Market Matters Afternoon Report Tuesday 30th August 2016

Good Afternoon everyone

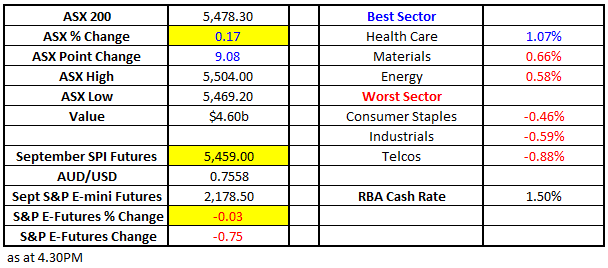

Market Data

What Mattered Today

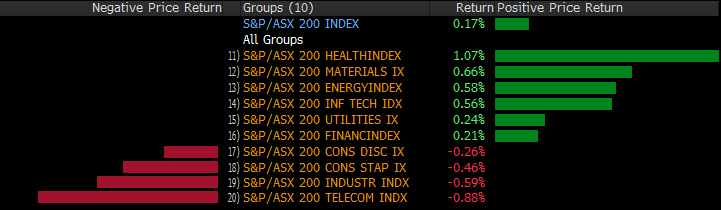

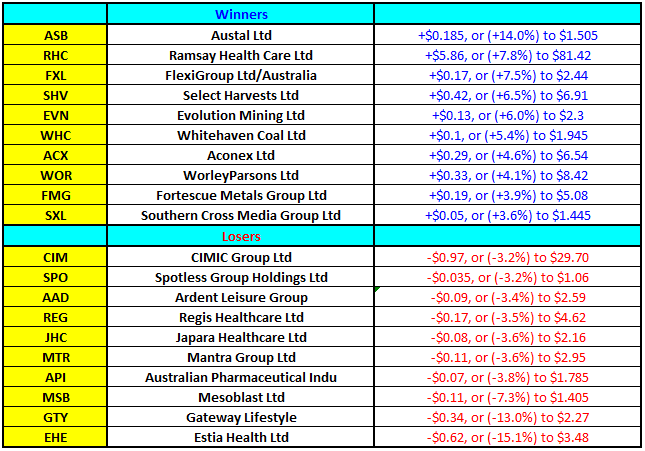

The ASX200 regained some of yesterday’s lost ground, rallying 0.17%, but unfortunately again underperforming the US indices, who rallied 0.5% overnight to close within a whisker of their all-time high. The major market stand-outs today were, for a second day, in the aged care space and regrettably again for all the wrong reasons as investors unceremoniously sold the sector - Estia Health (EHE) -15.1%, Gateway Lifestyle (GTY) -11.5% and Regis Healthcare (REG) -3.5%.

We reiterate our previous comments that we see no reason to buy stocks in this sector.

Estia Health (EHE) Weekly Chart

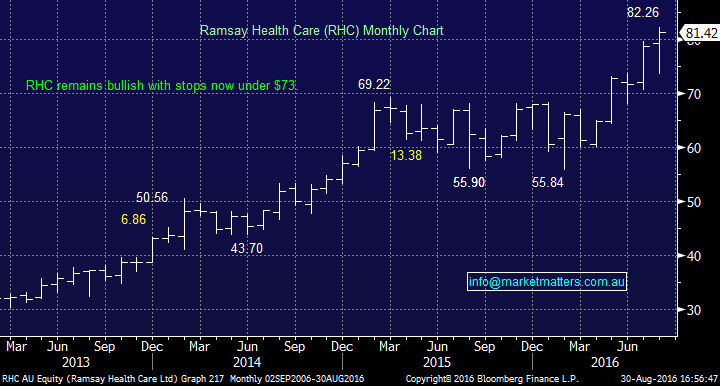

Market stalwart Ramsay Healthcare (RHC) was a bright light for the market today, hitting a record all-time high of $82.26 and closing up $5.86 (+7.7%), after they announced an increase in annual profits of 17% from strong growth in patient visits.

We remain bullish with stops now under $73.50.

