Market roars early, fades late (FMG, BHP, IPL)

WHAT MATTERED TODAY

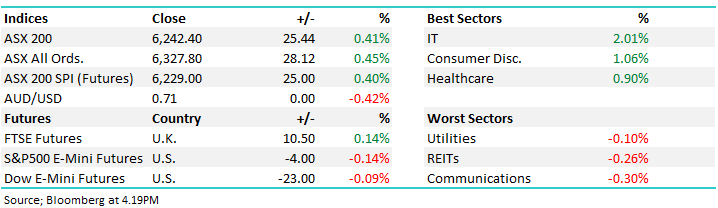

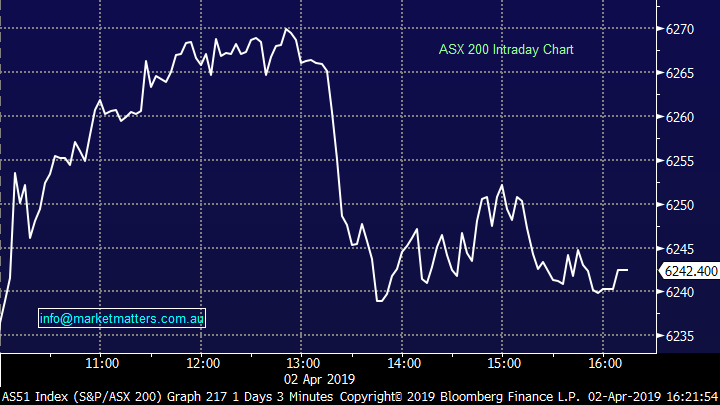

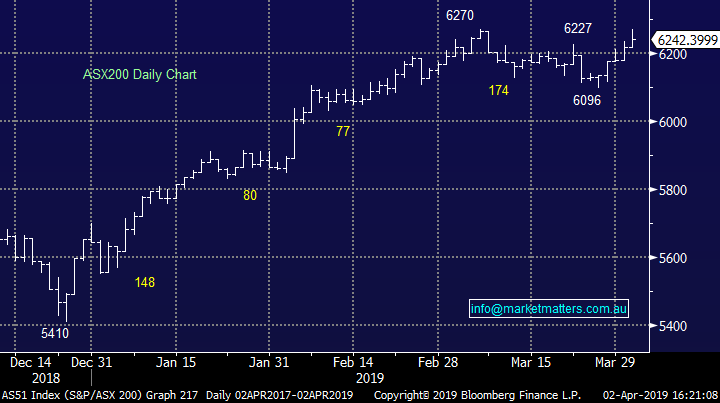

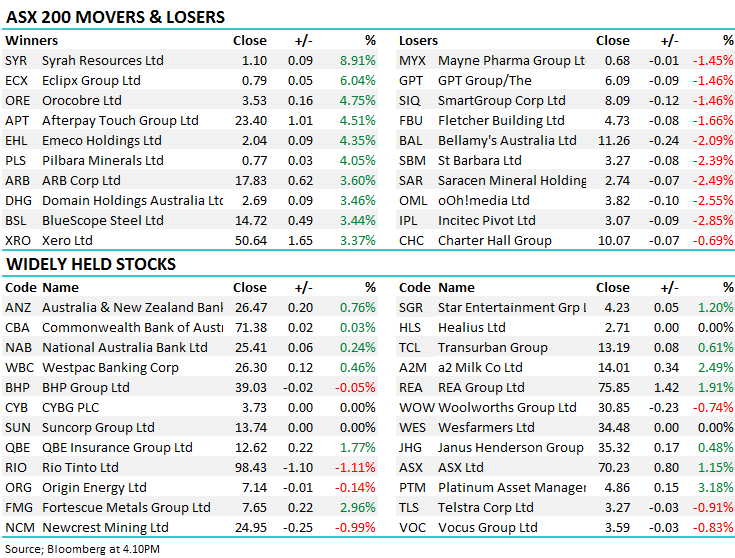

Aussie stocks were bullish early thanks to strength overseas – resources the main driver early on pushing the index up to a 6270 high - smack on the high we saw on 7th March before the market pulled back ~150pts. Those same jitters seemed to kick in today with the ASX 200 dropping 33points after the lunchtime high before tracking sideways into the close. Tech stocks also had a day in the sun with AfterPay Touch (APT) trading at an all-time high ($23.40 close), ditto for Z1P Money (Z1P) which closed at $1.87 and Xero (XRO) which is closing in on its all-time high of $52.58

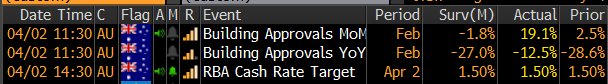

A lot of domestic data out today with Building Approvals better than expected, the RBA kept rates on hold at 1.5% and of course we get the Federal Budget out tonight.

Overall today, the ASX 200 added +25 points or +0.41% to 6242. Dow Futures are trading down -22pts / -0.11%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

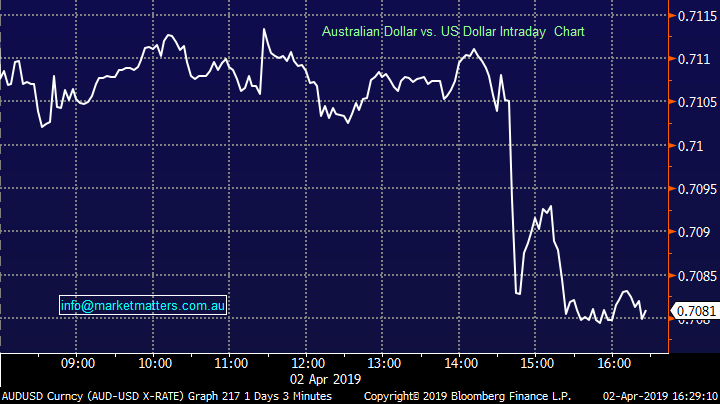

RBA kept rates on hold at 1.50% as expected, the AUD copped some selling as a result and settled the day back below the 71c handle.

