Markets down but not out (ASX:CYB, ASX:CBA, ASX:TRS)

WHAT MATTERED TODAY

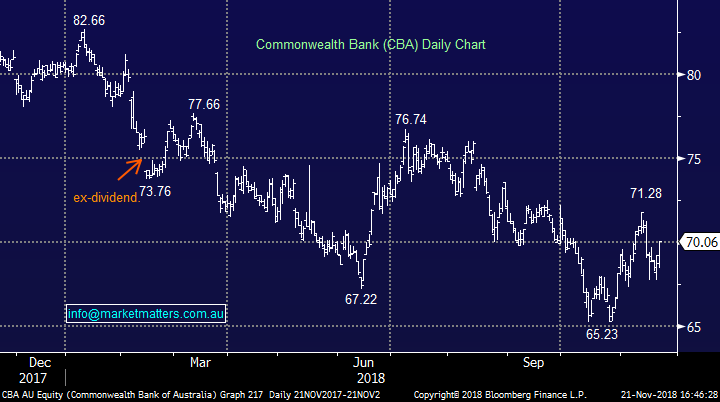

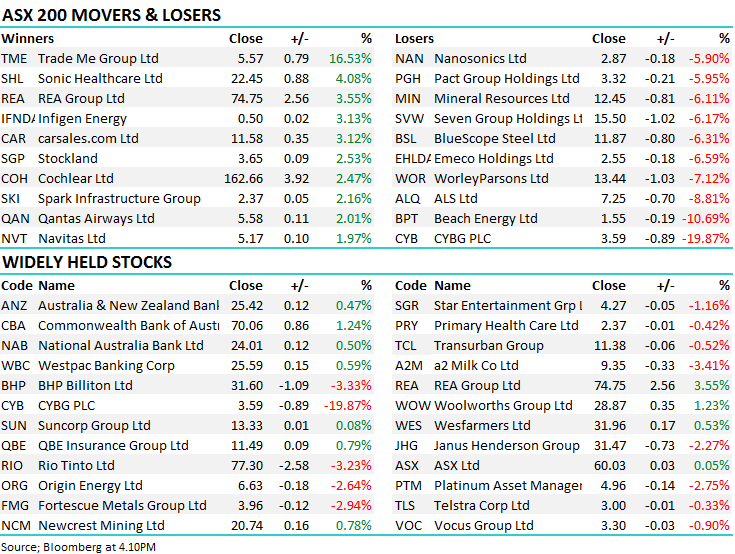

Yesterday the market looked like it wanted to rally thanks to buying in the banking space however overseas markets had other ideas. The Dow Jones fell -535points overnight underperforming the tech heavy Nasdaq despite Apple being slogged by another ~5%. The stock now trading on 13x forward earnings while delivering growth of 14% - not a bad deal. Today stocks were sold hard early, the ASX 200 hitting an 11am low at 5594 before buyers stepped in (us included) pushing the index up ~50points into the close.

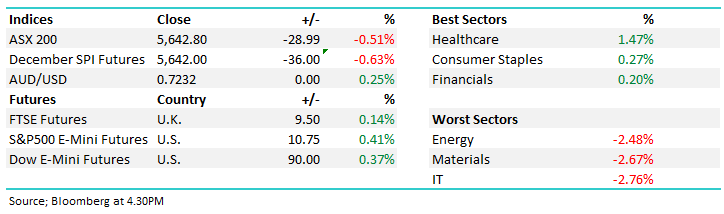

Once again the banks climbed the wall of worry to end the session higher – CBA the best of the bunch adding +1.24% to $70.06 while the rest were up between 0.47% & and 0.59% – again, a pretty good effort really under the weight of a weak market and the focus of the Royal Commission – it simply says to us there’s now a void of sellers, and buyers are slowing getting on top. A sniff of positive news for the banks and they could really get a move on. As Harry just said…CBA…what a standout!

Commonwealth Bank (CBA) Chart

Unfortunately that wasn’t the case with all the banks, CYBG, the NAB spin out that is currently merging with Virgin Money was clobbered by nearly 20% after delivering poor results overnight. Resources were also on the nose today, particularly some of the mid cap names which were hit as risk came off the table early, only to recover some of those losses into the close. The Healthcare duo CSL (ASX:CSL) and Cochlear (ASX:COH) both finished the session higher, COH the better of the two adding 2.47% while CSL added 1.72%,. It’s hard not to think the seller of the big line in CSL yesterday had been selling the sector for a while...

Overall, the ASX 200 closed down -29 points or -0.51% at 5642. Dow Futures are currently up +82 points or +0.34%

ASX 200 Chart

ASX 200 Chart

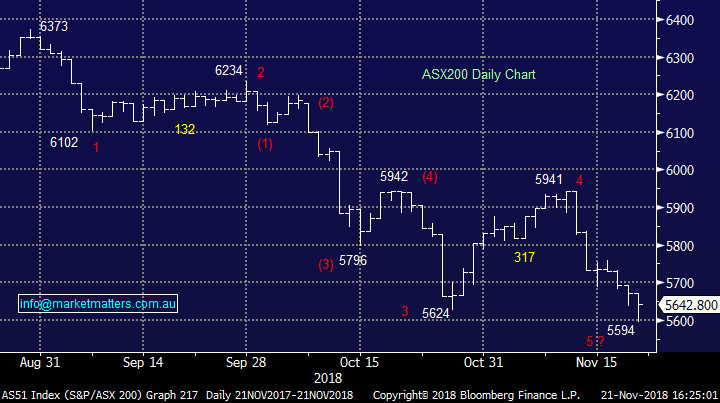

CATCHING OUR EYE;

