Markets chop around today, end little changed (GMG, BPT, PPT, BIN)

WHAT MATTERED TODAY

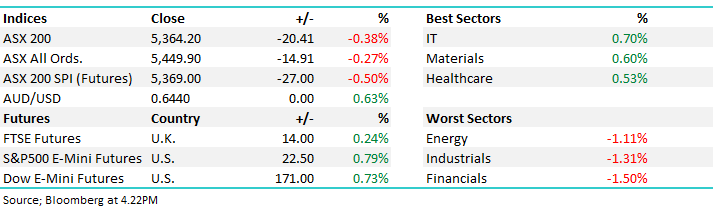

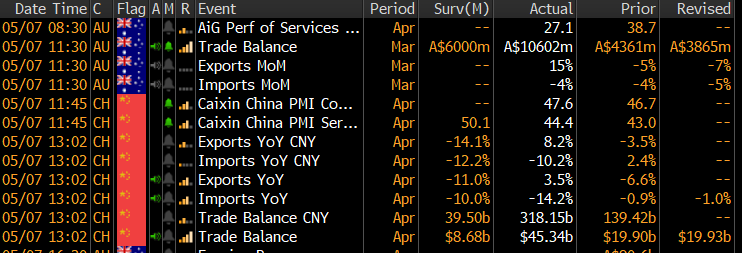

A choppy session today where the market found buyers into weakness and closed near enough to intra-day highs. Financials lagged while the Tech’s and the Resources were strong, our tech sector clearly following the bullish relative moves that have been playing out on the Nasdaq in recent days. Chinese data outlined below, the Caixin manufacturing number was slightly ahead of weak forecasts while exports were also better than expected.

Data today

Source: Bloomberg

Today the ASX 200 lost -20pts /-0.38% to close at 5365 - Dow Futures are trading up +171pts/+0.73%

ASX 200 Chart

ASX 200 Chart

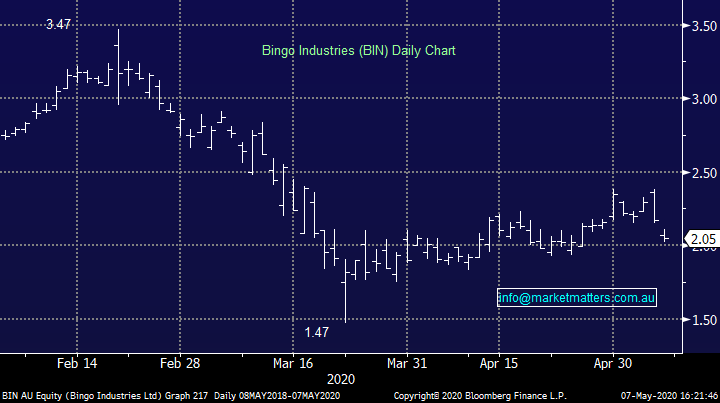

AUSBIZ…This morning I discuss Bingo (BIN) after Shaw downgraded the stock. I also talked Bluescope (BCL), Goodman Group (GMG) and Virgin Money (VUK).

CATCHING MY EYE:

Goodman Group (GMG) +3.75%: They came out and reconfirmed both earnings and dividend guidance for the full year, highlighted that gearing is at the lower end of their target range (0-25%) and they have cash ($1.4bn) + funding facilities ($1.1bn) currently available. A property stock that pays 50% of their earnings out in dividends and reinvests the rest, they’re a critical part of the online sales supply chain and they’re incredibly well managed. It’s a good story and while we don’t own, we should at the right price.

