Markets calm ahead of Fed talks (CGC, MYX, GMG, SGM)

WHAT MATTERED TODAY

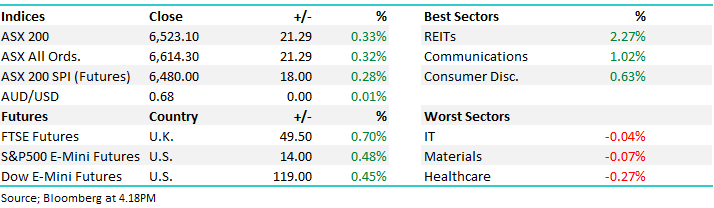

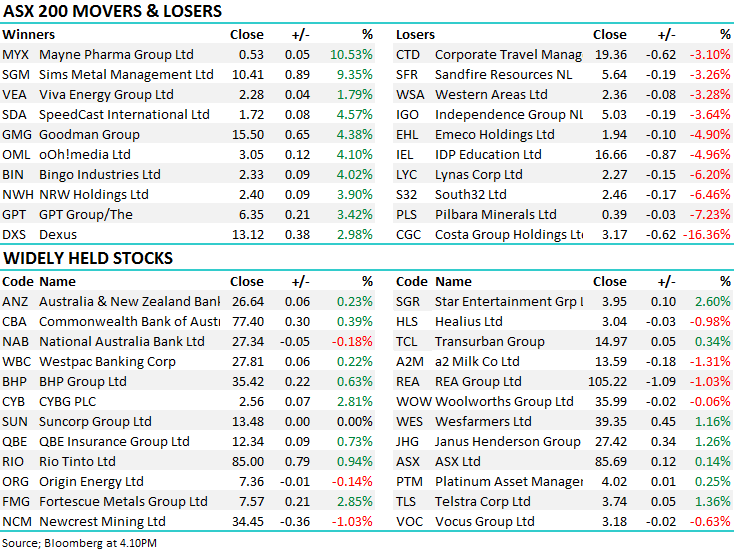

The market crept higher to round out a reasonable week of trading. There wasn’t a great deal of direction given from overseas markets with many investors watching for the commentary coming from the Jackson Hole symposium of Federal Reserve members – Chairman Jerome Powell is set to speak tonight. REITs the standout as the search for yield continues along with a number of stocks reporting well today. Healthcare was the worst sector, however it only closed marginally lower. NAB was the only bank to close lower today as ASIC moves against the bank for allegedly using unlicensed and customers were treated dishonestly.

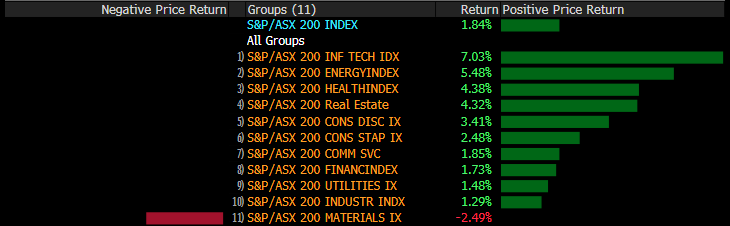

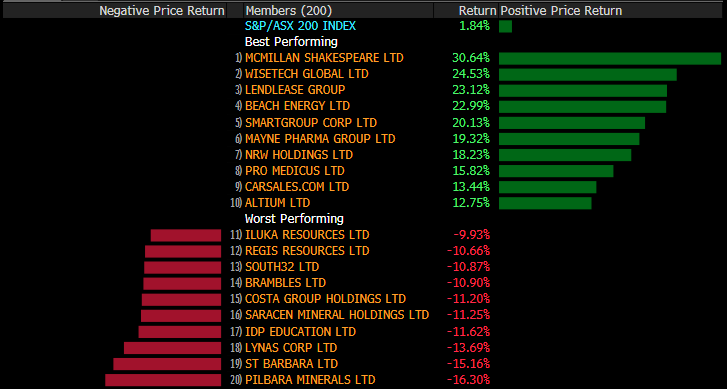

The market added 117pts / 1.8% for the week, rebounding from last weeks sell off.

Overall today, the ASX 200 closed up 21pts or +0.33% to 6523. Dow Futures are trading up +119 points or +0.45%

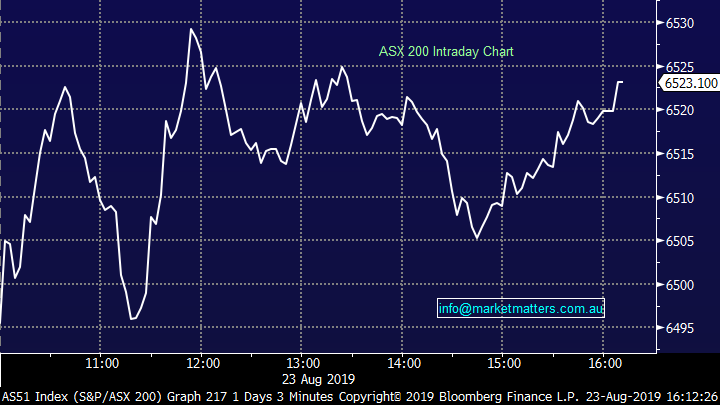

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

Reporting: More beats than misses today. BWX the stand out closing marginally off the days high.

