Market shows first sign of cracking (APT, HUB)

WHAT MATTERED TODAY

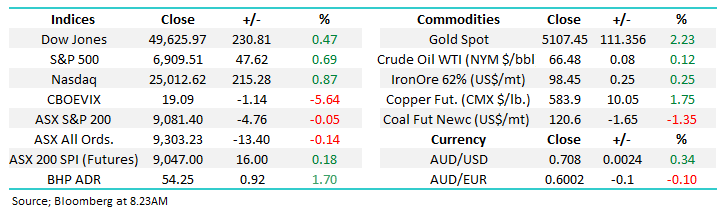

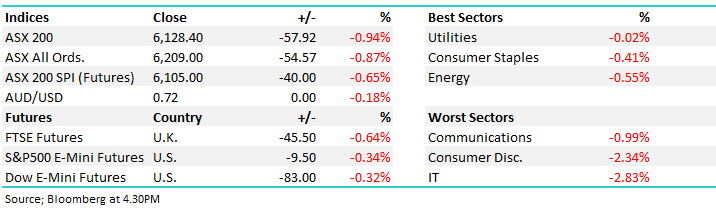

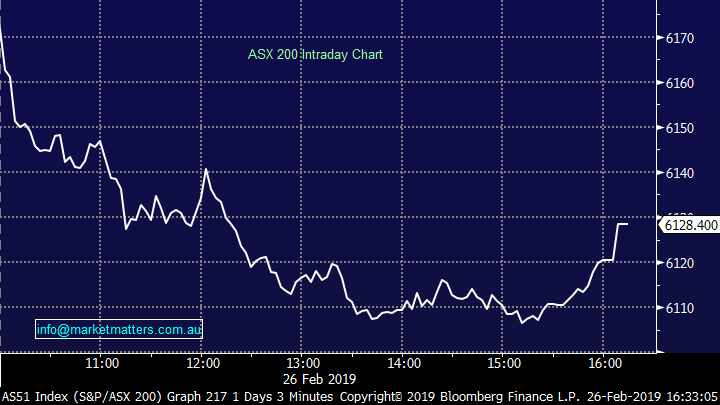

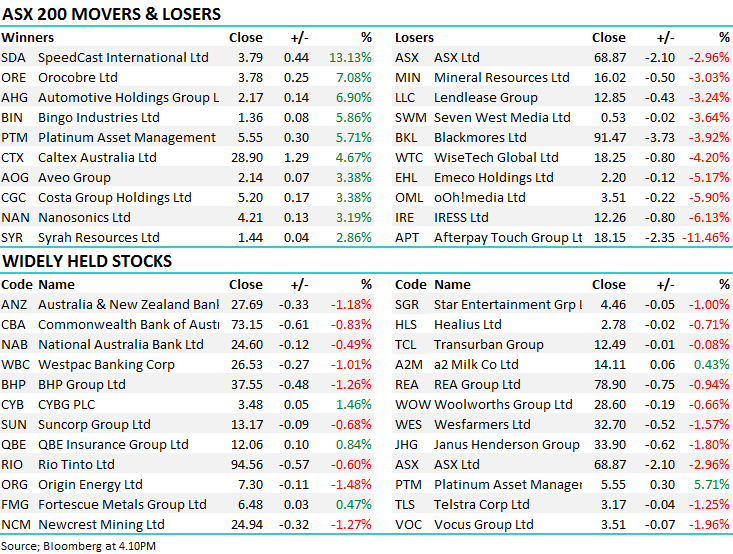

A weaker session played out across the Australian market today, and while there were a raft of stocks trading ex-dividend, a drop of -58points at the index level was still the first meaningful pullback we’ve seen this calendar year. Asian markets were weaker today, although China added +0.5% after a stellar run of +6% yesterday while US futures also tracked lower despite positive news around US / China trade negotiations - as we suggested this am, perhaps it’s a case of buy the rumour, sell the fact on the tariff saga.

At a sector level today, all ended in the red led by the recent high flying technology names while as to be expected, the defensive utilities and consumer staples sector were the place to hide.

Overall today, the ASX 200 fell by -58points or -0.94% to 6128. Dow Futures are currently trading down -86pts / -0.33%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

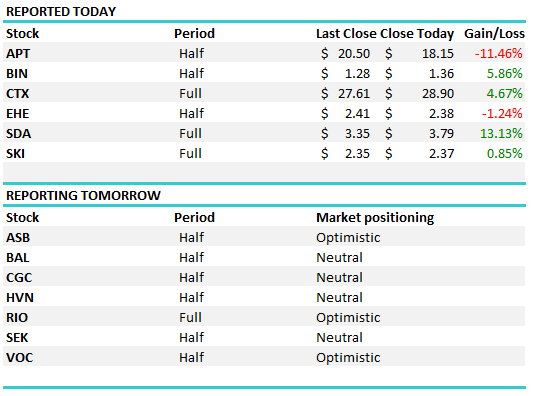

Reporting today; A mixed session today in terms of company reports, clearly Afterpay Touch (which Harry covers below) was in focus after reporting weaker than expected numbers while Caltex launched a surprise buy-back which the market likes plus the underlying results was actually a pretty good one relative to recent trends – the stock added +4.67%. I cover HUB 24 which was also sold down on the day while Bingo Industries (ASX:BIN), a stocks we recently bought in the Growth Portfolio added +5.86% after releasing half year results, although no new news with that one given they already downgraded about a week ago – the main catalyst on the 28th with the ACCC ruling on the DADI acquisition…