Goodman Group (GMG) Chart

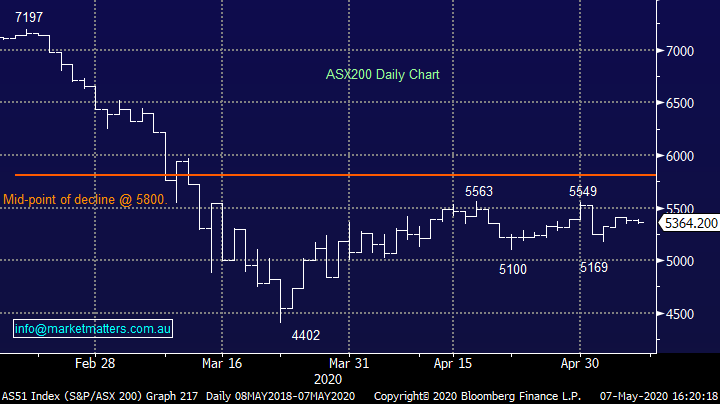

Macquarie Conference: a few big hitters rounded out the final day of the virtual conference today. Beach Petroleum (BPT) was the last of the energy names to talk, trumpeting their strong balance sheet and capex flexibility as well as the large portion of earnings that come from fixed price contracts or hedged production. We own Beach in the Growth portfolio with today’s presentation justifying exactly why. They are a low cost, high quality producer with a diversified product mix. Key to their ability to survive the oil market slump is that 97% of production in FY21 is already contracted while costs continue to come down. They also said they were “confident in long term oil and gas fundamentals” implying the price of oil will revert higher as production comes off and demand returns. BPT closed 2% higher while other energy names were mostly weaker.

Beach Energy (BPT) Chart

Caltex (CTX) was marginally higher today despite spending much of the presentation talking to the slump in petrol demand. They noted jet fuel demand was down 80-90% currently while retail fuel had fallen 16% year to date, though this does include time pre-lockdown. Capex has been cut, and costs are being stripped where they can, including retail worker hours cut back. Caltex continues to assess how it can unlock value in the property, considering an IPO of the property portfolio. Caltex was under takeover recently, and it will be interesting to see if the bidders return at a cut rate price given the fall in the shares.

Spark Infrastructure (SKI) reaffirmed their distribution guidance ahead of their presentation today, keeping the minimum payout of 13.5cps over the full year. Spark noted higher operating expenses as well as a reduced demand for energy in March. South Australia saw the biggest decline in usage, falling 11.1%. Despite the squeeze, they do have a reasonable look through of revenues through the rest of the year, and recently secured further funding for growth.

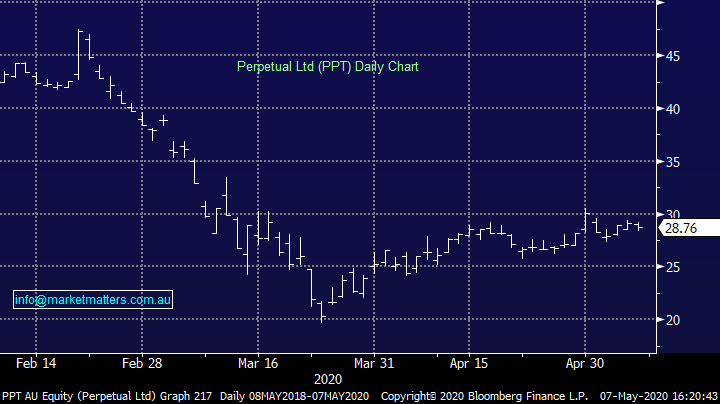

Perpetual (PPT), a stock we hold in the Income Portfolio also presented today and they spoke of the diversity in their business over and above a straight fund manager. We like their diversified lines and remain comfortable holders.

Perpetual (PPT) Chart

BROKER MOVES:

Our BIN analyst at Shaw downgraded BIN this morning then Credit Suisse jumped on the same boat. Shaw now has a hold (from Buy) and $2.40 PT while CS is at $2.45. The rationale from Danny being the stock trades on a high multiple and there are a number of uncertainties in the short term, mainly around lower volumes which have a flow on impact to pricing. We have a decent overweight on BIN in the Growth Portfolio and while the downgrade is a negative, for now we’re holding the position. The medium term thematic’s in BIN still stack up, just the short term is a bit more clouded around what lower volumes mean for pricing / margins.

Bingo Industries (BIN) Chart

- New Century Rated New Buy at Foster Stockbroking

- Regis Resources Cut to Sell at Morningstar

- Sydney Airport Raised to Buy at Morningstar

- JB Hi-Fi Cut to Neutral at JPMorgan; PT A$37

- Medibank Private Raised to Neutral at JPMorgan; PT A$2.70

- Growthpoint Raised to Outperform at Credit Suisse; PT A$3.15

- JB Hi-Fi Cut to Hold at Morgans Financial Limited; PT A$35.67

- Bingo Industries Cut to Hold at Shaw and Partners; PT A$2.40

- Sigma Healthcare Rated New Buy at Blue Ocean

OUR CALLS

No changes

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.