Market subdued – Nanosonics a left field pick! (NAN, WES, IGO, OZL)

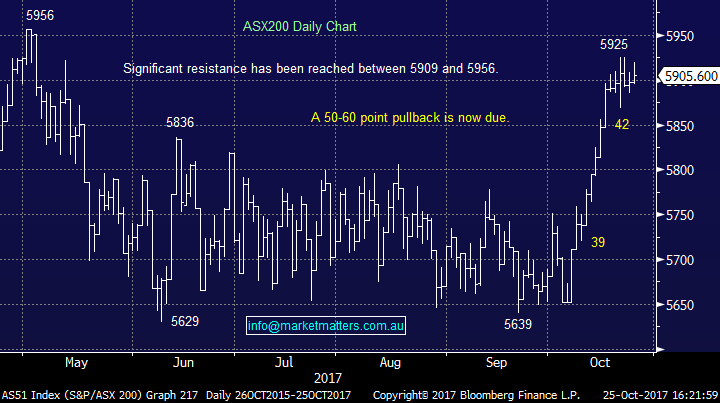

A strong lead overnight turned into an OK session today as the 5900 level once again proved to be a sticking point for the market. Highs were reached early but confidence faded, led by disappointing CPI data coming in below the RBA target range at 1.8% for the year. This was most disappointing for Consumer staples, the worst performing sector, falling 1.24%, while energy and materials charged on as global growth seemingly continues to pick up. Overall a range today of +/- 24points, a high of 5919, a low of 5895 and a close of 5905, up 7pts or 0.14%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Independence Group (IGO) - The morning IGO posted September quarter production numbers with strong Nickel results which is the key to this stock now.. Nova Nickel hit the top end of guidance, while the Tropicana gold production numbers hit the middle of the range. Free cash flow was also strong which the mkt liked. It’ll be interesting to see how the shorts react to this result, IGO climbed to an intraday high up +4% on yesterday’s close before finishing over 2% higher this afternoon. Hopefully the shorts start to scramble and this drags the stock up strongly. We own IGO in the Growth Portfolio

Independence Group (IGO) Daily Chart

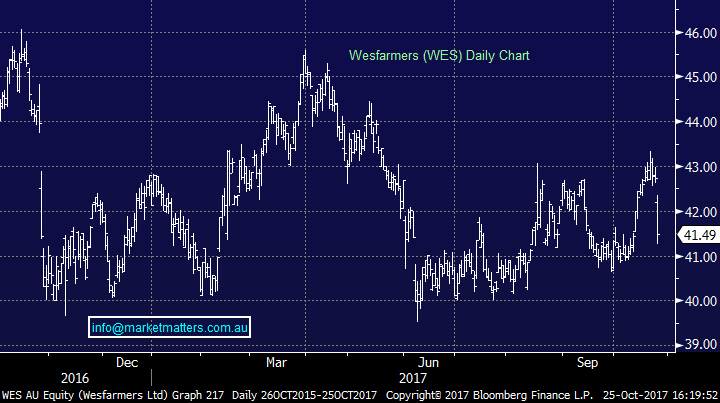

Wesfarmers (WES) - In contrast, Wesfarmers announced their first quarter sales this AM which disappointed. LFL sales in Coles was weaker than expected at 0.4% QoQ, but possibly most disappointing was the price deflation, where prices fell 2.3% driven by fresh foods. Clearly margins in supermarkets continue to come under pressure, and there could be some way to go given Australia’s supermarkets have some of the highest margins v global counterparts and competition continues to grow. Bunnings, Kmart and Officeworks made some ground however it was not enough to offset poor outcomes from the largest part of the Wesfarmers group. The stock closed down 2.9% to $41.49. We have no interest in WES or WOW for that matter.

Wesfarmers (WES) Daily Chart

Current MM Trades – Two positions in play at the moment, with today’s alert on Nanosonics (NAN) slightly left field, however the technical picture of that stock simply looked exceptional, and the stock has a low correlation to the broader market, or in other works, if the mkt corrects, NAN is unlikely to be hit hard and will more than likely run its own race. It is a $850m company and resides in the S&P/ASX 200 however more unconventional versus our usual picks.

That said, we got set early in the MM portfolio, however concede that liquidity is very low in the stock and it moved quickly. We would be comfortable from a risk / reward perspective to increase our buy range to around $3.00 up from around $2.90.

Nanosonics (NAN) Daily Chart

Oz Minerals (OZL) - is another we have a BUY in for at $8.24, with the stock hitting $8.26 yesterday. The sub $8.25 buy alert remains active this week however we are not advocating chasing the stock, preferring to wait for the stock to come to us.

Oz Minerals (OZL) Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/10/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here