Market Matters Afternoon Report Tuesday 29th March 2016

Good afternoon everyone

Market Data

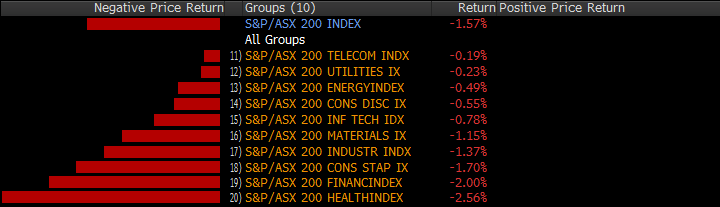

| ASX 200 | 5,004.50 | Best Sector | ||

| ASX % Change | -1.57 | Telcos | -0.19% | |

| ASX Point Change | -79.71 | Utilities | -0.23% | |

| ASX High | 5,095.70 | Energy | -0.49% | |

| ASX Low | 4,998.50 | Worst Sector | ||

| Value | $3.93B | Consumer Staples | -1.70% | |

|

| Financials | -2.00% | ||

| June SPI Futures | 4,990.00 | Health Care | -2.56% | |

| AUD/USD | 0.7550 |

| ||

| June S&P E-mini Futures | 2,032.00 | RBA Cash Rate | 2.00% |

What Mattered Today

1. Banks Banks Banks – seems to be all that matters at the moment with the BIG 4 copping it on the chin once again. ANZ the worst – off -3.41% with CBA the best off ‘just’ -2.27%....collectively they took -30pts off the index which dropped -79pts in aggregate.

2. Unlike Thursday last week, the selling was fairly broad based with the negative sentiment in the banks overflowing to other sectors….Healthcare stocks in particular seemed to lose their defensive attributes today – dropping -2.56% collectively led by CSL which was off -3.55%

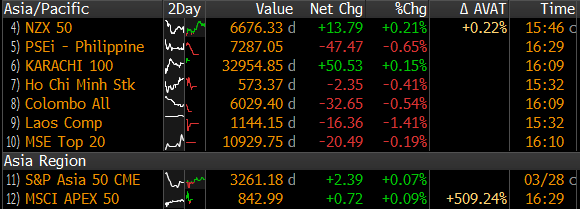

3. Interesting to look further afield with US futures resilient (DOW +14pts) throughout our session, while Asian markets were softish – but less so than what we experienced….

4. It’s largely on concern around exposure to resource companies (plus others service coys that have been under pressure such as Slater & Gordan and Dick Smith) and in particular, concern around whether or not current provisioning is adequate.

5. Two aspects here that are worth a mention again…ANZ said at least another $100m in bad debt charges for the half implying v’little clarity from management about what the actual number will be, while Westpac (WBC) have flagged exposure to five problematic loans which will dictate their bad debt charge for the half – again, this implies v’little clarity/predictability and a high degree of uncertainty which markets hate. Hence, banks get sold pending more clarification/confirmation of what their exposures are, and whether or not they have baked the numbers in already.

6. Over the last 20 years, the average bad debt charge has been 0.28% - which means, for every loan they write 0.28% of it is eaten up by the ones that go soar.

7. During the GFC, that number blew out to 0.80%, while in 2014 this number was just 0.16%. Right now, we sit at 0.19% - with most thinking, as written in this morning’s note – that we’ll track back towards more normal levels – around 0.28%. So, right now, bad debts are expected to rise which is playing out as expected, yet the market is in a tail spin, and we’re seeing a run on the banks

8. We’re now hearing more talk, more concern about the banks and seeing notes go around the market musing about the impending crisis. Again, this seems to us like emotional posturing rather rationale positioning – but time will tell.