Broker Moves; Morningstar have been active upgrading a huge heap of names in the last few days into weakness…

· A2 Milk (A2M AU): Raised to Outperform at First NZ Capital; PT NZ$12.25

· Bapcor (BAP AU): Upgraded to Buy at Morningstar

· CSL (CSL AU): Upgraded to Buy at Morningstar

· Fletcher Building (FBU AU): Raised to Neutral at First NZ Capital

· McMillan Shakespeare (MMS AU): Upgraded to Buy at Morningstar

· Oil Search (OSH AU): Upgraded to Hold at Morningstar

· Spark Infrastructure (SKI AU): Reinstated at CIMB With Hold; PT A$2.32

CYBG (CYB) $3.59 / -19.87%; The spin-off from NAB’s UK arm CYBG (ASX: CYB) has plummeted today following a disappointing result overnight. The stock slumped in UK trade, and the local ticker has tracked it lower today, falling by around 20%. So what was so bad? The stock had already fallen 29.6% from its 52-week high ahead of the result on BREXIT concerns, and it is now trading 43% below that mark set in August.

The problems stem from a number of fronts within the business, but first and foremost, the bank has an income problem, struggling to grow the pile over the past few years. Mortgages aren’t growing, and if anything, received interest rates are edging lower. On the other side of the ledger, the bank has struggled to grow deposits which is a banks cheapest source of funding. Mortgages have increased £2.8B over the past 2 years, while deposits grew just £0.5B forcing Clydesdale to turn to the more expensive wholesale market for funding, further squeezing the net interest margin (NIM).

Another big problem is the banks efforts to cut costs. The long story of this trade is that CYBG had plenty of ‘fat on the bone,’ or costs to cut helping improve profitability. This result showed the costs being cut may just be pushed into a capitalised costs figure, extending current costs into future years – a total £73M were capitalised in FY18. The final string to the selling bow was further provisions being made for remedies to previous insurance products, something that has plagued the bank and one of the many reasons NAB let go of the UK arm a few years back. A bleak story to read no doubt, but where do you find value in CYBG?

CYBG is a holding that has performed well for us in the past – with the MarketMatters taking a 10% profit in July at $6. Although we missed some upside, the recent move has proved that sale correct.

Many have clearly found a reason to sell the stock recently (BREXIT) & today (the result). We love to be contrarian here at MM, but in our the time to buy CYB hasn’t quite come yet. Rather than try and pick the bottom now, we are closely watching the BREXIT saga and the UK banking metrics closely for a good entry point back into the stock. The stock is trading well below net tangible assets (NTA) so it is priced to lose money – clearly some value here.

CYBG (CYB) Chart

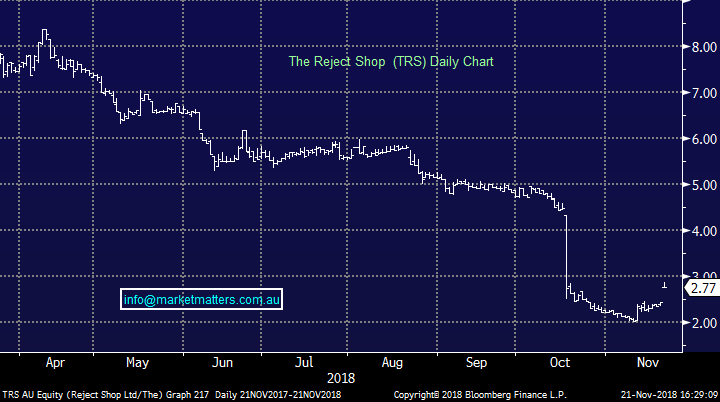

Takeovers; Two stocks that did well today was The Reject Shop (ASX: TRS) & Trade Me (ASX: TME) – both receiving takeover offers this morning. The Reject Shop (ASX: TRS) has been hit with an on market offer at $2.70/share from Allensford with an undisclosed line to buy shares in the market at that price. Shareholders have the ability to ‘accept’ the offer simply by selling the shares in the market, with Bell Potter acting as the broker, with the offer available until 7 January 2018 unless extended.

It seems an opportunistic bid, with The Reject Shop trading near decade lows, and the premium set at just 11% above the last traded price. Allensford is wholly owned by a private company called Kin Group owned by rich-lister Raphael Geminder of Pact Group (ASX: PGH). TRS is currently ~70% below its 52-week high after tumbling since May.

TRE added 13.99% to close at $2.77 while TME was up 16.53% to $5.57

The Reject Shop (TRS) Chart

OUR CALLS

We were active in the market today tweaking the MM Growth Portfolio towards growth into current weakness. We added Altium (ALU), Xero (XRO) and we were filled on Appen (APX) this morning. This gives us a basket of growth orientated names. We used our position in Healthscope (HSO) as a funding vehicle today. We are now fully invested in that portfolio.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.