Ramsay Healthcare (RHC) Monthly Chart

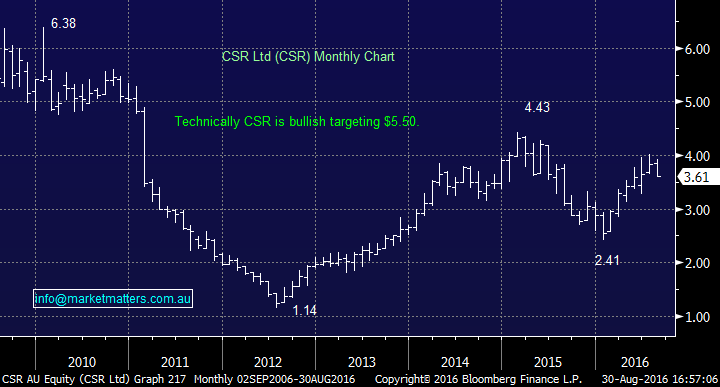

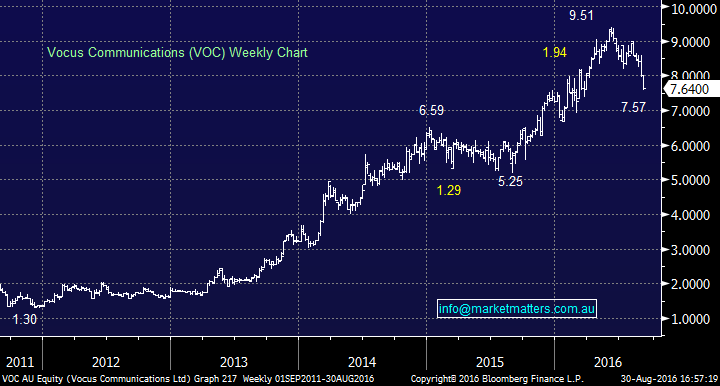

At Market Matters, we were active in the market today, switching our CSR Ltd (CSR) position to Vocus (VOC) and purchasing Bendigo Bank (BEN) outright. We reiterate our past comments that the second half of 2016 is likely to generate the best results by adopting a more active approach.

1. We sold our CSR position as the stock has lost upside momentum and a pullback towards $3.30 now looks a possibility, we flagged this sale in recent reports.

2. We used the funds from the exit of CSR to average our holding in VOC, taking our holding to 10% market weight with an average ~$7.95. Again, this purchase / switch was flagged in recent reports, at today's prices, it’s simply our view that VOC represents better value than CSR.

CSR Ltd (CSR) Monthly Chart

Vocus Communications (VOC) Weekly Chart

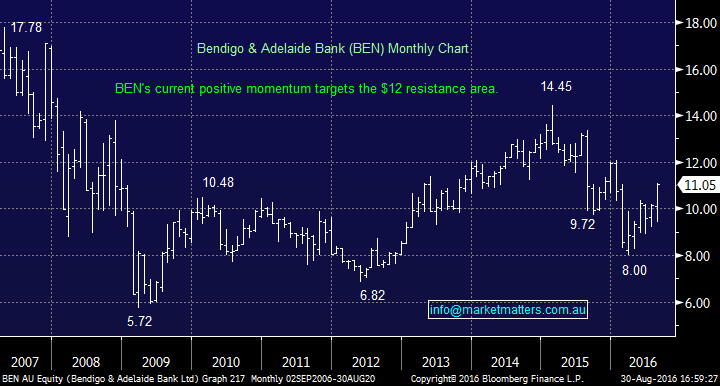

3. This morning we purchased Bendigo Bank (BEN), our "Standout Chart" from the weekend report and we’re very happy to see the stock rally 22c (2.1%) intraday, to close at $11.05. As we have been discussing recently, we feel it's time for the banks to outperform in the ASX200 and BEN looks a standout at present, especially with a 34c fully franked dividend looming in early September.

Bendigo Bank (BEN) Monthly Chart

ASX 200 Intra-Day Chart

On the market today, we had a range of +/- 35 points, a high of 5504, a low of 5469 and a close of 5478, up +9 points or ++0.17%.

Sectors

Source; Bloomberg

ASX 200 Movers

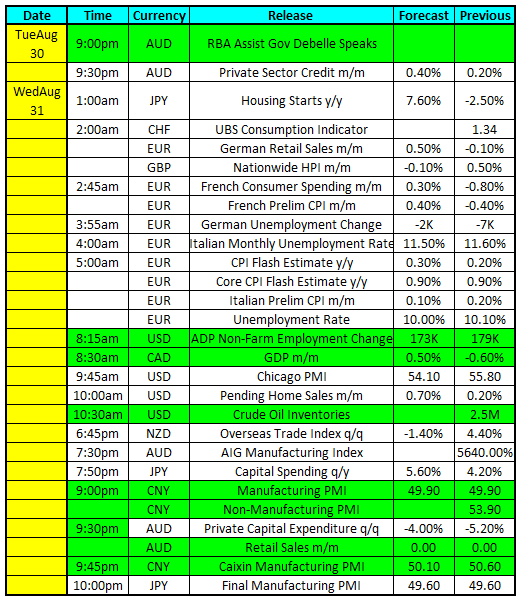

Select Economic Data – This week Stuff that really Matters in Green

What Matters Overseas

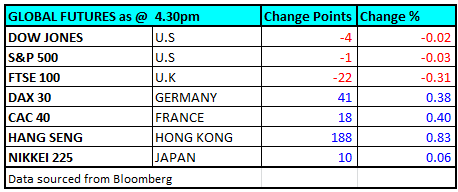

FUTURES mixed…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/08/2016. 5:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here