Markets again start the week on the back foot (BIN, WEB, IGL, PMV)

WHAT MATTERED TODAY

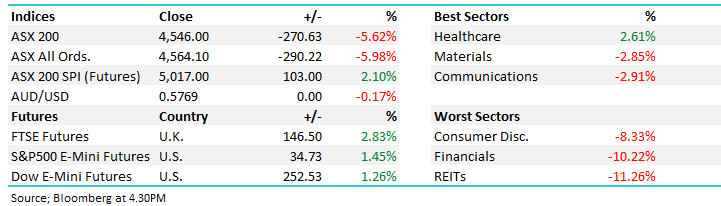

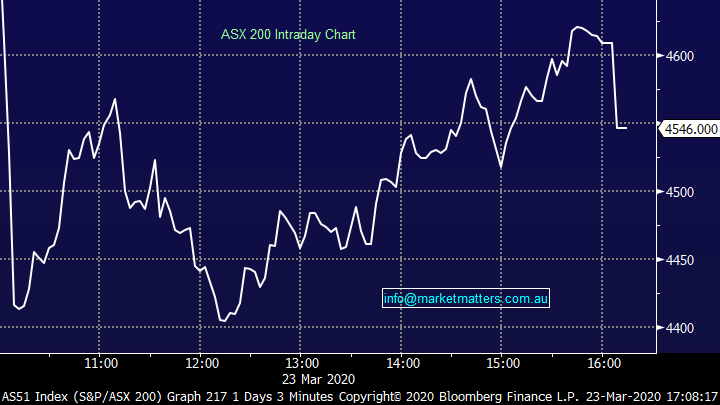

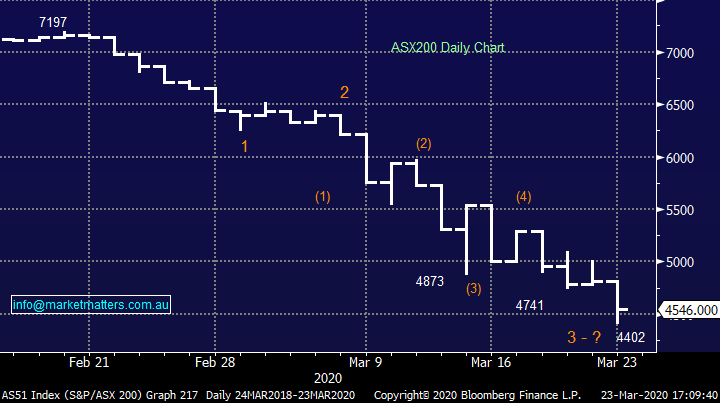

Monday’s are proving to be a baptism of fire for Aussie investors as the first major market to open and digest the weekend news flow, this morning the ASX 200 traded off more than 8% at the worst putting in a morning low of 4402 before edging higher throughout the session to close at 4546, however that was around 60pts below the afternoon high as a big MOC order (market on close) hit the screens in the match. US Futures went limit down first up this morning, meaning trade was halted after they declined ~5%, that was a result of the Democrats blocking the US stimulus bill, the argument being on where the funds should be directed rather than the amount, a deal should be done here soon.

Todays close was the lowest since November of 2012 wiping 7.5 years’ worth of price gains from the mkt. I revisited sectors today after our weekend note and one thing became very clear, there’s been no place to hide out in this market, traditional areas like infrastructure, property etc have all been hit hard, ditto for gold and gold miners, listed income securities like Hybrids are down 20% or more in some cases, corporate bonds, particularly lower grade debt has been hit for six as the market simply hits the liquidation button. The concept of cash being king has never rung more true.

Why has there been such indiscriminate selling? The markets inability to price risk given the worlds a different place from a week ago, let alone last month. We’re dealing with something that doesn’t have a road map and the error in judgement was clearly comparing this COVID-19 to other virus’s, this one trumps all others in terms of contagion, geographical spread and subsequent economic impact.

I’ve been accused of remaining too optimistic / not selling enough in a market like this and it’s a fair criticism, however we made the call that we missed selling early and that we’d focus our attention on improving the quality of our portfolio’s, which is an uncomfortable decision right now, and selling more equities sooner would have been the way to play it, however truth be told I haven’t seen a market like this before, it took almost a year during the GFC to see a decline like this one we’ve seen in a bit over a month.

