gas pipe owner operator rose despite a slight miss on the profit line today. Profit growth of around 9% was driven by new assets coming online and pricing structures in a number of contracts which saw a reasonable increase in income. Outlook for FY20 was in line with estimates, while upside can be seen in distributions with APA currently running a relatively low payout ratio.

APA Group (APA) Chart

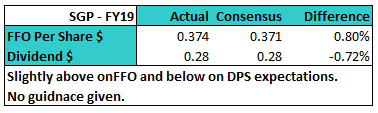

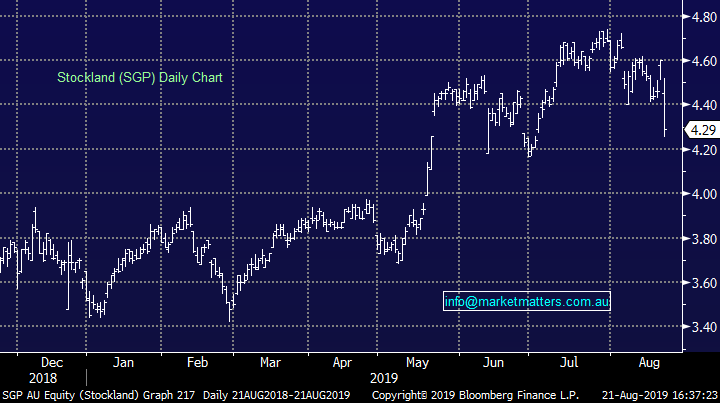

Stockland (SGP) -6.74%; Broadly inline with market expectations with the main number we look at being funds from operations per share (FFOPS), which printed 37.4cps v 37.1cps expected. The market remains wary of retail focussed property plays. Guidance was inline, aiming for just 1% growth in FFO. Hard to get excited about, however we like it for yield. Good run pre-result probably the biggest issue

Stockland (SGP) Chart

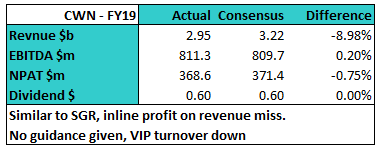

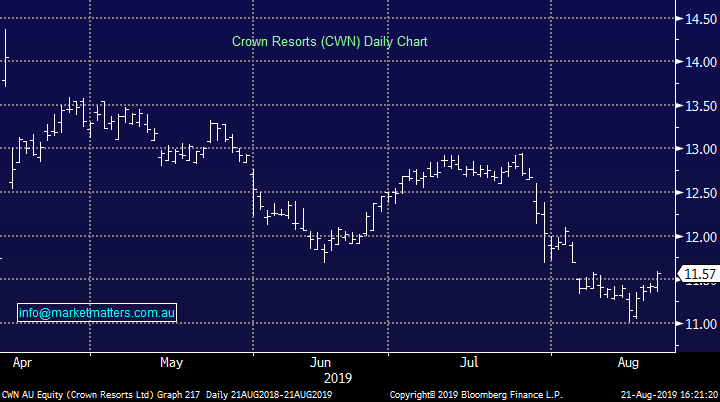

Crown (CWN) +1.31%; Was up today on the result. Similar to Star Group a few days ago, it was a miss on the revenue line which was blamed on lower VIP spend which is set to continue. They did keep costs in control to meet at the profit line however.

Crown Resorts (CWN) Chart

Broker moves;

- Platinum Asset Downgraded to Sell at Ord Minnett; PT A$3.53

- Seek Upgraded to Neutral at UBS; PT A$19.50

- Seek Upgraded to Add at Morgans Financial; PT A$22.31

- Telstra Downgraded to Market Perform at Bernstein; PT Set to A$4

- Monadelphous Downgraded to Sell at Citi; PT A$15.50

- Alacer Gold GDRs Downgraded to Underperform at Macquarie; PT A$6

- Altura Upgraded to Hold at Canaccord; Price Target A$0.1

- IPH Downgraded to Hold at Canaccord; PT A$8.90

- IPH Downgraded to Neutral at Goldman; PT A$9

- IPH Downgraded to Hold at Morgans Financial; PT A$9.48

- Sonic Healthcare Raised to Neutral at Credit Suisse; PT A$26.80

- iSelect Downgraded to Hold at Bell Potter; PT A$0.65

- Regis Resources Downgraded to Hold at Bell Potter; PT A$5.27

OUR CALLS

We bought BHP in the Growth Portfolio today & added Abacus Property (ABP) to the Income Portfolio

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.