Market Matters Easter Report Monday 13th April 2020

We were going to send a more comprehensive Easter Report out tomorrow morning, however, it was done so it’s in your inbox today.

In today’s note I’ve focused on the simple question most subscribers ask MM “should I buy or should I sell now?” with of course the word “what” tagged into this phrase somewhere.

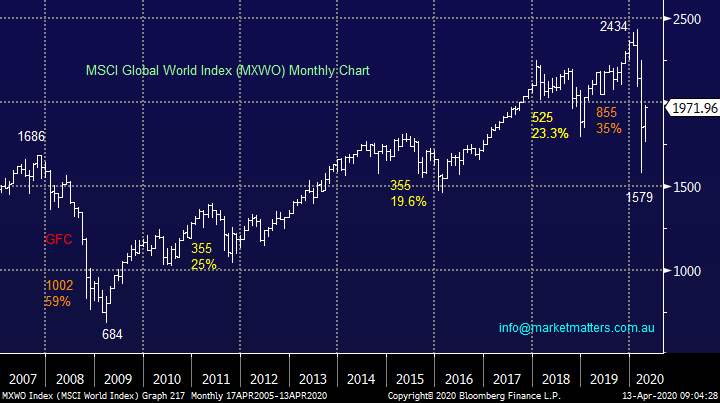

Firstly, I just wanted to thank our clients and subscribers for the many kind messages I’ve received over the last month or so. Your concern and kind words when your portfolios are suffering means a lot to myself and the team. Additionally, I think its important to acknowledge all the important medical staff in our unprecedented moment of need, the worst thing that can happen to me is I get the market wrong and lose $$, these people and all their support staff can catch COVID-19 and get sick or even die - if you haven’t considered this fact it’s worth a few minutes reflection. The same obviously applies to all necessary workers as Australia continues to perform admirably when compared to the world during this global pandemic, as of this morning we had ‘only’ endured 59 deaths compared to the UK with over 10,000, Italy at almost 20,000 and the US with over 22,000.

After contemplating the sobering humanitarian impact of COVID-19 I have moved onto its impact of financial markets which by definition is a reflection of the populations journey back to the normal life we enjoyed but probably didn’t fully appreciate in the first few months of this year. I have listed the main stages through which I see things unfolding as most importantly we attempt to unravel what comes next:

1 – Blissful ignorance / complacency as the coronavirus spread through Wuhan and Hebei province, Wuhan went into lockdown on January 23rd but most Western equity markets continued to rally with the Dow and ASX200 both making fresh all-time highs amazingly about a month later – as we said at the time it felt like crazy optimism to basically apportion a zero percent risk that the virus would spread globally.

2 – Sheer panic as investors realised they were wrong and in many cases leveraged to risk markets including equities, most international stock markets plunged an unprecedented 35 to 40% in just a few weeks.

3 – As Governments & Central Banks literally throw the proverbial kitchen sink at the COVID-19 issue equities have retraced around 45% of their losses as they bask in the comfort that if the Fed & Co. are “going all-in” to support the global economy things should be ok, sooner rather than later.

That’s the end of the brief history of 2020 so far, now onto the far more tricky part of the equation: what’s next in arguably the most crucial investing period of our generation.

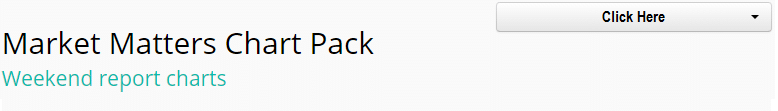

The MSCI World Equities Index Chart

History tells us that after Winter follows Spring, to acknowledge this with regards to equities we only have to reflect on 1929, 1987 and the recent GFC in 2008. Significant and sustained rallies eventuated however their characteristics / look & feel were mostly different. The one common denominator being that positioning in solid risk / reward stocks when the recovery does undoubtedly unfold, ideally in today’s case after a vaccine has been released, is where the real money is made.

