Markets drift lower again – closing back below 6000 (GMA, TCL, MQA)

WHAT MATTERED TODAY

A choppy session played out today with some decent buying off early lows before the mkt simply rolled over and drifted into the weekend. Public School holidays start today so volumes will drop off and as we suggested in the AM report this morning, markets are generally well bid from here until the tubby bloke in the red suit squeezes himself down the chimney. I was out of the office today, a few meetings this morning before getting ready for my Dads birthday bash we’re hosting tomorrow. It was meant to be a surprise of sorts however the cat was out of the bag early – anyway, should be a great night and look forward to catching up with many family and friends – a lot of who read these notes!

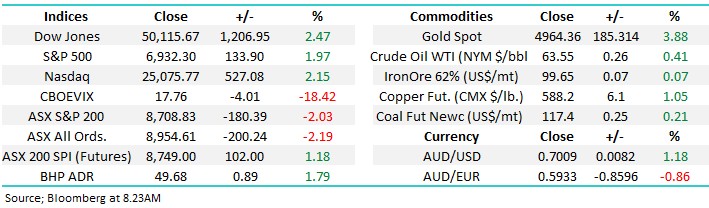

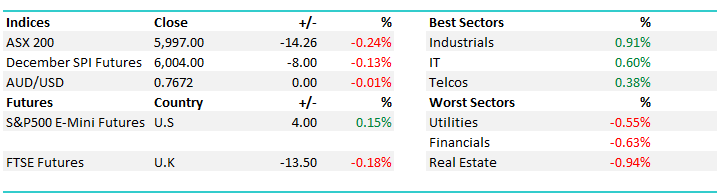

Back to markets and the banks were the real dead weight on the index today, ANZ the major drag down nearly 1% with yet more new claims coming out of the CBA Austrac hearing – that stock off by 0.62% as a result. Resources were ok, particularly RIO and Fortescue supporting the market

The Industrials sector was the standout, while Real Estate struggle. An overall range today of +/- 21 points, a high of 6010, a low of 5989 and a close of 5997, off -14pts or -0.24%

ASX 200 Intra-Day Chart

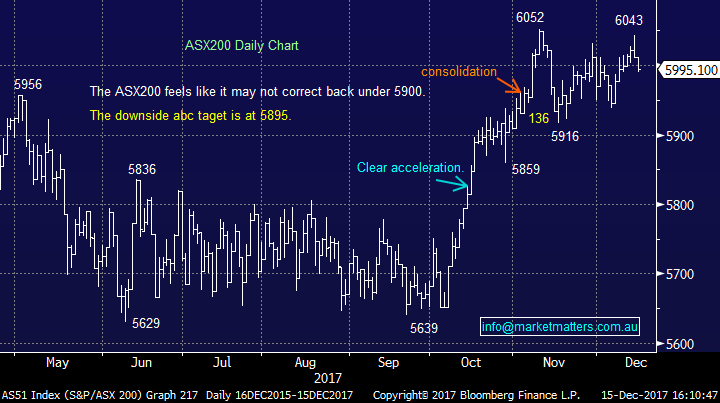

ASX 200 Daily Chart

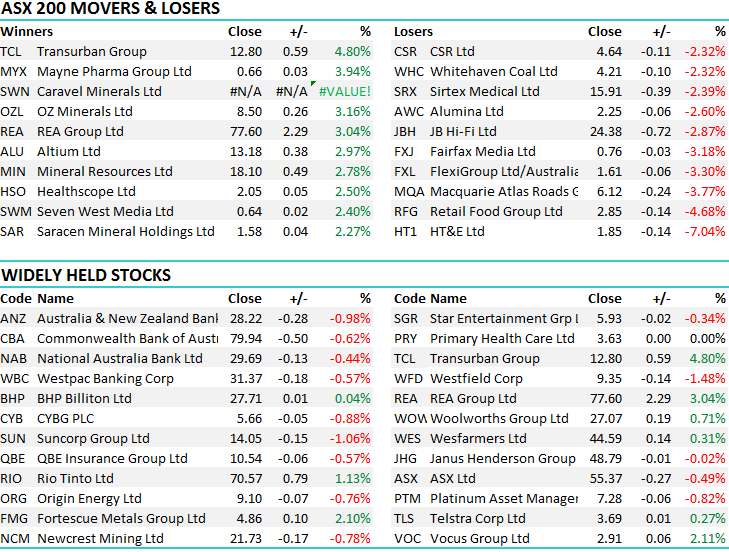

TOP MOVERS

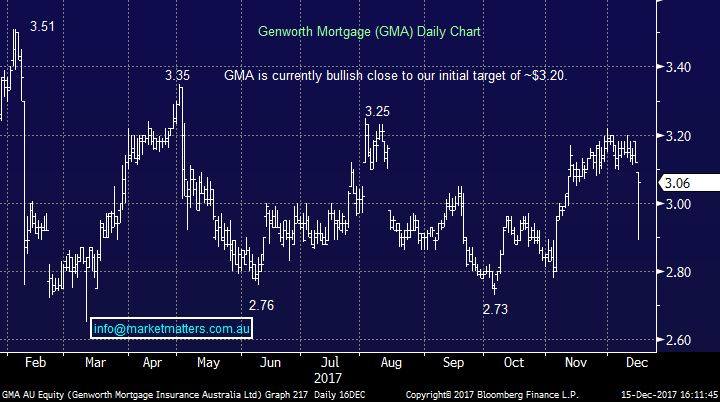

1.Genworth Mortgage (GMA) $3.06 / -1.92%– Downgraded 2017 Net Earned Premium guidance by around 6% today through changes to the “earnings curve”. The changes come at the conclusion of the annual review noting that they are a result of the losses from mining related regions and improvements in underwriting quality after an ASIC query. GMA though is typically one to buy into bad news particularly around lower sales given that reduced sales = less capital and therefore more capital management. They currently have a $100m buy back going on and can afford to do more, and the stock price showed that today, rallying ~6% from the daily lows. We own GMA in the Income Portfolio and view it as a big capital return story.

Genworth Daily Chart

2. Macquarie Atlas Roads (MQA) $6.12 / -3.77% – Macquarie Group announced that it had sold it’s 11.3% stake in MQA overnight, selling 76 million shares ($456 mil) at a 5.7% discount to last traded price. The sale put an end to the recent strong run in MQA which had put on around 10% in the last month, however with the removal of this overhang, it is likely that MQA will trend higher. Similar reasoning was used to enter Woodside in our portfolios after the Shell sell down.

MQA Daily Chart

3.Transurban (TCL) $12.80 / +4.8% – came back online today after raising $1.9bil from investors to fund Melbourne’s West Gate tunnel. The entitlement offer for existing shareholders was completed at $11.40, however the book build was completed at a significant premium at $12.50 for each new share, around a2.5% above last traded. This is a huge premium on the stock and the reaction by the market will be one to watch in the short term.

Transurban Daily Chart

OUR CALLS

No changes to the portfolio’s today…

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/12/2017. 5.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here