Market rounds out February and reporting with more gains (ABC, BIN, HVN, RHC)

WHAT MATTERED TODAY

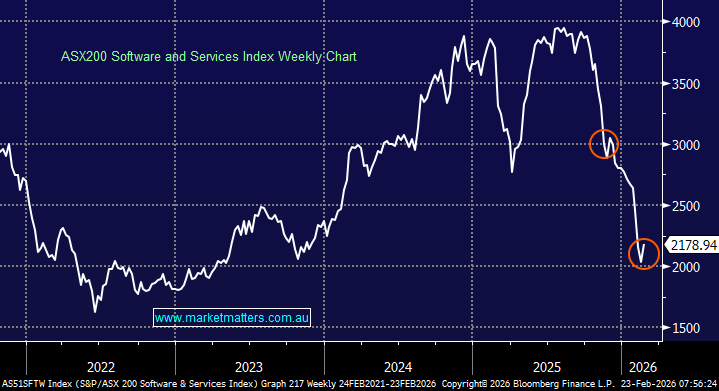

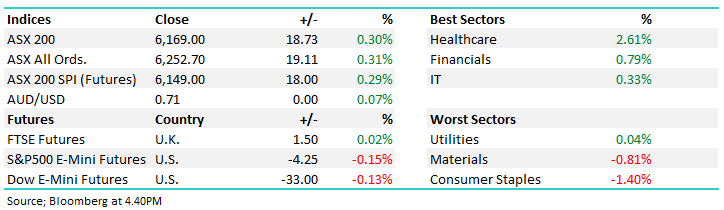

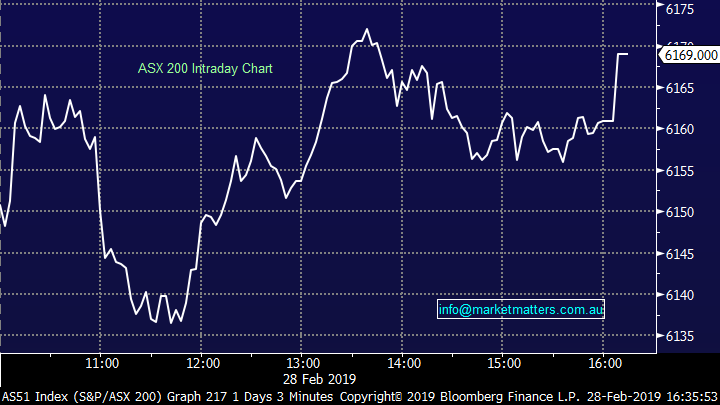

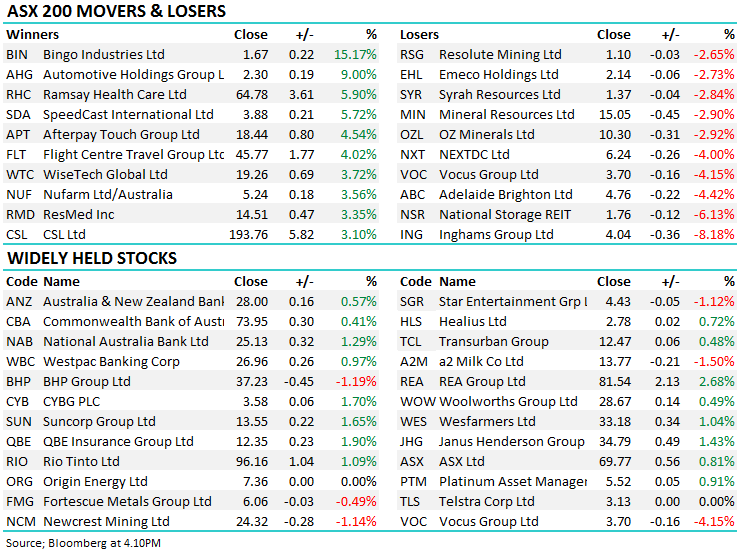

Another day where the market chopped in and out of positive territory before a late rally to end the short month of February. Late buying into the close has been the norm in recent days and it will be interesting to see whether that thematic continues into March – it looked like a case of window dressing today! Reporting season is now pretty much over – a few of the larger caps out today and then a lot of small caps that have been putting off bad news out in the next week or so - it’s certainly been a busy time on the desk and I’ll look to wrap it all up in the Weekend Report on Sunday.

Today we saw Bingo Industries (ASX:BIN) a stock we bought into recent weakness get the green light from the ACCC to proceed with the Dial-a-Dump purchase on the premise they divest one asset – which isn’t a big deal – plus they launched a $75m share buy-back which is positive - the stock ended ~15% higher, although I tend to think there is more left in the tank.

Healthcare was a strong driver of the gains today – Ramsay reported well, Resmed & CSL put on more than 3% a piece, the latter accounting for almost +9 index points (50% of today’s gains), although Cochlear continued to lag up just ~0.5% Banks were higher, NAB the best of them adding +1.29% while it seems there was some rotation playing out in the resources, selling of BHP and FMG to buy RIO ahead of its big dividend bonanza.

Around the region, Asian market were slightly higher throughout our time zone however nothing that influential while US futures were trading down.

