Market Matters Afternoon Report Wednesday 7th September 2016

Good Afternoon everyone

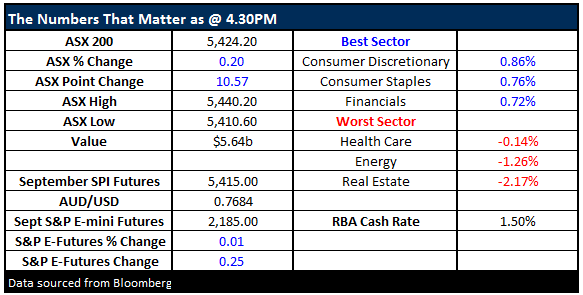

Market Data

What Mattered Today

A slow market today with the index trying to bounce – sort of succeeding – but not convincingly so. Banks were good with Westpac (WBC) the best of them adding +1.62% to close at $30.07 while Commonwealth Bank (CBA) put on +1.11% to $72.56 – following Aussie GDP which came as expected at 3.3% for the year – which is a very good number.

Aged care stocks were up again, somewhere between 1% and 9.9% for Estia Health (EHE) which has been the hardest hit in recent times. Goes to show – that from a short-term trading perspective, focussing on names within a sector that have been hit hardest (relative to the sector) can offer the biggest ‘bounce potential!!!

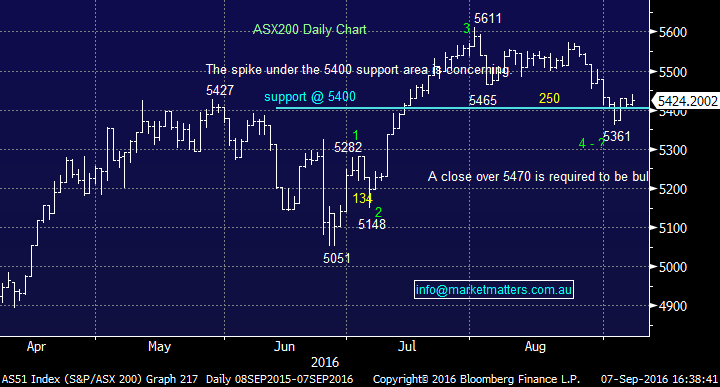

Overall, we had a tight range of +/- 30 points, a high of 5440, a low of 5410 and a close of 5424, up +10 points or +0.20%

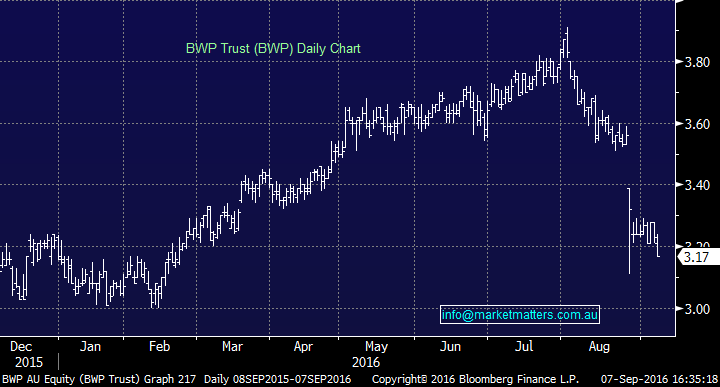

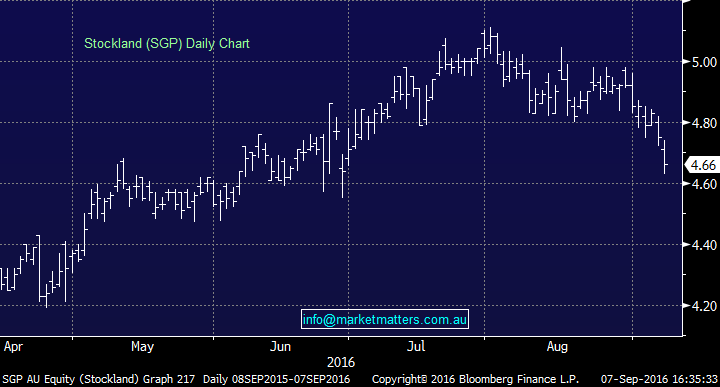

One of the themes we’ve been talking about at length in months passed has been the risk that sits in the high yield – quasi-bond like areas of the market. Infrastructure and property stocks were our main examples / areas of potential risk. We’ve copped a bit of flack about it which is pretty normal when you talk about sectors / stocks that are widely held – and have delivered good returns in a market that has struggled.