Stocks On The Move

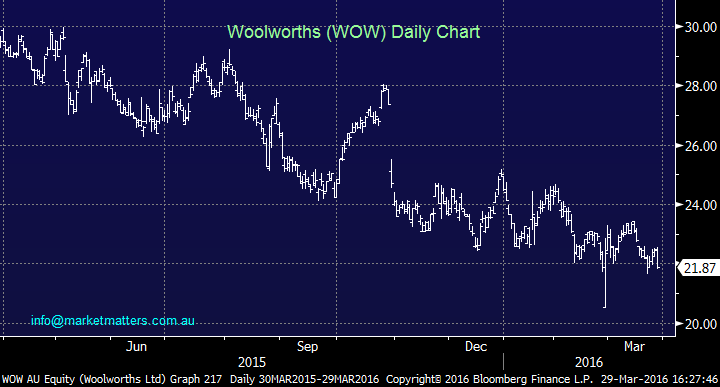

1. Woolworths (WOW $21.87, -2.58%) – A big ship pointing the wrong way…

- There’s currently a smell about Woolies, and it’s not ring fenced to the dairy isle…. it’s not about the disastrous Masters foray, nor is about their struggling general merchandise business which houses Big W and Ezibuy. It’s not even wafting from their hotels business which saw EBIT down -6.6% in 1H16. It’s more a function of public perception on the quality of their discount products relative to their much talked about German rivals.

- To address this ‘perception problem’, Woolies today announced plans to merge their Homebrand and Essentials product lines and package them as one – using the Essentials branding. It marks the end of the long running Homebrand labelling at Woolies, and is another step on a long road to recovery for the struggling retailer.

- It certainly is a step in the right direction, however it’s a big ship, and changes to packaging is only a fraction of what is needed to turn around the Australian Food and Liquor business, which is the main driver of Woolies earnings.

- Market Matters have no interest in Woolies at current levels

2. CSL (CSL $98.57, -3.55%) – Profit taking obvious into strength

- CSL is a quality company, with a great outlook for its plasma therapies, however on 32 times earnings, a 1.7% dividend yield and an extended run up in share price, it’s a little rich for us

- Today’s share price move -3.55% highlights the susceptibility of this stock to profit taking, as investors trim winners to put cash back into portfolios, with the hope of picking up bargains in the not too distant future

- Around $94 is the initial downside target for CSL, failing that, a move closer to $90 would look interesting.

ASX 200 Movers

| Winners |

|

| Aconex Ltd (ACX) | +$0.26, or (+4.3%) to $6.30 |

| News Corp (NWS) | +$0.56, or (+3.2%) to $17.82 |

| Sims Metal Management Ltd (SGM) | +$0.19, or (+2.2%) to $8.94 |

| BlueScope Steel Ltd (BSL) | +$0.12, or (+2.0%) to $6.18 |

| CSR Ltd (CSR) | +$0.06, or (+1.9%) to $3.28 |

| Sandfire Resources NL (SFR) | -$0.13, or (-2.2%) to $5.79 |

| Austal Ltd (ASB) | +$0.025, or (+1.8%) to $1.45 |

| Aristocrat Leisure Ltd (ALL) | +$0.17, or (+1.7%) to $10.13 |

| APN News & Media Ltd (APN) | +$0.01, or (+1.6%) to $0.65 |

| DUET Group (DUE) | +$0.03, or (+1.3%) to $2.26 |

|

|

|

| Losers |

|

| Sirtex Medical Ltd (SRX) | -$1.23, or (-4.4%) to $27.00 |

| Liquefied Natural Gas Ltd (LNG) | -$0.025, or (-4.4%) to $0.54 |

| Premier Investments Ltd (PMV) | -$0.79, or (-4.5%) to $16.84 |

| St Barbara Ltd (SBM) | -$0.095, or (-4.7%) to $1.915 |

| Monadelphous Group Ltd (MND) | -$0.38, or (-5.0%) to $7.17 |

| Mesoblast Ltd (MSB) | -$0.13, or (-5.1%) to $2.43 |

| South32 Ltd (S32) | -$0.08, or (-5.2%) to $1.465 |

| Mineral Resources Ltd (MIN) | -$0.32, or (-5.4%) to $5.62 |

| Bellamy's Australia Ltd (BAL) | -$0.71, or (-6.5%) to $10.14 |

| Broadspectrum Ltd (BRS) | -$0.085, or (-6.6%) to $1.195 |

Regards,

The Market Matters Team

Level 12 28-34 O'Connell St

Sydney NSW 2000

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/03/2016. 4.13PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.