Market Matters Afternoon Report Wednesday 28th September 2016

What Mattered Today

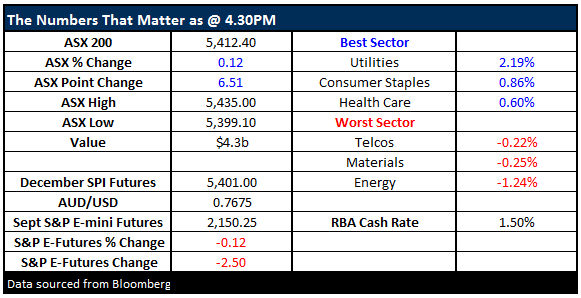

Another session where we saw the index tick around that 5400 level we’ve highlighted in recent reports with the best of it seen early on. Selling kicked in from around 10.30am, the market backed out between 12 & 2 before a whimper of a rally into the close. A range of +/- 36 points, a high of 5435, a low of 5399 and a close of 5412.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

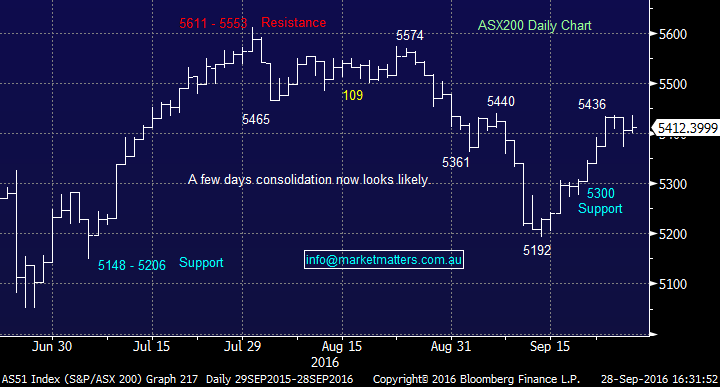

Australia continues to struggle in terms of productivity ranking 22nd among our neighbours in the Asia Pac and hardly worth a mention in terms of Global rankings. Hard to believe the Kiwi’s were 9 places ahead of us at 13!

Source; Global competitiveness report 2016-17

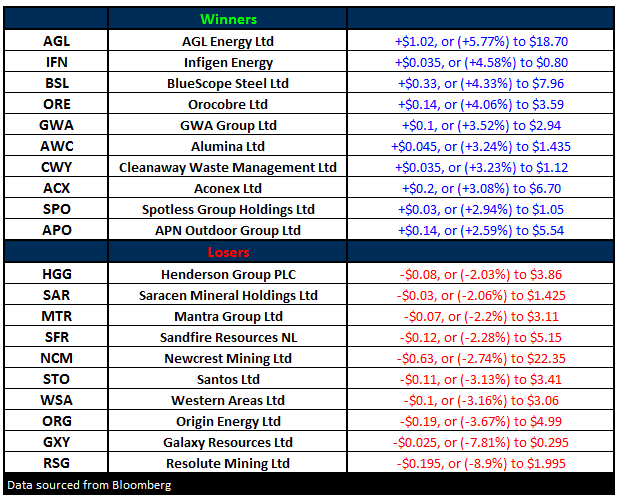

AGL (AGL) was a standout today – putting on +5.77% to close at $18.70 after announcing a 5% share buy-back while they also issued profit guidance for FY17 (underlying basis) of $720-$800m – which is a big range but about inline with expectations. They also lifted their dividend payout ratio from ~65% to 75% with a minimum franking level of 80% - which should flow through to a lift in divi for FY17 of 13.5% and FY18 by 15%.

AGL (AGL) Daily Chart

Nickel stocks were again in focus today following after the Philippines said three-quarters of its mines fell short in an environmental audit, with 20 mines facing suspension unless they can respond to shortcomings within days, on top of the 10 already halted. (AFR). The Philipines is the biggest supplier of nickel ore to China and this recent development should be supportive of our Domestic Nickel coys. We’re looking for Independence Group (IGO) to trade up to our $4.50 target v today’s close at $4.25.

Independence Group (IGO) Daily Chart

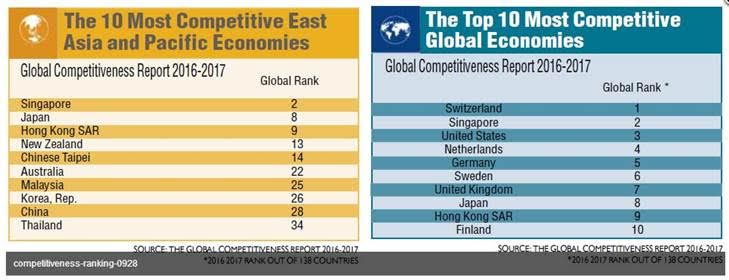

On the other side of the ledger, QBE Insurance (QBE) continues to struggle and now trades at the lowest level in around 13 years – and it looks like going lower. We’ve tossed up buying QBE numerous times in recent weeks but the trends in global commercial insurance premiums remain weak, and QBE continues to struggle as a result. The BIG macro play that QBE is often touted as seems illusive at this stage…although we do think QBE will turn at some stage. Right now, the selling is not impulsive and we haven’t seen that ‘capitulation’ style event that would suggest a low is finally in place.

