Market Matters Afternoon Report Monday 19th September 2016

Good Afternoon everyone

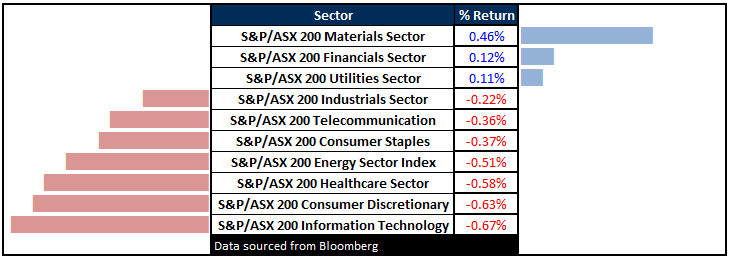

What Mattered Today

The ASX has found themselves in another IT bungle with the stock exchange late to open this morning and when it did, there was only a few hours of uninterrupted trade before stocks were halted again around 2.00pm. At 3.37pm they confirmed the market would not re-open today given the market needs 30mins for ‘pre-open’ making 3.30pm the cut off - unfortunately the ASX failed to fix the issue in time.

They’re reporting that the glitch is a technical one - put simply, the system that the ASX uses to process trades went down. The last time the ASX suffered such embarrassment was on the 27th October 2011 and today’s reoccurrence will give those calling for greater competition amongst exchanges in Australia some additional fire power.

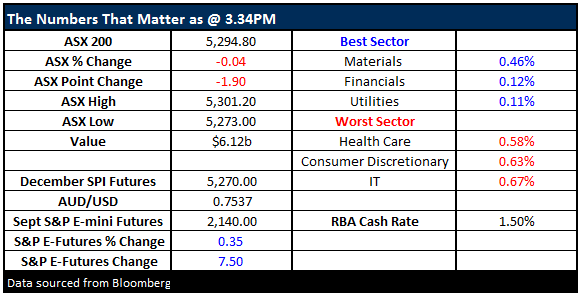

The market opened around 11.30am this morning with the index trading around par - some selling ticked up thereafter – a low was put in place around midday before a recovery back up to around par before the premature end of the day’s trade. We had a range of +/- 28 points, a high of 5301 a low of 5273 and a close of 5294, down -1 points or -0.04%

ASX 200 Intra-Day Chart

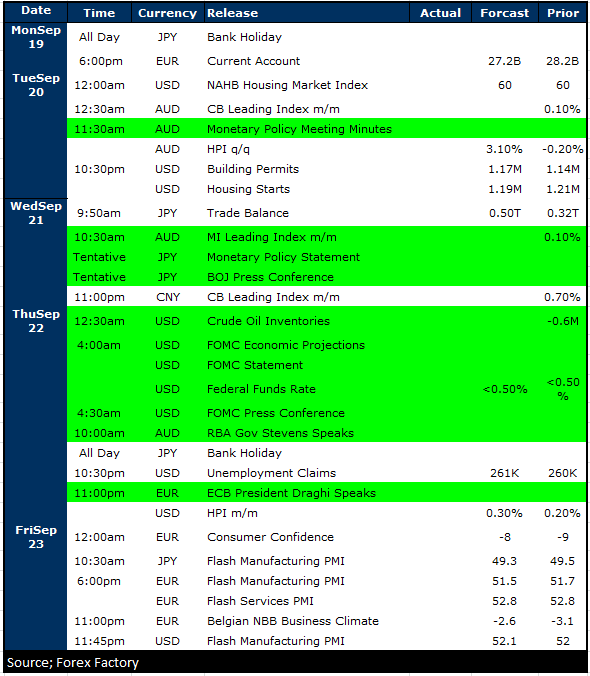

Central Banks are going to be in focus this week with the RBA releasing minutes from their last meeting tomorrow, while more importantly, the Bank of Japan releases their policy statement and gives a press conference on Wednesday while the US Federal Reserve – which is the main game in town this week will make their decision on rates Wednesday evening and hold a press conference early Thursday morning our time.