4 – Encouraging data is emerging from a number of developed countries as aggressive lockdowns appear to have “flattened the curve”, we already know from China that once the virus is controlled countries can slowly return to work however Singapore has also illustrated that relaxing restrictions too early can be a case of 2 steps forward and 3 back! South Korea has been a huge success with its results against COVID-19, only 214 deaths to-date for a population of over 50 million is a solid performance for a country whose basically on the doorstep of China, but their schools remain closed while over 1/3 of new cases are still from people arriving from overseas, this doesn’t bode well for globalisation short-term.

MM believes that the developed world will flatten the COVID-19 curve with the US coming in a distant last BUT normal global trade & travel will largely be on hold in 2020.

5 – From reading numerous scientific articles over the last week it appears very unlikely that we will see a mass produced Vaccine this year. Bill Gates estimates its 18-months away and while we can undoubtedly quell its spread without one “things aren’t going to be normal. They can open up to some degree but the risk of a resurgence in cases will be there until we have very broad vaccination.”

Hence MM believes we’ve seen the worst of COVID-19 from both a humanitarian and stock market perspective but expecting a rapid ”V-shaped” recovery is highly likely to be too optimistic.

How to “play” COVID-19 has become an enormous and tricky balancing act for governments both here and abroad, the economy on one hand and human life on the other. Its pure guesswork as to when the respective governments will throw caution to the wind although I expect President Trump might be first to press the button even if the US is still only in the middle of its respective pain, remember Trump has an election to try and win in November.

Locally while we’re winning through our strong lockdown laws the financial pain is not sustainable and Scott Morrison cannot keep handing out money without a “back to work plan” which will involve sacrificing a pick-up in new cases / deaths. I read a perfect analogy this morning which compared a speed limit of 5km/h to save lives versus a practical higher limit for day to day existence – it’s all compromise with some politicians unfortunately being almost asked to play god.

Confirmed COVID-19 deaths in Italy & US Chart

This leads MM to a couple of decision defining conclusions with regard to investing through the remainder of 2020:

1 – The local ASX200 has only recovered 35% of its decline since equities started plunging in late February primarily because of our influential Banking sector which remains under financial and political pressure. We believe equities are going to rotate with an upward bias throughout 2020 i.e. buy weakness / sell strength in a year which we believe will see significantly diminished volatility compared to March but still much higher than the majority of the last decade.

On an index level MM is a buyer of pullbacks in 2020 – we can easily see a range of ~5000 to ~6000 for the next few months ahead.

ASX200 Index Chart

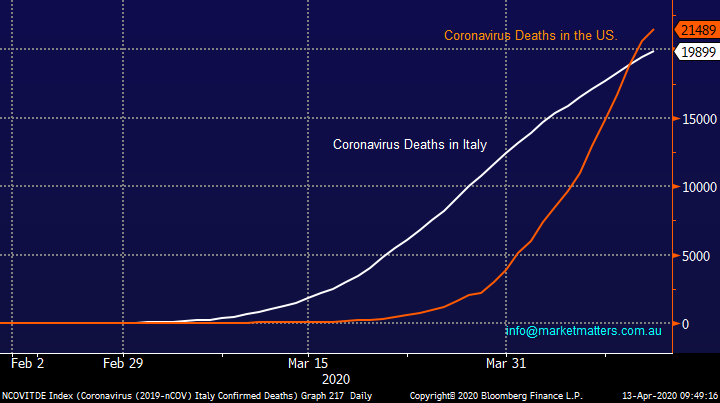

2 – When we stand back and look at the main US index the picture is surprisingly rosy especially if we close ourselves off to all news – the markets appears to have experienced another healthy correction after the longest bull market of all-time which lasted 11-years and saw stocks rally over 400%!

MM remains bullish the US S&P500 targeting fresh all-time as early as 2021.