QBE Insurance (QBE) Daily Chart

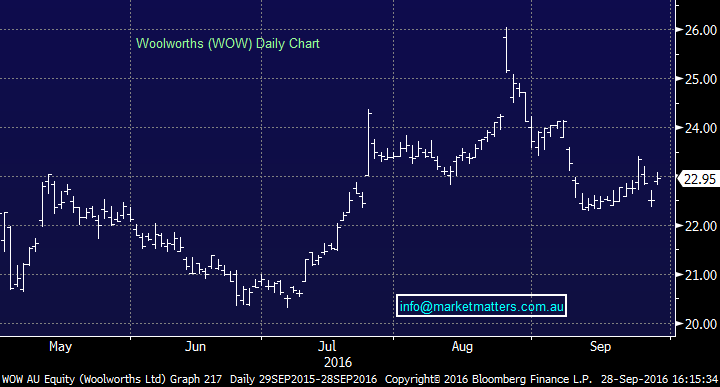

Woolworths (WOW) was up today by 2% to $22.97 after winning its legal battle against Lowes – it’s JV partners in the Masters debacle. Lowes were accusing Woolies of "oppressive" and "prejudicial" behaviour and acting in bad faith, and they wanted to appoint a liquidator to oversee the "equitable and orderly wind up". That hasn’t floated with the courts and Woolies is now free to clean up their own mess. No change to our short term negative view on Woolies, however, we’d start to look again if it traded nearer $20

Woolworths (WOW) Daily Chart

We’ll have a look at ‘Short Selling’ Interest in tomorrow afternoons note

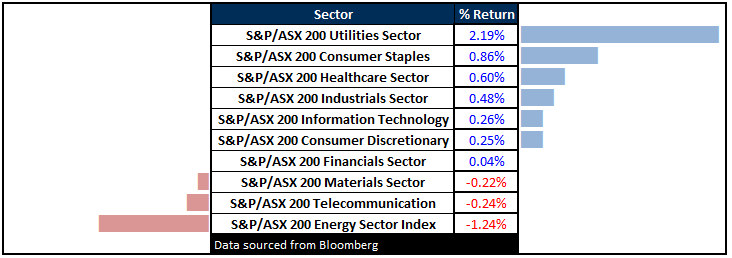

Sectors

ASX 200 Movers

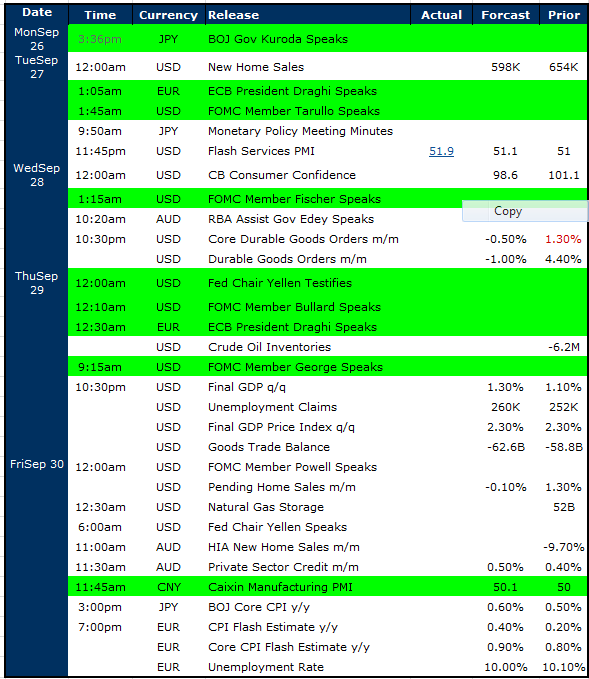

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

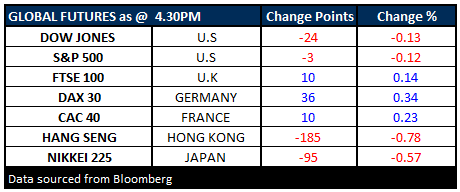

FUTURES MIXED… Deutsche Bank shares up +2.5% on open in Europe!!

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here