Aussie Dollar

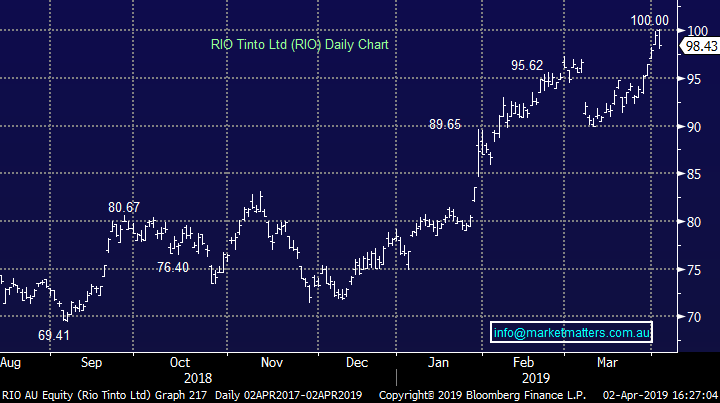

BHP -0.05% down smalls today after hitting an early high of $39.40. the Big Australian saying the recent Cyclone will impact Iron Ore production by 6-8mtpa which obviously adds to the supply issues from rivals RIO which said supply would be -14mpta plus of course Vale has the longer term issues impacting supply by around 40mpta for the next 2-3 years. All in all, this makes for a tight Iron Ore market and today we saw RIO hit the $100 handle – the first time since the GFC.

Rio Tinto (RIO) Chart

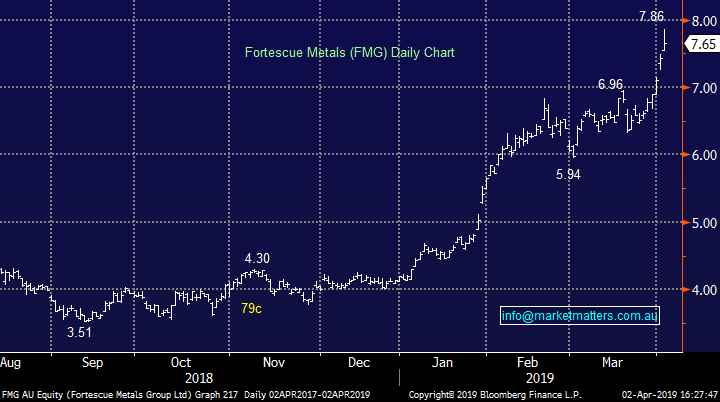

Fortescue (FMG) +2.96% was also out today with some positive news saying it would move ahead with stage 2 for the joint venture at Iron Bridge. The project will deliver a higher grade iron ore than Fortescue is used to, to be blended with existing product to ultimately sell a 60% blend – above FMGs 57%, but still below the market standard 62% grade, although ore will be produced at a grade as high as 67% out of Iron Bridge. The project will require around $US 2.6b of investment, with Fortescue up for the bulk of the capital. This was a plan devised when the discount for FMG Ore was sitting around 40% and FMG were in the cross hairs of Asian Shorter’s…Today FMG hit a high of $7.86, before closing at $7.65

Fortescue Metals (FMG) Chart

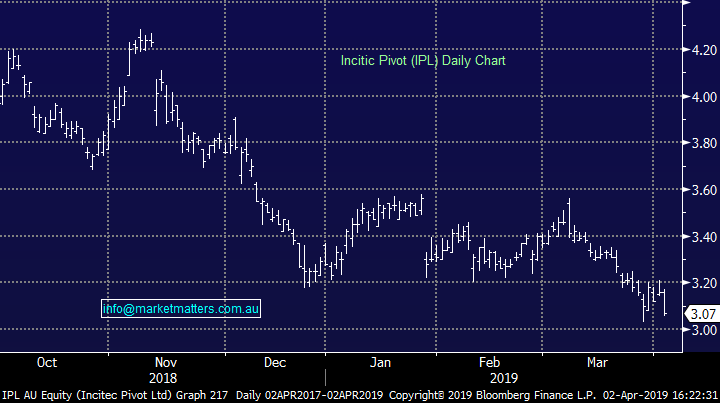

The fertilizer supplier Incitec Pivot (IPL), -2.85%, slumped today after confirming another hit to earnings as well as plans to combine two Victorian facilities for a cost of $13m. They have been under pressure the past few months with both ends of the weather spectrum impacting earnings. The Queensland floods in February is set to cause a $100-$120m hit to earnings with rail lines curbing product distribution, while the company today flagged another $20m hit coming from dry weather dragging demand. Sales will come in around 200,000 tonnes lighter than the year before when the company announces full year results in late May. We like agriculture stocks into weather related weakness, and like Incitec’s proactive response in cutting costs with the factory merger which will help earnings in the medium term.

Incitec Pivot (IPL) Chart

Broker Moves:

· Fortescue Upgraded to Hold at Deutsche Bank

· Harvey Norman Downgraded to Sell at Morningstar

· Platinum Asset Upgraded to Neutral at Credit Suisse; PT A$4.70

· Magellan Financial Cut to Neutral at Credit Suisse; PT A$35

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.