Costa Group (CGC) - 16.36%: reported their first half numbers today. It was light on, even for their revised guidance from the AGM in May. The company talked to a number of issues continuing to impact earnings such as drought, a raspberry virus and pricing pressure on blueberry’s and mushrooms. They also noted costs continue to edge higher, leading the company’s crop harvest growth plans. The market was most concerned with the outlook with the company saying “trading and forecasting remains challenging with potential further downside risk." We own Costa Group, with more to come in the Weekend report.

Costa Group Holdings (CGC) Chart

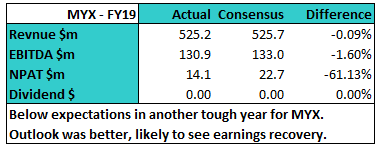

Mayne Pharma (MYX) +10.53%; the pharmaceutical developer and distributor saw earnings slide again in the year, however the stock popped despite the miss in today’s FY19. The company has been through a challenging US pharmaceutical market over the past few years, but it looks like we are now seeing the bottom of the cycle and earnings will look to recover from here. The company didn’t give any financial guidance, but did flag increasing demand as well as a number of new products close to launch.

Mayne Pharma (MYX) Chart

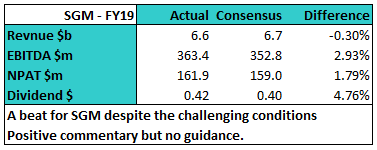

Sims Metals (SGM) +9.35%; scrap metal business Sims rallied today on a profit beat. The market was negative Sims heading into the result, however the company managed to do well in tough conditions. Profit was down 14% for the year, but beat expectations. The company didn’t give any financial guidance, but they did talk down any impact from Chinese quotes while also talking down Turkish demand.

Sims Metals (SGM) Chart

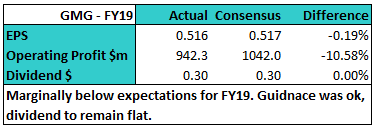

Goodman Group (GMG) +4.38%; Goodman, which owns business parks and warehouses, saw operating profit rise 11% in FY19, with earnings in line with expectations. The company talked up the outlook for the industrial real estate space and flagged opportunities in helping customers improving supply chain efficiency. The operating profit for FY20 was flagged as $1.04b, behind expectations however the stock rose on the positive commentary. Dividends are expected to be flat in FY20.

Goodman Group (GMG) Chart

Sectors this week:

Stocks this week:

Broker Moves;

- NRW Holdings Upgraded to Accumulate at Hartleys Ltd; PT A$2.58

- Universal Coal GDRs Rated New Buy at Foster Stockbroking

- Bingo Industries Upgraded to Buy at Goldman; PT A$2.75

- Qantas Upgraded to Buy at UBS; PT A$6.40

- Qantas Raised to Speculative Buy at Evans & Partners; PT A$6.68

- Flight Centre Downgraded to Sell at Morningstar; PT A$39

- Flight Centre Downgraded to Hold at Bell Potter; PT A$47

- ERM Power Downgraded to Neutral at Macquarie; PT A$2.47

- ERM Power Downgraded to Neutral at JPMorgan; PT A$2.45

- Origin Energy Upgraded to Buy at Citi; PT A$8.17

- Santos Upgraded to Add at Morgans Financial; PT A$8.05

- Medibank Private Downgraded to Sell at Morningstar; PT A$3.25

- Medibank Private Upgraded to Equal-weight at Morgan Stanley

- Downer EDI Upgraded to Neutral at Credit Suisse; PT A$7.70

- EBOS Downgraded to Hold at Deutsche Bank; PT Set to NZ$24.10

- Coca-Cola Amatil Cut to Negative at Evans & Partners; PT A$9.25

- Pro Medicus Upgraded to Hold at Bell Potter; PT A$29.20

- Pro Medicus Upgraded to Add at Morgans Financial; PT A$32.79

- Western Areas Downgraded to Hold at Bell Potter; PT A$2.79

- Pacific Smiles Upgraded to Buy at Bell Potter; PT A$1.47

- Coles Group Upgraded to Neutral at Credit Suisse; PT A$13.23

- Mt Gibson Upgraded to Neutral at Citi

- IDP Education Upgraded to Add at Morgans Financial; PT A$19.85

- Auckland Airport Cut to Sell at Deutsche Bank; PT Set to NZ$8.90

- Sky Network TV Raised to Buy at Deutsche Bank; PT Set to NZ$1.50

- BHP Group PLC Downgraded to Sell at Liberum; PT 14 Pounds

- Rio Tinto Downgraded to Sell at Liberum; PT 33 Pounds

OUR CALLS

No changes today

Watch out for the weekend report.

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.