This afternoon’s report will simply give a few charts we’ll discuss in the days ahead in our morning reports – given they highlight one of the main investment ‘risks’ we’ve been highlighting.

Suffice to say, the selling in these areas of the market have clearly been obvious as the market positions for higher interest rates, eventually’!!

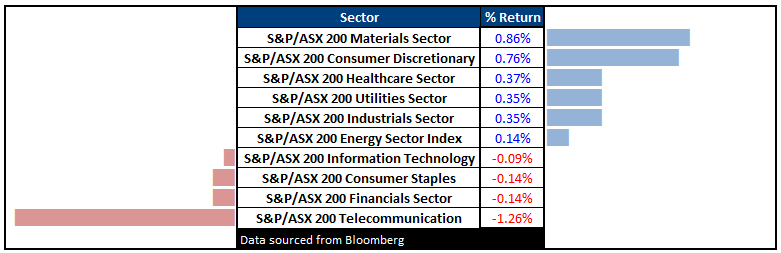

Sectors

ASX 200 Movers

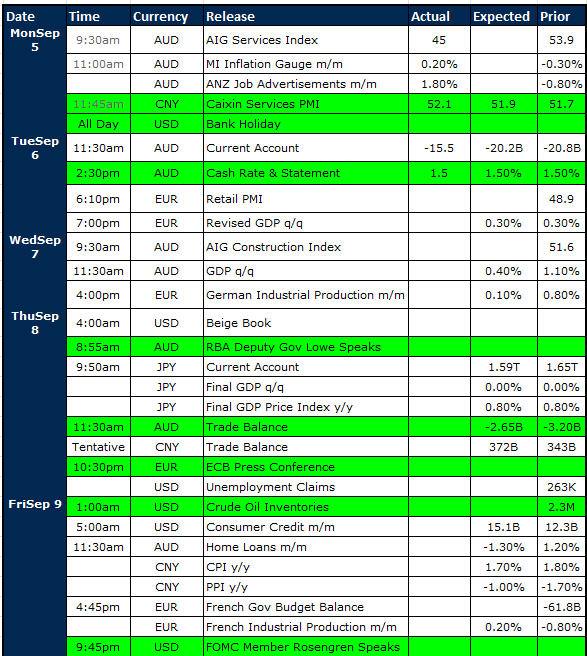

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

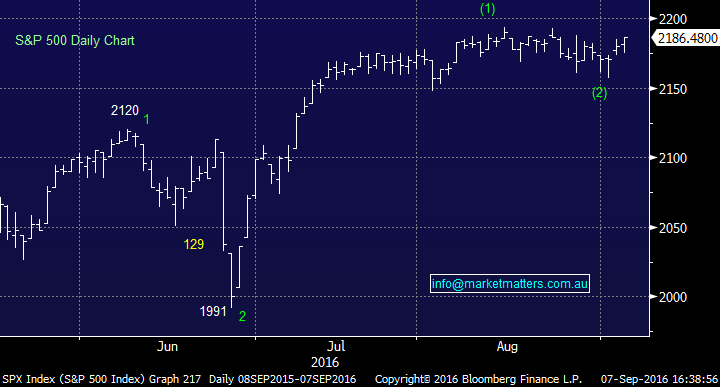

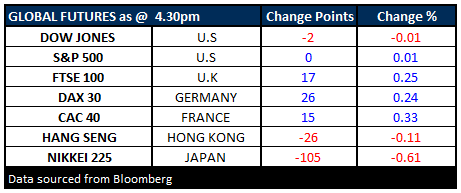

FUTURES Mixed…however as discussed this morning, the US market looks primed to make new highs….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here