Market Matters Afternoon Report Tuesday 6th September 2016

Good Afternoon everyone

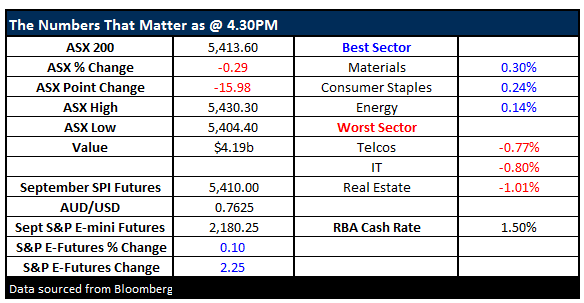

Market Data

What Mattered Today

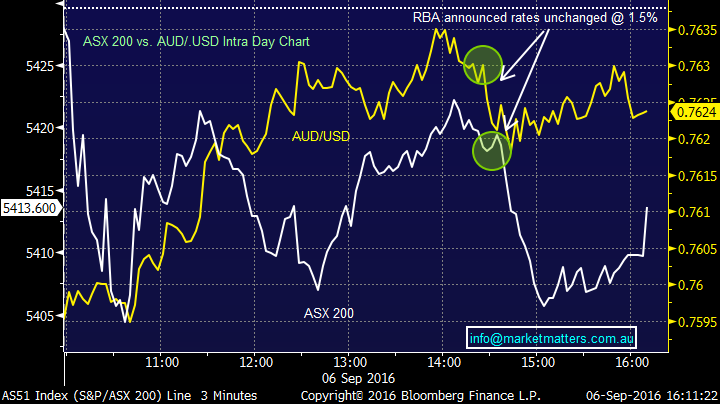

The RBA decision on rates dominated discussion today even though we were unlikely to see a cut on Glenn Stevens last hurrah after 10 years at the helm. A tough period to be head of any central bank and Glenn Stevens has certainly done a sterling job in trying circumstances.

The Statement released with the decision was fairly bland – some discussion on house prices that ‘have risen modestly’ but all in all, not a lot to hint about future direction on rates, with incoming Governor Philip Lowe now charged with the task of (a) the stability of the currency of Australia; (b) the maintenance of full employment in Australia; and (c) the economic prosperity and welfare of the people of Australia’ (source RBA)

We’d think the RBA will await the US Feds September Meeting and if we did see a surprise cut there (currently prices as a 36% probability) then the RBA might be done at 1.50% - at which time it might be a good idea to look at fixed rate home loans!!

The index was choppy today, with most movement coming around the 2.30pm decision. The Aussie Dollar sold off – but the market fell more before a tepid recovery late in the session. The US was closed overnight for Labour Day so we had very little to key off domestically.

Overall, we had a tight range of +/- 26 points, a high of 5430, a low of 5404 and a close of 5413, down -16 points or -0.29%

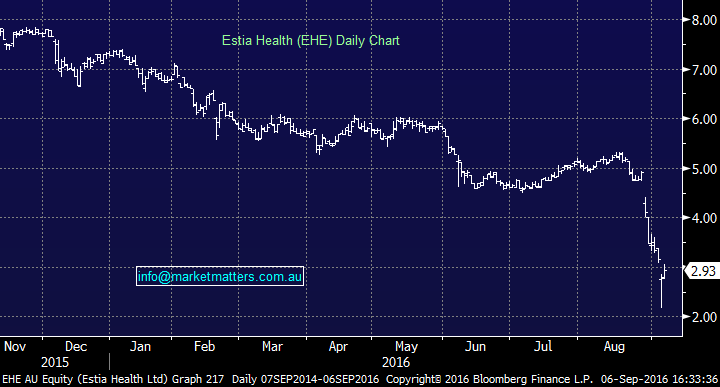

The aged care stocks had a bounce – up between 3.5% for Regis (REG) and 6.03% from Japara (JHC). We had a conference call with Paul Gregersen (CEO) & Joe Genova (CFO) of Estia Health (EHE) today – and they worked hard to dispel some of the markets concerns. As we covered yesterday, the issues stem from whether or not a new ‘Capital Refurbishment Fee’ can be legally charged which was put in place to offset some of the impact from the Govt changes to the Aged Care Funding Instrument (ACFI).