US S&P500 Index Chart

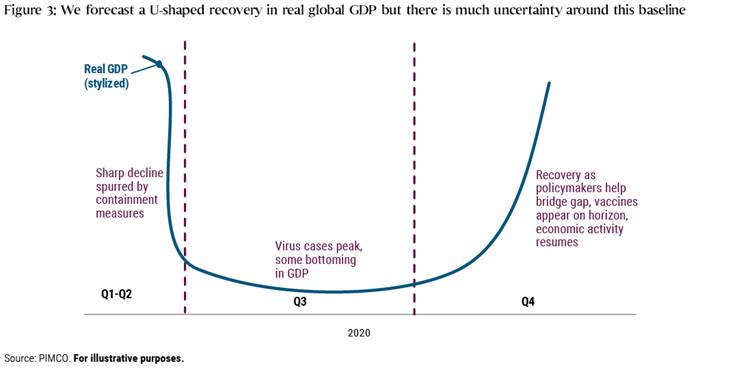

Australia remains fortunate that 3 of our largest 4 trading partners are already emerging from COVID-19 which should help our economy follow a U shaped recovery profile as opposed to the more painful “L shaped” scenario, most economists are not expecting a meaningful recovery until Q4 of 2020. However the good news for investors is that equities usually move around 6-months ahead of the fundamentals hence if things are going to turn as PIMCO recently illustrated below stocks should be bottoming around now, our current view at MM.

We wouldn’t be surprised to see the bottom of the “U” stretch into 2021 for reasons touched on earlier but its only likely to lead to some sideways action by stocks as opposed to another large downturn, unless of course stocks become too optimistic in the ensuing months.

I’m sure a number of subscribers are questioning “Why and how could stocks possibly make fresh all-time highs” the answer in our opinion is the enormous combined power of QE & interest rates. Back in May of last year legendary investor Warren Buffett said “he thought stocks were ridiculously cheap if you thought the yield on 30-year Bonds at 3% made sense” BUT today stocks are at the same level whereas now 30-year bonds are trading at only 1.35%. I know COVID-19 has dramatically changed the investment landscape but if we assume that in say 2-years’ time things have returned to relative normality then the current stimulus and intertest rate tailwinds are enormous e.g. Home loan rates in Australia have almost hit 2%, that’s half of just a few years ago.

The RBA has slashed official interest rates in Australia to 0.25% and while there’s clearly not much love left in this tank we believe both our and global central banks will be very reticent to turn off the tap too quickly post CIOVID-19. Hence if people are comfortably back at work and they can borrow $$ for a mortgage at around 2% the affordability soars and we may rapidly see property return to its dizzy heights – a stable property market is critical to the RBA and government for the Australian economy to recover, we don’t like to spend money if our house price is falling!

MM is bullish risk assets medium-term.

Australian & US 10-year Bond Yields Chart

We believe huge market volatility is largely behind us and investors focus should return to underlying value although there will be “themes” which prevail over the short / medium term. Hence if we believe stocks are going to rally in a choppy manner through 2020 the question is what stocks should we buy - our answer is at this stage of the “game” is go with quality especially as question marks remain as to exactly how long and what form the economic recovery will take. At MM we are looking for sustainable, quality earnings with manageable debt in sectors we like - sounds easy but these aren’t always the best stocks from a ROI perspective e.g. our position in Emeco Holdings (EHL) has recovered ~130% once the market decided they would be able to raise money if required whereas CSL ( CSL) has only bounced 35%.

Stocks that have recovered strongly after being unceremoniously dumped on concerns for their longevity may again start to underperform.

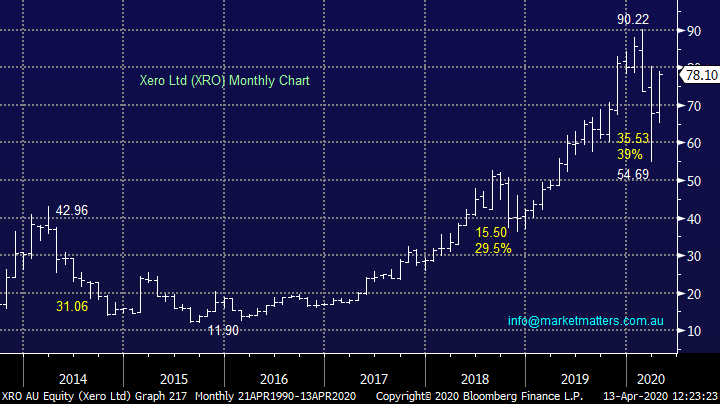

A perfect local example of quality prevailing is Xero (XRO) which we bought at the start of April, its rallied over 40% from its March low, outstripping most of the Australian IT Sector in the process – this is a classic time to invest to sleep as opposed to be a hero!

MM still believes it’s an opportune time for investors to be accumulating equities while moving up the quality curve.