Daily moves in stocks of 6-8%, 10-12% in the high beta names are becoming the norm - that said, it’s worth remembering that it’s not the norm, this is a market that is anything but normal, because of that, when a rally does come, and it will, the market will rip significantly higher in a short amount of time – it will surprise everyone. While I’m not sure when that will be, it feels like it’s getting closer – much closer. Remember, the market will bottom before the news cycle will.

From the 7197-high set on the ASX 200 on the 20th Feb, the market has now fallen 2795pts/39% in a decline that no one predicted (a few probably but I bet it’s not the first time they’ve predicted it).

Overall, the ASX 200 fell -270pts / -5.62% today to close at 4456 - Dow Futures are trading down -821pts/-3.93%.

ASX 200 Chart – Some buying from the lows today, mkt put in +144pts from midday

ASX 200 Chart

CATCHING MY EYE:

Bingo (BIN) -4.96%: fell on their sword today as they walked away from FY20 guidance that was reiterated just 4 weeks ago - a sign of the fluidity of the evolving situation however its becoming the norm across the ASX.

Despite pulling guidance, the company did say that the 3rd quarter was on track to hit expectations however given the impending shut down in NSW & Vic, visibility in earnings was too murky to stand by guidance. Bingo estimates that around 15% of revenue falls in the Commercial & Industrial (C&I) category which will be most impacted by the shutdown. Although volumes in construction remain firm, Bingo also noted potential disruption of projects could impact volumes in Building & Demolition (B&D) in the final quarter of the year, although government stimulus packages targeted at these industries may mean a strong rebound.

The show must go on for Bingo, and MD David Tartak was keen to point out the company's strong balance sheet. Tartak has acted quickly to cut costs with "the deferral of all non-essential capital expenditure and reduction of operating costs" in an effort to protect the business if the situation deteriorates further. Bingo shares fell less than the market, a sign a lot of the comments were expected by the market. BIN hit a $1.47 today before closing at $1.82, I know it doesn’t feel like but that’s a bullish move on the day.

Bingo (BIN) Chart

Webjet (WEB) Halted: The hat is going around for WEB as they attempt to raise $250m in equity. Not sure of the terms yet / or the price and it’s going to be very interesting whether or not they can get this done. Watch this space. Flight Centre (FLT) also short of cash, they have cancelled their dividend + are in talks with the Federal Government for assistance, Credit Suisse saying they need $200m, I would suspect more. FLT remain in a trading halt as do WEB

Webjet (WEB) Chart

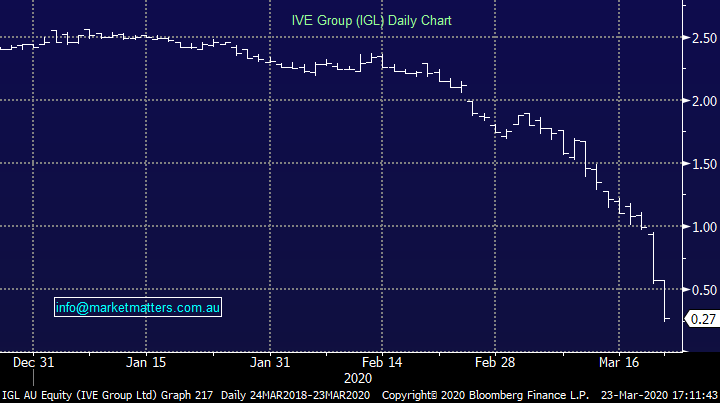

IVE Group (IGL) -52.63%: Hit hard today after they came out of a trading halt, pulled their guidance and cancelled their dividend. They also pulled their planned capital expenditure of $25-30m for catalogue automation. They refinanced their banking facilities last year with facilities not maturing until April of 2023 + they confirmed they remain within their banking covenants. 5 Directors have bought stock this month, the Chairman spent ~$1m, not a small amount, hardly likely if the business was is extreme financial difficulty.