All three providers sought legal advice before implementing the new fee, yet it’s validity has been questioned by analysts. It seems that any fee needs to correlate with a direct benefit to the resident and that needs to be proven. It’s clearly a grey area – which is what the company said, and there will be some uncertainty until the fee schedule is tested in court, however as with any commercial operation, it will come back to supply and demand. If demand for beds is there, the fee will be charged in some way, even if the current structure / name is not palatable.

Buying EHE looks like a reasonable trade HOWEVER it’s very high risk and the unpredictable nature of Governments will be a large swing factor.

Estia Health (EHE) Daily Chart

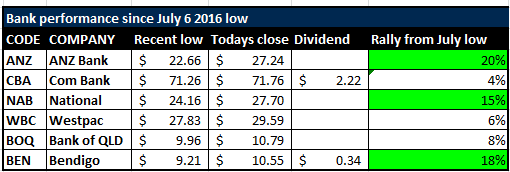

The Banks have been interesting in recent times and we’re overweight the sector. Interesting because we’ve seen a divergence in individual performance from the recent low point which was on the 6th July. Clearly, the market is buying into Shayne Elliott’s strategy at ANZ and their significantly better capital position than the market was forecasting while recent downgrades of CBA continue to weigh on the stock. It’s the worst performing bank over this period. We remain positive the banks in the short-term, however, will be sellers into meaningful strength.

The worst HIT banks pre-July 6 have been the best performers from the sectors lows. This is a characteristic of the final stage of a mature bull market – a theme we’ve discussed at length in our morning reports.

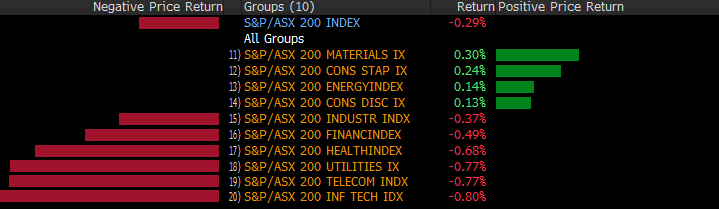

Sectors

Source; Bloomberg

ASX 200 Movers

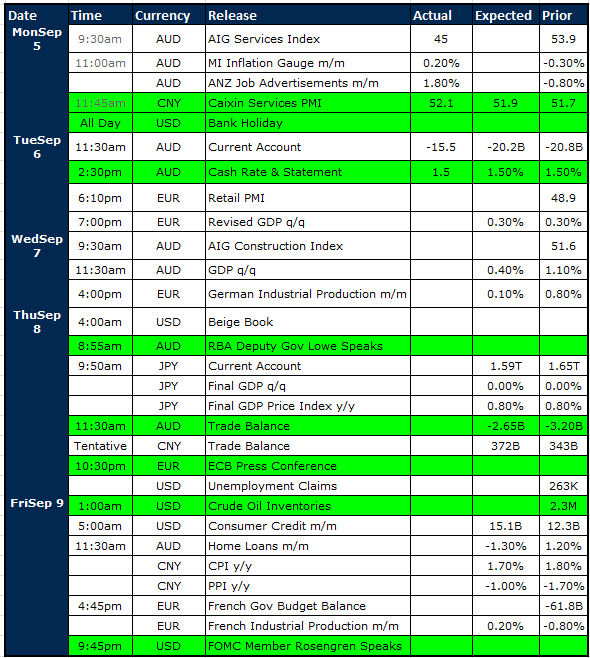

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

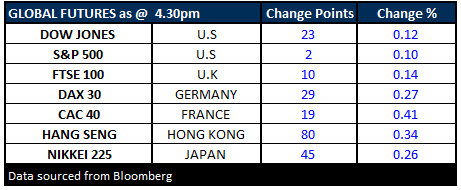

FUTURES Higher…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 6/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here