Markets cruise into the weekend after a solid week (BHP, AMP)

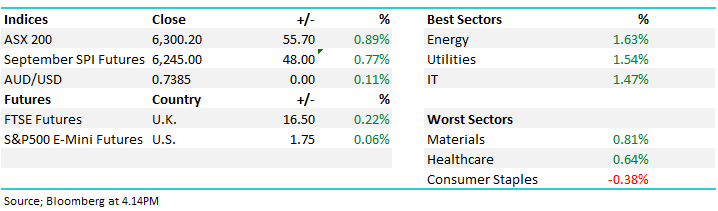

WHAT MATTERED TODAY

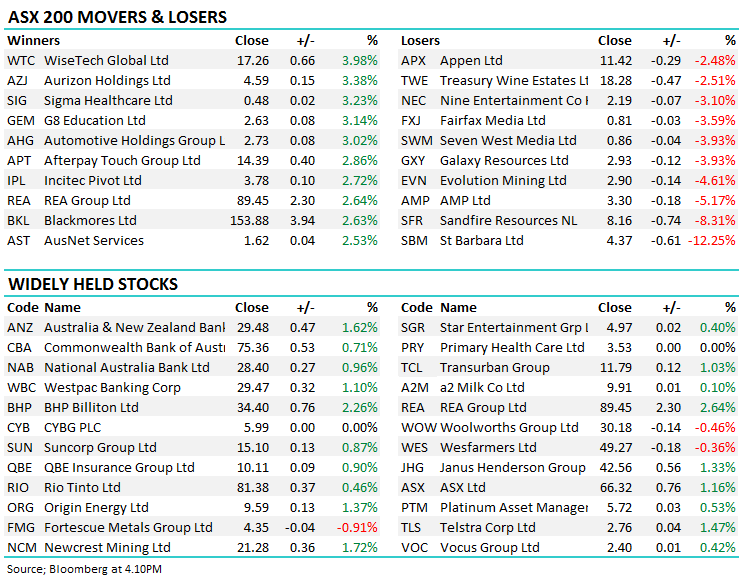

The Australian market pushed up through 6300 for a period this morning – just 3pts why of the recent highs – before losing some steam leading into the close. Still, a was a bullish day with BHP coming out with news around the sale of their US Shale assets for US$10.8b – a good price however the market knew it was coming and early strength for the ‘Big Australian’ was sold into. A clear cut case of buy the rumour / sell the fact by the look with BHP now at the top of its recent trading range. Elsewhere, Macquarie (MQG) recovered after yesterday’s sell-off, much of the focus being rightly so on the new CEO who seems to be universally loved by those who have worked with her – while their guidance for flat earnings in FY19 versus the markets 5% expectations simply being put down to under promising from the silver donut.

Elsewhere, AMP had another poor session down by -5.17% after providing a market update that was less than comforting, the other wealth managers were also weak while we saw some interest in Newcrest (NCM) today following their strong production numbers yesterday. We bought NCM in the Growth Portfolio this morning – the stock adding 1.72% on the session to close at $21.28.

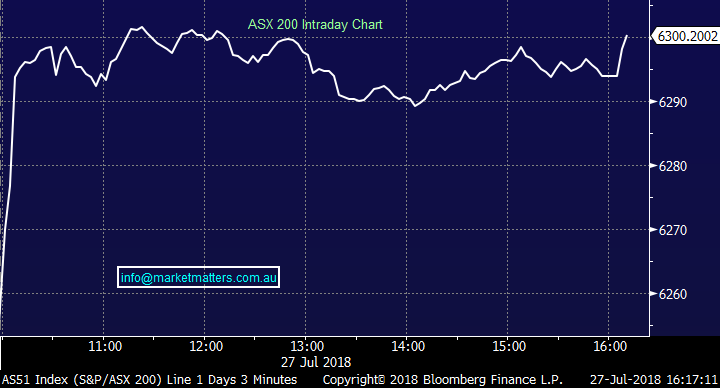

Overall, the index closed up 55points or 0.89% to close today at 6300 – up 0.2% on the week, just 6 points from the recent intra-day high & the highest close since 2008.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

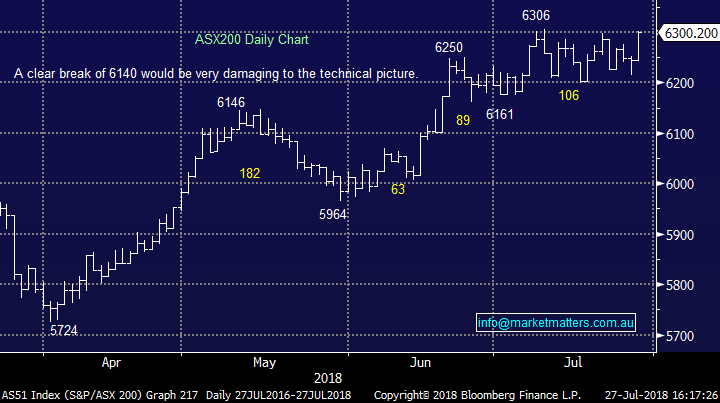

BHP Billiton (BHP) $34.40 /+2.26%; This morning BHP announced the sale of US shale assets to BP and Merit Energy for an all cash total of $US 10.8bil. It’s a great result for BHP, with the market expecting a number closer to the $US 10bil mark. Half of the cash will be paid in October, with the remaining coming in 6 equal monthly instalments. BP picked up the bulk – paying $US 10.5bil for the Petrohawk Energy Company while Merit paid $US 300mil for the Fayetteville assets. Management had previously flagged that the proceeds for this transaction would go straight to shareholders, so we can expect special dividends and/or buybacks to occur, although the timeframe for this will now depend on whether BHP will wait until all cash has been received.