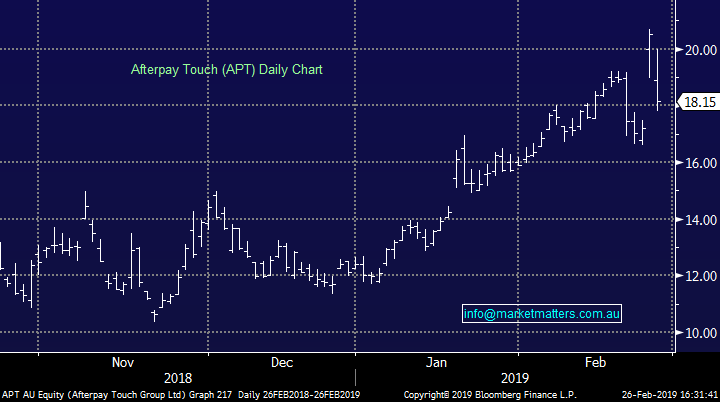

Afterpay (ASX: APT) -11.46%; Buy now pay later platform Afterpay has slumped today on soft half year results as its volatile ride continues which includes a fall of 7.8% , a +19.2% rise yesterday while today it is currently trading more than -8% lower. Today’s half year result missed the market despite showing substantial growth across the business. Both users & merchants have more than doubled over the past 12 months leading to a near 150% rise in transaction volume in the last 6 months of 2018. This dropped down to a half year EBITDA of $17m, falling around 3.5% short of one of the more conservative analyst estimates. Despite having a market cap of over $4b the company ran a loss for the half of $22.2m.

Expenditure continues to ramp up as APT accelerates its push into the US, and is also soon to launch in the UK, growth still remains king. There is no doubt that APT had the first mover advantage locally, but the same cannot be said for the new markets it enters. It is ahead of schedule in terms of overseas investment and the market seems to be fearing that these dollars spent won’t be seeing the same rate of return as its previous investments. Locally, Afterpay bounced yesterday after the Senate inquiry handed down their final report after market Friday. The report eased fears of more strict regulation but did leave the door open for an increase in obligations for Afterpay. A big market cap for a loss making machine Afterpay is certainly a market darling – something we are conscious and cautious of at MM. It’s a good product but one that can be impacted by a number of uncontrollables at any point in time.

It looks to have run too hot at the moment but may take a closer look at the $16 support level.

AfterPay Touch (ASX:APT) Chart

HUB24 (ASX: HUB) -14.31%; Platform provider HUB 24 released first half results today and the stock slumped on the back of the numbers. While the profit line missed expectations, coming in at $3.2m versus ~$5m expected by the market, profitability in the business at the current stage of growth is less important than other factors. The key metric here is Platform EBITDA which printed $8m, below expectations for $8.5m on platform revenue of $25.4m, which was in line (give or take) with expectations. Margins were lower which highlights the pressure of increasing costs across that business. Clearly the Royal Commission into Financial Advice is a factor here with the annual opt in provisions now likely to impact HUB.

Funds under administration (FUA) increased by 46% to 10.0 billion while they also enjoyed net fund flows of $2.1bn – almost doubling the number set in the 1H of 2018. Their cash position tracked lower, down from $17m to $15.5m which highlights how capital intensive platform development is becoming, while also important to understand that increasing FUA will likely require further regulatory capital in the future. It’s been a ‘hot stock’ in recent years however as the business matures and the regulatory landscape tightens.

It’s hard to get excited on HUB for now, and the current trading range between $11 & $15 looks likely to hold

HUB24 (ASX:HUB) Chart

Broker Moves;

- NZ Refining Cut to Underperform at Forsyth Barr; PT NZ$1.70

- G8 Education Upgraded to Buy at Moelis & Company; PT A$3.64

- Myer Upgraded to Neutral at UBS; PT Set to A$0.38

- Appen Downgraded to Neutral at UBS; PT A$24

- Appen Downgraded to Neutral at Citi; PT A$23.29

- Appen Downgraded to Sector Perform at RBC; PT A$20.50

- Automotive Holdings Upgraded to Neutral at Macquarie; PT A$1.95

- Automotive Holdings Upgraded to Buy at Wilsons; PT A$2.45

- Chorus Downgraded to Neutral at Macquarie; PT NZ$5.25

- GTN Ltd Upgraded to Speculative Buy at Canaccord; PT A$1.80

- MMA Offshore Upgraded to Speculative Buy at Canaccord; PT A$0.25

- Stockland Downgraded to Neutral at JPMorgan; PT A$3.80

OUR CALLS

No changes today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.