There’s currently only a small chance for a September rate hike in the US – something around 20% probability, however of more importance will be the ‘setting of expectations’ for a rate hike later in the year. We’ve spoken at length about this in recent times however our view remains that the Fed will hike this year and given this is not being fully priced in by markets, they’ll be some fall out as a result. The $US is likely to move higher and that will obviously put pressure on the Aussie Dollar – and probably underlying commodity prices – although that theme was not obvious today.

Independence Group (IGO) had a reasonable session today – which is timely given we were looking at our long position closely over the weekend (and wrote about it this morning). Anyway, the stock rallied +4.63% today to close back up at $3.84 and should be given the benefit of the doubt for now at least. $3.50 looks like a good level of support.

Independence Group (IGO) Daily Chart

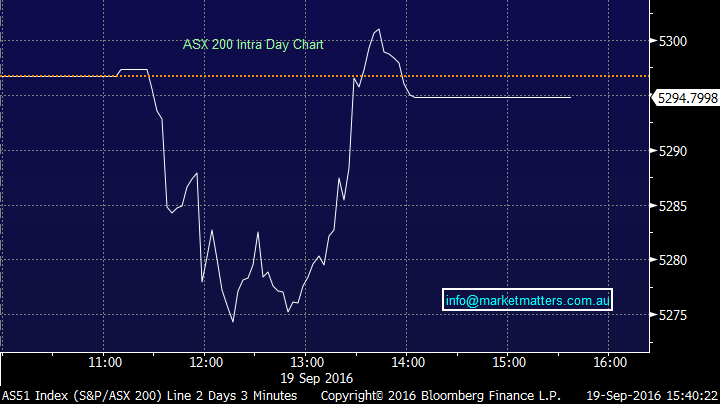

Elsewhere, Vocus (VOC) went ex-dividend for 8cps fully franked and closed down 11cps – or back around that $7 support region we’ve flagged recently. It’s trying to put in a low at current levels.

Vocus Communications (VOC) Daily Chart

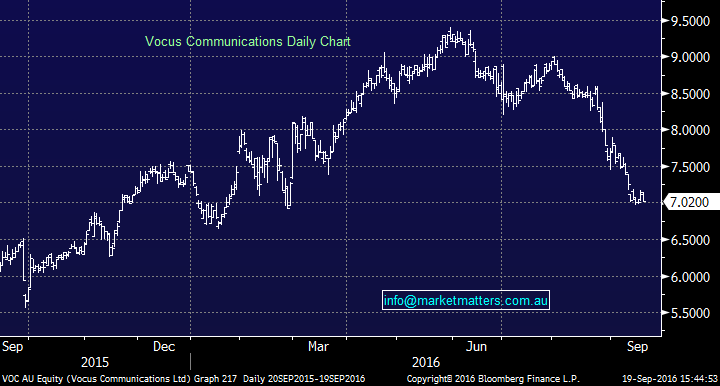

Sectors

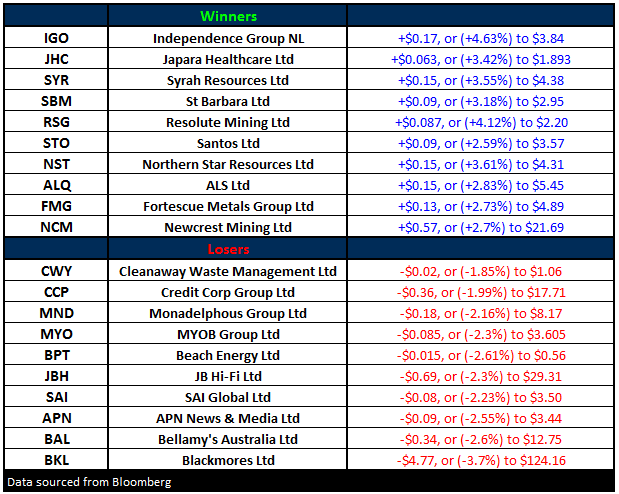

ASX 200 Movers

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

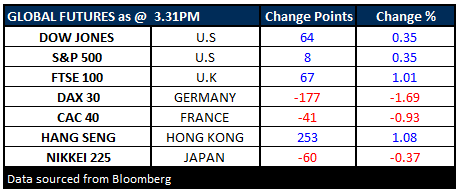

FUTURES higher – particularly in the US which has underpinned the positive move from the lows in our market today.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/09/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here