IVE Group (IGL)

BROKER MOVES:

Premier Investments (PMV) upgraded from Citi below to buy ($14.90 PT) is actually one to look at. $100m cash on balance sheet, good online presence and if there are two operators who can pressure landlords, its Solomon Lew and Mark McInnes. Stock has fallen from ~$21 closing today at $8.95.

Premier Investments (PMV) Chart

· Premier Investments Raised to Buy at Citi; PT A$14.90

· JB Hi-Fi Raised to Neutral at Citi; PT A$31.20

· Flight Centre Raised to Buy at Citi; PT A$22.70

· City Chic Collective Ltd Raised to Buy at Citi; PT A$2.50

· Regis Resources Raised to Outperform at Macquarie; PT A$3.60

· Resolute Mining Raised to Outperform at Macquarie

· Qantas Raised to Buy at Citi; PT A$3.70

· Coca-Cola Amatil Raised to Neutral at UBS; PT A$10

· Technology One Raised to Neutral at UBS; PT A$7.25

· Pro Medicus Raised to Buy at UBS; PT A$29.30

· Altium Raised to Buy at UBS; PT A$37.50

· St Barbara Raised to Outperform at Macquarie; PT A$2

· OceanaGold GDRs Raised to Outperform at Macquarie; PT A$3

· Newcrest Raised to Neutral at Macquarie; PT A$22

· FlexiGroup Cut to Neutral at Macquarie; PT A$1

· Evolution Raised to Outperform at Macquarie; PT A$3.80

· SCA Property Raised to Buy at Jefferies; PT A$2.65

· Kogan Raised to Outperform at RBC; PT A$5

· Medibank Private Cut to Hold at Morningstar

· Metcash Cut to Sell at Morningstar

· Transurban Raised to Buy at Morningstar

· Blackmores Cut to Hold at Morningstar

· ALS Raised to Hold at Morningstar

· GPT Group Raised to Buy at Morningstar

· Pendal Group Raised to Positive at Evans & Partners Pty Ltd

· Austal Raised to Buy at Goldman; PT A$3.73

· James Hardie GDRs Raised to Sector Perform at RBC; PT A$23

· South32 Raised to Buy at Renaissance Capital; PT A$3.02

· Worley Cut to Neutral at JPMorgan; PT A$8.30

· Woodside Cut to Neutral at JPMorgan; PT A$24

· Oil Search Cut to Neutral at JPMorgan; PT A$3.65

· Carnarvon Cut to Neutral at JPMorgan; PT 39 Australian cents

· Beach Energy Raised to Overweight at JPMorgan; PT A$2.15

· Crown Resorts Raised to Outperform at Credit Suisse; PT A$11

· IOOF Holdings Raised to Hold at Bell Potter; PT A$3.25

OUR CALLS

No changes to the portoflios today

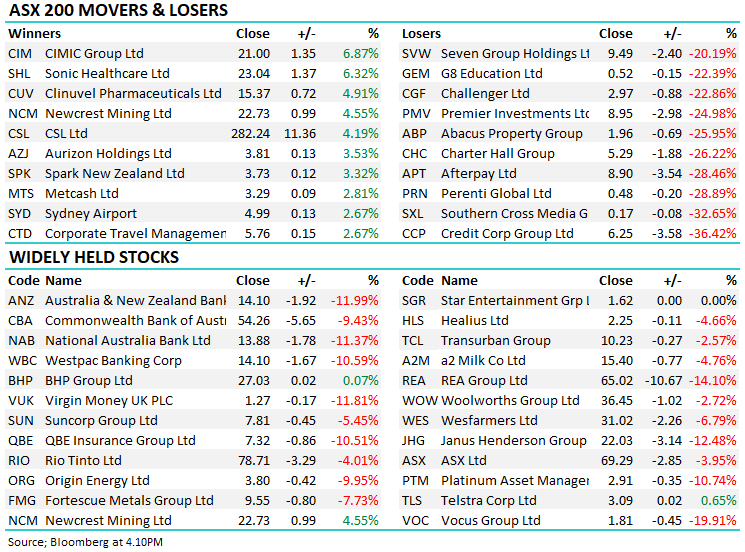

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.