Overall, the ASX 200 added +18points or +0.3% to close at 6169 - Dow futures are currently trading down -30pts /-0.10%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

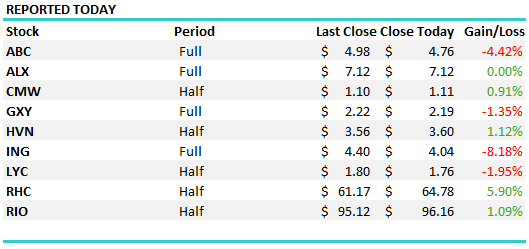

Reporting today; That’s pretty much a wrap for reporting season…not a bad one overall but importantly better than the market was positioned for leading into it.

Ramsay Healthcare (ASX:RHC) +5.90% was out early this morning with their half year results which were solid, however it’s the first time in a while I heard them talk about improvement in the UK and France. From an earnings perspective, core profit came in at $290m v the $287m expected by the market and they guided to core EPS growth of up to 2%. The market was already looking for +2.2% growth however it was the commentary around volume growth in the UK and better pricing outcomes in France that was interesting, and that would have underpinned the buying.

Building products company Adelaide Brighton (ASX:ABC) -4.42% missed the mark when they reported pre-market. They delivered profit of$285m versus the market at $292m (3% miss) however they also guided to flat sales for the full year. The market had some tentative gains pencilled in and considering the small miss for the first half and flat guidance, it looked about a 10% miss to me in terms of the full year relative to consensus. The SP has been under pressure in recent times so market expectations are not high, however still, hard to get excited about building material stocks from what I've heard this reporting season.

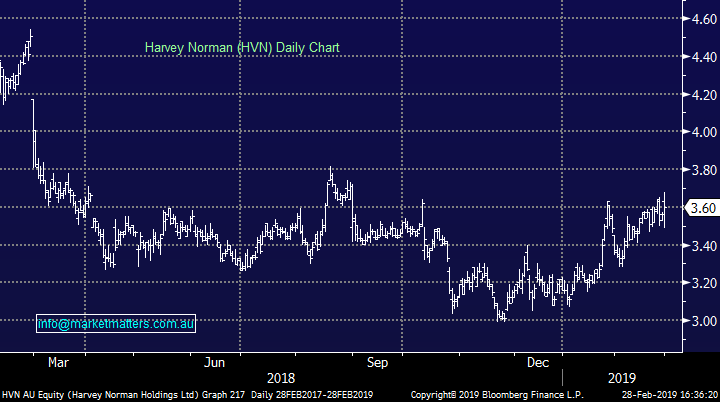

Harvey Norman (ASX: HVN) +1.12% rounded out the retailers reporting season today on a positive note with a reasonable first half result which showed comparable sales growth of 2% in a tough environment thanks to a record offshore sales figure. Profit came in about 5% better than the consensus numbers but about in line with last year’s first half. It’s clear that international investment is the focus for Harvey, seen as producing higher margins and better sales growth. Already this year, and what likely concerned investors given the share price was only ~1% higher for the session, was the soft sales growth for the current calendar year to date. Locally sales have gone backwards significantly as the retail market continues to suffer, whilst comparable sales at overseas outlets has been solid. We continue to be cautious of the retail landscape

Harvey Norman (ASX: HVN) Chart

…and finally, Bingo Industries (ASX: BIN) +15.17% rallied today off all-time lows set last week on the back of ACCC approval of the Dial-a-Dump acquisition. The stocks panic low of $1.17 came on the back of revised full year guidance which we wrote about here. The ACCC has spent the last few months pondering the take over which BIN pre-emptively raised capital for at $2.45 in August last year. Today they approved the deal provided one asset, the Banksmeadow processing plant, is divested.

Investors also got the sugar hit of an on-market buyback launch as well for Bingo. The company plans on purchasing up to $75m of stock as a result of the required divestment – a move that will be strongly earnings accretive.

The end result is Bingo now leads the market in terms of landfill space in NSW and commercial & building waste volumes, as well as adding a contaminated waste facility to its assets while aiming for $15m of costs synergies in the combined group. A green light for Bingo and for its share price. We expected either the acquisition to go ahead or for a large share buyback to be launched – we got both. The result is substantially EPS accretive and we see the bounce back as only just beginning. We hold the stock, looking for a recovery back to the $2 mark for now.

Bingo (ASX: BIN) Chart

Broker Moves;

- Seek Downgraded to Sell at UBS; PT A$17

- NextDC Downgraded to Sell at Deutsche Bank; PT Set to A$5.50

- OZ Minerals Downgraded to Hold at Deutsche Bank; PT Set to A$11

- OZ Minerals Downgraded to Underperform at Credit Suisse; PT A$9

- OZ Minerals Downgraded to Hold at Morgans Financial; PT A$11.40

- ANZ Bank Downgraded to Neutral at Macquarie; Price Target A$28

- Rio Tinto Downgraded to Underperform at BofAML; PT A$85

- Rio Tinto Downgraded to Neutral at Goldman

- Stockland Upgraded to Buy at Morningstar

- SRG Global Ltd Cut to Speculative Buy at Hartleys Ltd; PT A$0.48

- Michael Hill Upgraded to Add at Morgans Financial; PT A$0.78

- Costa Downgraded to Underweight at JPMorgan; PT A$4.69

- A2B Australia Ltd Reinstated Neutral at Macquarie; PT A$2.02

- Carnarvon Reinstated Speculative Buy at Argonaut Securities

- Flight Centre Reinstated at Bell Potter With Buy; PT A$49

OUR CALLS

We bought Costa Group (ASX:CGC) in the Growth Portfolio, paying up for it after yesterday’s update. While we had targeted buying at lower levels, markets are fluid and we changed course.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.