XERO (XRO) Chart

In the US the ultimate example of quality prevailing is household name Apple (AAPL US) which is now only 22% below its all-time high. The human psychology from fund manager to retail investor alike during these turbulent times is easy to comprehend – they are cashed up and want / need to invest but they only want to buy companies that will be on a strong footing in the years ahead i.e. they are far more comfortable paying up for quality as opposed to buying “cheaper” more average businesses.

MM believes it’s rime for investors to be buying stocks globally while continuing to move up the quality curve.

If we are correct and stocks are destined to make fresh all-time highs in the next few years then its at the mature end of the rally when the lower quality stocks will come into their own, no hurry yet!

Apple Inc (AAPL) Chart

The Feds basically gone “all in” with its QE & rate cuts and until they again start tightening (QT) there’s a huge tailwind back in town for stocks. While this doesn’t mean the S&P500 will rally in a straight line it does add significant support to our view to buy periods of aggressive weakness. Its important for subscribers to remember that if we do buy stocks today they are still down 20-25% from Februarys high and while you & I may have missed the 2020 low in some stocks, its not a bad price to pay for a degree of clarity.

Ultimately, we’re never too pedantic on price if / when we intend to buy, its irrelevant where the stock was 3-4 weeks ago, what matters is what we believe its worth.

“I never buy at the bottom and I always sell too soon” - Baron Rothschild.

US S&P500 Index & the Fed Chart

Today I have briefly looked at 2 sectors critical to the overall health of the ASX which we will obviously be updating regularly as we look to identify standout opportunities in today’s exciting market.

The Australian Banks.

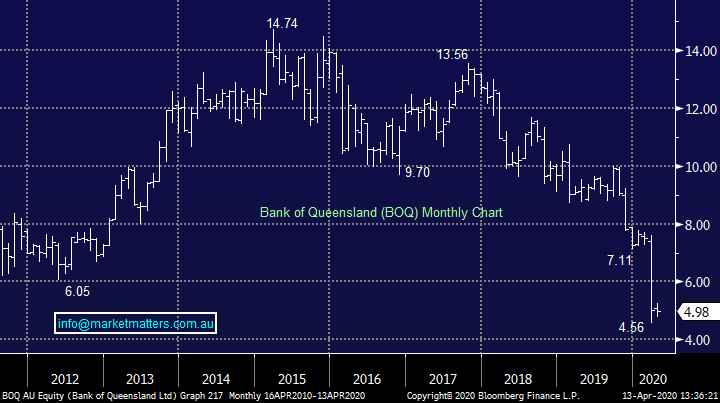

The Australian banks have been hammered by COVID-19 with APRA attempting to dictate how they operate certainly not helping matters. Sector and market heavyweight Commonwealth Bank (CBA) is down -6.9% over the last month compared to regional Bank of Queensland (BOQ) which has tumbled -17.1%. We believe they will be higher in a years’ time but there appears no need to be chasing the sector at current levels – when we look at the BOQ below my best guess is at least 1-2 months sideways similar to earlier in the year, for those considering increasing exposure another dip lower feels a strong possibility.

MM is neutral banks at current levels.

Bank of Queensland (BOQ) Chart

The Resources Sector.

At MM we are bullish the Resources Sector moving forward as we see the combination of Fiscal and Monetary Stimulus increasing both inflation and ultimately demand for the underlying commodities. However within the sector there is one “elastic band” which MM believes is becoming too stretched, we believe copper will catch up to iron ore in the months ahead leading to outperformance by the large producers like OZ Minerals (OZL).

MM is considering switching part of our Iron Ore exposure to Copper.

Iron Ore v Copper Chart

Conclusion

MM is in “buy mode” after stocks plunged 35-40% in just a few weeks.

We intend to continue migrating our Portfolio’s up the quality curve within the sectors we favour until further notice.

Our Holdings

Our positions as of Friday. All past activity can also be viewed on the website through this link.

Weekend Chart Pack

The weekend report includes a vast number of charts covering both domestic and international markets, including stock, indices, interest rates, currencies, sectors and more. This is the engine room of our weekend analysis. We encourage subscribers to utilise this resource which is available by clicking below.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.