Market Matters Afternoon Report Tuesday March 22nd 2016

Market Data

| ASX 200 | 5,166.60 | Best Sector | |

| ASX % Change | -0.32 | Telcos | 1.72% |

| ASX Point Change | -16.52 | Health Care | 0.90% |

| ASX High | 5,181.60 | Consumer Disc. | 0.69% |

| ASX Low | 5,152.60 | Worst Sector | |

| Value | $3.9B | Financials | -0.46% |

|

| Materials | -0.58% | |

| June SPI Futures | 5,159.00 |

| |

| AUD/USD | 0.7604 |

| |

| June S&P E- Futures | 2,041.50 | RBA Cash Rate | 2.00% |

WHAT MATTERED TODAY

1. Easter seems to be looming large on the ASX + other global markets with most minds on chocolate eggs and an extended break. Values were light, about $3.9b, while volatility is being crushed. The index tried again to push towards 5200 – hitting a high of 5181 before selling off into the close – to finish at 5166

2. As we covered in the morning note, the market is complacent, which is shown via the volatility index trading at fresh lows for 2016. Complacency is dangerous, and from an Options perspective, we simply don’t get paid adequately for risk – so we reduce our exposure.

3. The last time we saw the VIX trading sub 14 was in December 2015 – which corresponded with a shorter term market high. The time before that was in October 2015 – again, the corresponded with a short term market high

4. So, from a shorter perspective, there are a few indicators suggesting that we’re likely to take a breather – which has been playing out this week.

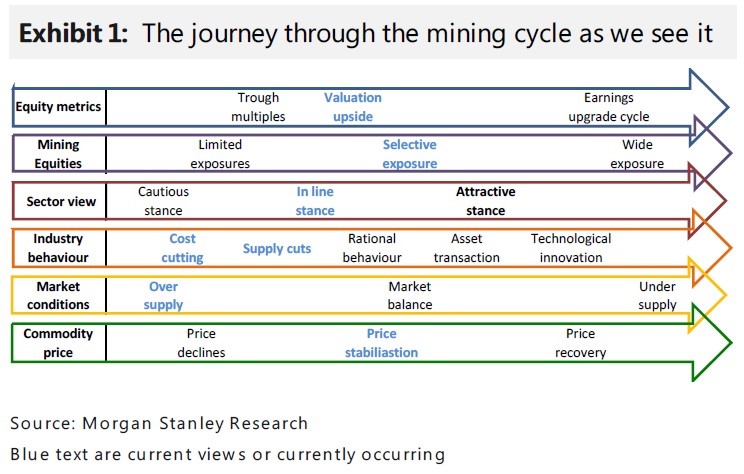

5. We came across an interesting chart from JP Morgan recently, highlighting the typical stages of a mining cycle….It’s relevant given we’re coming from the depths of despair in that sector – and it is cyclical. Things will get better. Take note at the labels marked in blue – this is where JP Morgan think we are now which we tend to agree with;

6. Telstra (TLS) in the news again today with another network outage – the 4th in a few weeks. You’ll hear a lot about it, but really, from an investment standpoint, it probably means very little. The stock was up +1.35% @ $5.26 today. We hold TLS after buying recently in the low 5’s.

7. Not a lot else from a markets perspective worthy of discussion. Two days of trade left before Easter, stock options expiry tomorrow (Wednesday) given a public holiday on Friday.

STOCKS ON THE MOVE

8. TPG Telecom (TPM $11.06, +7.15%) – Strong 1H16 result pushes stock higher

- Good first half result from TPG today and the first post their acquisition of iiNett. They beat earnings expectation and offered some upbeat guidance ($770-$775m) – about 2-3% ahead of market expectations

- One slight negative would be broadband subscriber growth – which was +34,000 for a period. A touch light but could be justified with the integration process. Stock on 21 times earnings remains expensive and a lot of growth priced in we would have thought.

- We concede it’s a v’good company, with a good outlook however we’ll struggle to recommend at current prices

9. Fortescue Metals (FMG $2.75, 0.36%) – Outperformed BHP + RIO today

- Not a bad day today – outperforming BHP & RIO to close up a tad at $2.75 however it seems some indigestion after their very strong bounce from around the $1.50 region up to around $3.20

- Historically, the market has had major concerns around FMG's gearing, their margins in a low price environment (given cost of debt) and their grade (which is lower than the other guys).

- Firstly, the rally in the Iron Ore price (now $60) has obviously helped margins. A few scenario's to consider here....(i) Scenario 1 – iron ore price stays at $38.30 (Dec. 15 low) = 4-5 year pay back of debt, (ii) Iron ore stays at $53.75 (4 March) = 2 year payback of all debt and (iii) iron ore stays at current $63 = 1 year pay back of debt.

- So clearly, FMG is a de-leveraging story and that risk, which has been substantial for a v'long time will be priced out of the market = shares going higher over time.

- Grade will improve under the Vale deal they announced a few weeks ago given the plan is to blend 80-100mt of material (combined) - which takes FMG's lower grade ore and blends with Vale's higher grade ore. This will most likely provide FMG with some incremental margin improvement.

- When we distil all of this down, it seems FMG is now becoming a very 'investible story' – and the share price should move higher over time, it’s just a function of how long the journey takes.

ASX 100 Moves

| Winners |

|

| Ardent Leisure Group (AAD) | +$0.23, or (+11.8%) to $2.18 |

| TPG Telecom Ltd (TPM) | +$0.74, or (+7.1%) to $11.09 |

| Australian Pharmaceutical Indu (API) | +$0.13, or (+7.0%) to $1.98 |

| St Barbara Ltd (SBM) | +$0.14, or (+5.7%) to $2.59 |

| WorleyParsons Ltd (WOR) | +$0.29, or (+5.4%) to $5.66 |

| Sigma Pharmaceuticals Ltd (SIP) | +$0.045, or (+4.8%) to $0.99 |

| CIMIC Group Ltd (CIM) | +$1.47, or (+4.3%) to $35.64 |

| APN News & Media Ltd (APN) | +$0.025, or (+4.1%) to $0.64 |

| Downer EDI Ltd (DOW) | +$0.15, or (+4.0%) to $3.87 |

| Premier Investments Ltd (PMV) | +$0.63, or (+4.0%) to $16.4 |

|

|

|

| Losers |

|

| Sandfire Resources NL (SFR) | -$0.12, or (-2.0%) to $5.86 |

| Fisher & Paykel Healthcare Cor (FPH) | -$0.2, or (-2.4%) to $8.27 |

| Cover-More Group Ltd (CVO) | -$0.04, or (-2.5%) to $1.56 |

| Mantra Group Ltd (MTR) | -$0.11, or (-2.5%) to $4.27 |

| Tabcorp Holdings Ltd (TAH) | -$0.11, or (-2.7%) to $3.99 |

| Programmed Maintenance Service (PRG) | -$0.045, or (-3.1%) to $1.43 |

| FlexiGroup Ltd/Australia (FXL) | -$0.08, or (-3.1%) to $2.50 |

| Western Areas Ltd (WSA) | -$0.09, or (-3.7%) to $2.33 |

| DuluxGroup Ltd (DLX) | -$0.25, or (-3.9%) to $6.20 |

| Independence Group NL (IGO) | -$0.14, or (-4.4%) to $3.06 |

Regards From,

The Market Matters Team.

28-34 O'Connell St

Sydney, NSW 2000