Markets down most in more than a month (ILU) **Buy SH US**

WHAT MATTERED TODAY

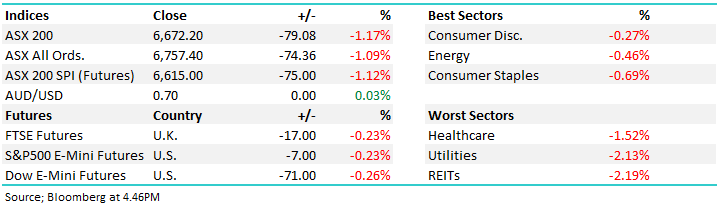

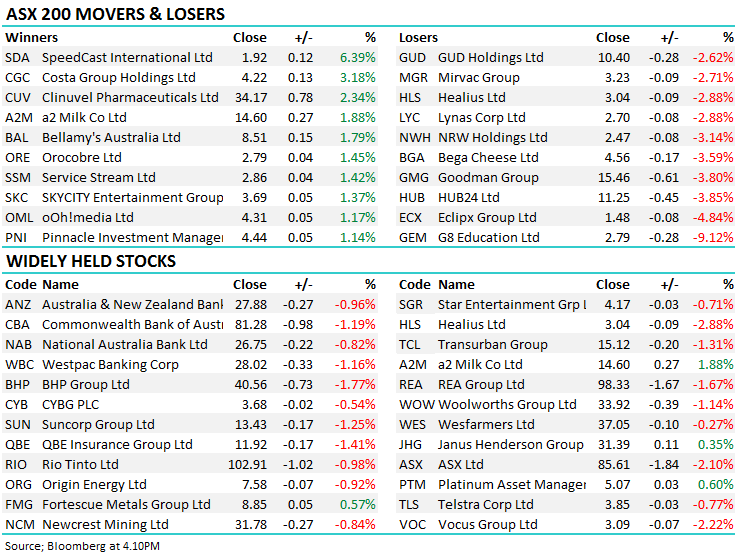

A big sell off today for Aussie stocks with sellers out early and sustained throughout the day with very little respite to speak of – the market eventually closing on its lows. Banks came under pressure on a broker downgrade of the sector while the Iron Ore names felt the heat of a weaker Iron Ore price – although Fortescue (FMG) and RIO did well to pick themselves up and rally from the morning lows as Iron ore ticked higher in Asia. At a sector level, all finished in the red with recent strength in the property, utilities and healthcare names giving way today.

US Futures fell during our time zone however it was Asian markets that felt the brunt with Hong Kong and China off around ~2% a piece while Japan was down by ~0.60% .

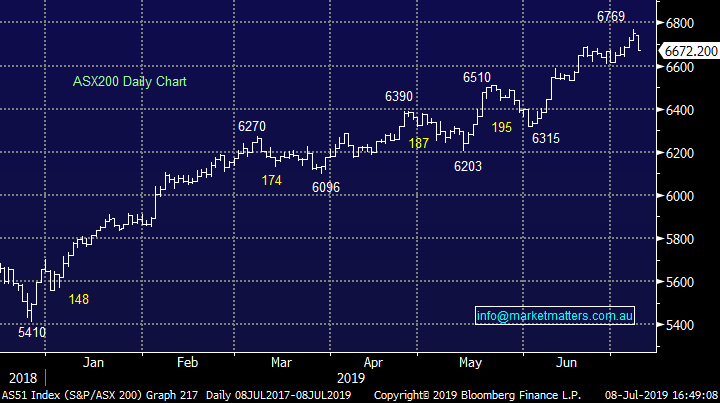

Overall, the ASX 200 fell -79pts today or -1.17% to 6672. Dow Futures are trading down -70pts / -0.25%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Yield stocks feel the heat: One obvious theme from the sector performances today was that the traditional yield names felt the brunt – Property & Utilities, sectors that generally perform relatively well in a weak market – not today and while we don’t like re-hashing content revisiting what we wrote on the weekend around interest rates, and the market getting ahead of itself is relevant today.