The timing of the transaction comes as a slight surprise - it was a little earlier than we expected. It is a great result for the times, although worth mentioning that they lost a fortune on the assets since buying them a few years ago. Shareholders can expect the full benefit of the proceeds, we expect mostly through buy-backs as BHP will be able to utilize its large franking credit balance it has struggled to pass on to shareholders in the past. While commodity companies do well in an inflationary environment, we remain keen buyers of weakness, but not strength.

BHP Billiton (BHP) Chart

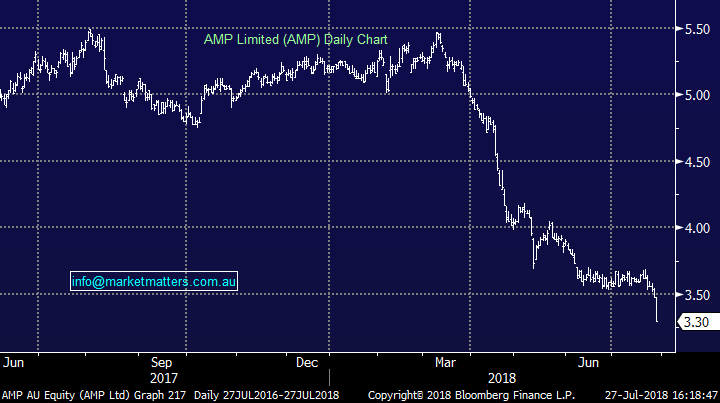

AMP (AMP) $3.30 / -5.17%; No surprises here from AMP as the poor news continues to come out of the financial services firm. This morning AMP gave an update ahead of their first half report, “AMP takes action to reset business” – hardly a comforting name, in which AMP went on to announce provisions of $290mil for advice remediation, reduced fees on products, lowered expectations for first half profits and predicted the dividend to be at the lower end of the pay-out ratio for the full year, however they said the interim dividend would be cut more substantially.

The announcement highlights the difficult conditions AMP is operating in, as platform and advice fees come under pressure, AMP is also under pressure from the regulator, shareholders and clients – certainly a tough gig at the moment. Our last note on AMP here

AMP Chart

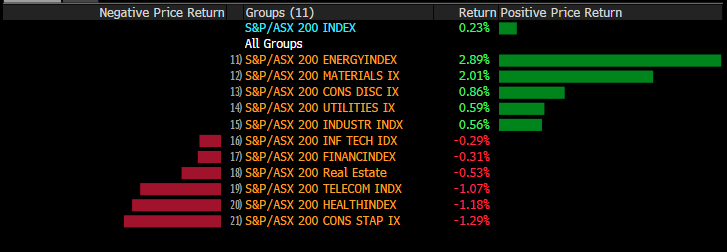

Weekly Moves – Stocks & Sectors;. A mixed bag for Aussie sectors throughout the week – Energy remains strong while the Healthcare stocks – mainly the US earners started to struggle.

Sectors over the past week

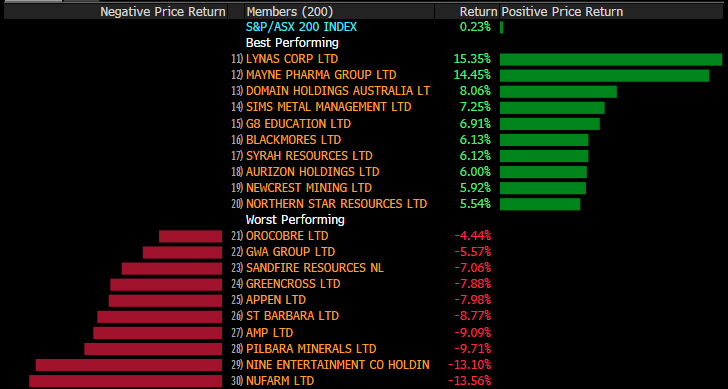

At a stocks level, a downgrade from Nufarm (NUF) and a takeover from Nine Entertainment (NEC) saw both stocks plumb new lows while AMP remains on the nose – rightly so.

Stock moves over the week

Broker calls; Most analysts agree that the Nine Entertainment Co.’s plan to acquire Fairfax Media Ltd. for A$2.2 billion ($1.6 billion), bringing together two of the nation’s biggest brands in television and newspaper publishing, is unlikely to get antitrust scrutiny from regulators.

Elsewhere;

· Fortescue Downgraded to Neutral at Citi; PT A$4.70

· Marley Spoon GDRs Rated New Buy at Canaccord; PT A$2.40

· Oceania Healthcare Raised to Outperform at First NZ Capital

· Nine Entertainment Upgraded to Hold at Morningstar

· Woolworths Group Downgraded to Neutral at JPMorgan; PT A$30

· St Barbara Downgraded to Sell at Canaccord; PT A$4.35

· Treasury Wine Downgraded to Sell at Goldman; PT A$14.20

· Macquarie Group Cut to Hold at Shaw and Partners; PT A$122

OUR CALLS

We added Newcrest to the Growth Portfolio this morning around $21.15 with a 3% allocation. A reasonably active week for the growth portfolio adding small positions in IRE, MIN, HSO & NCM.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here