Over recent months MM has been confident the RBA would cut interest rates to at least 1% with our main indicator being the 3-year bond yield was trading noticeably under the Official RBA rate. However over the last week the 1% mark has felt like a magnet to both rates, while a few days clearly doesn’t make a summer, we feel the “easy money” for the rate cut lovers is behind us. Markets are still expecting one more 0.25% cut in 2019, with potentially another in 2020, but this may become 1 or 2 cuts too far with potential disappointment for investors already ravenous for “cheap money”. Logic says to me the RBA will want to see the impact of these 2 quick rate cuts before considering going again.

Australian 3-year bond yields v RBA Cash Rate Chart

Morgan Stanley turn negative: MS have moved from equal weight to underweight global equities saying the ability of central bank policy easing to offset weaker economic data, poorer readings on the economic cycle, and disbelief that a trade truce between the US and China at the Group of 20 meeting will lead to a lasting positive outcome. ." We see a market too sanguine about what lower bond yields may be suggesting – a worsening growth outlook.

We also had news that Deutsche Bank was cutting its Australian equities business as part of a global cost-cutting plan. About 50 jobs are being cut largely from research, sales and trading roles.

Broker moves;

- Adelaide Brighton Cut to Underweight at JPMorgan; PT A$3.90

- SRG Global Ltd Cut to Hold at Argonaut Securities; PT A$0.52

- Austal Downgraded to Sell at Argonaut Securities; PT A$2.75

- Austin Engineering Cut to Hold at Argonaut Securities; PT A$0.21

- G8 Education Downgraded to Hold at Moelis & Company; PT A$3.38

- Auckland Airport Cut to Underperform at Forsyth Barr; PT NZ$7.90

- Magellan Financial Downgraded to Sell at UBS; PT A$42

- CBA Downgraded to Neutral at Credit Suisse; PT A$79

OUR CALLS

We made a number of amendments to the Growth Portfolio today and we plan to ‘tweak’ the income portfolio on Wednesday.

Today we sold Iluka (ILU) & Macquarie (MQG) for good profits, and bought into Tabcorp (TAH) & Bluescope Steel (BSL). This improves the defensive qualities of the portfolio while we maintain our 23% cash buffer looking for further weakness to deploy.

Iluka (ILU) Chart

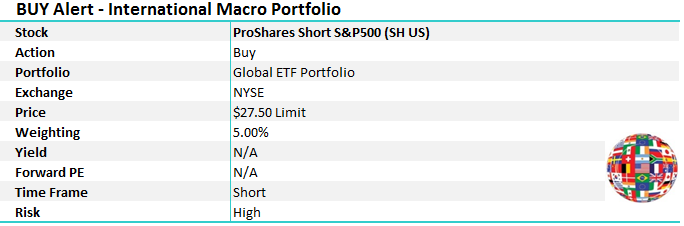

**International ETF Portfolio**

The chart below illustrates that the last 18-months rally by US stocks has been strongly correlated to “cheap money” as the S&P500 and iShares IBOXX ETF (HYG US) – an ETF that holds high yield bonds - have moved in almost perfect tandem. However the HYG has started turning lower even while the S&P500 made fresh all-time highs on Friday night, plus we saw a few cracks appear when stock futures initially fall -1.2% on a sniff that the Fed might not cut rates later this month.

The better than expected employment print on Friday could be a catalyst for traders to take some money off the table into this rally.

MM is becoming increasing wary of US stocks after they have reached our targeted 3000 area plus the “heavy” HYG is adding to this feeling.

US S&P500 & Junk Bond ETF Chart

For this reason, we are taking an initial short position on US stocks via the ProShares Short S&P 500 ETF

Major Movers Today – Costa (CGC) starting to show signs of recovery. It’s cheap and should trade sharply higher if the last downgrades were in fact weather related as we believe.

Have a great night

James the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.