Market Matters Afternoon Report Friday 19th August 2016

Good Afternoon everyone

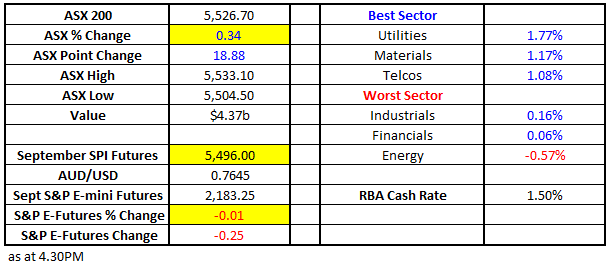

Market Data

What Mattered Today

Reporting, Reporting, Reporting….continues to dominate trade with the good and bad offsetting one another. The ASX 200 is down -4pts for the week – so a bit of a yawn in aggregate but a lot of big swings from individual companies. It actually feels like we’re writing the same thing on a daily basis – which we might be, and it’s frustrating.

We had a range of +/- 28 points, a high of 5533, a low of 5504 and a close of 5526, up +19 points or +0.34%.

ASX 200 Intra-Day Chart

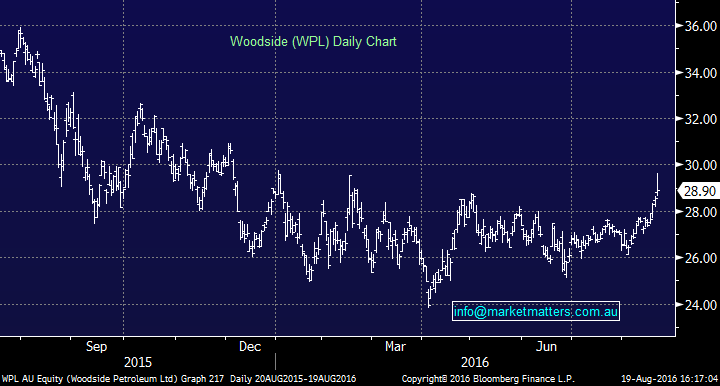

In terms of our portfolio, we’ve got a few things doing well and a few not. Woodside (WPL) for instance reported good numbers this morning and was up another +1.23% by the end, closing at $28.90 but it was a long way off the session highs. Offsetting that was Origin Energy (ORG) which was soft again, and in all fairness, looks pretty average after today’s close.

Woodside (WPL) – Daily Chart

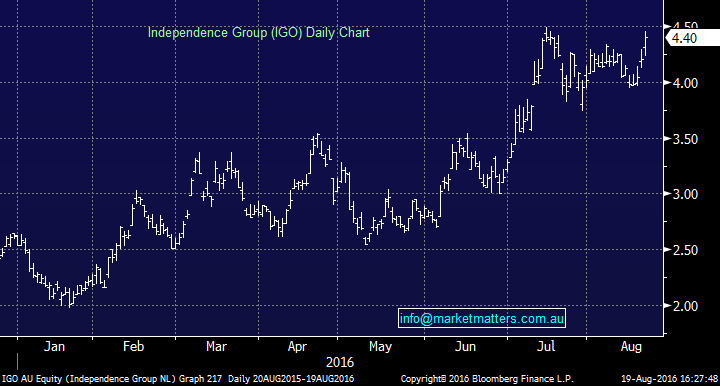

Independence Group (IGO) traded well adding +4.76% - we’re happily long here from the $3.80 region yet CSR is struggling around the $3.72 region.

Independence Group (IGO) daily chart

What sets Markets Matters apart from other reports is our openness, our transparency, and our practical approach. We make calls, back them and see them through to the end. We’re investors, working and trading in the markets daily, and like you, we get frustrated and at times annoyed. We’re in that frame of mind this afternoon.

Lend Lease (LLC) reported full year numbers which were good – a FY16 profit after tax of $698.2m (+13%pcp)and a 2H16 DPS of 30.0¢, bring full year DPS to 60.0¢. As usual, no guidance was provided. Growth looks good for this stock yet there remains concerns about residential property in Oz – particularly units while whispers of overseas (Chinese) buyers defaulting continue to be rife – but well and truly overblown if LLC and Mirvac (MGR) commentary is anything to go by. Earnings growth set to continue in FY17 for LLC.

Lead Lease (LLC) Daily Chart

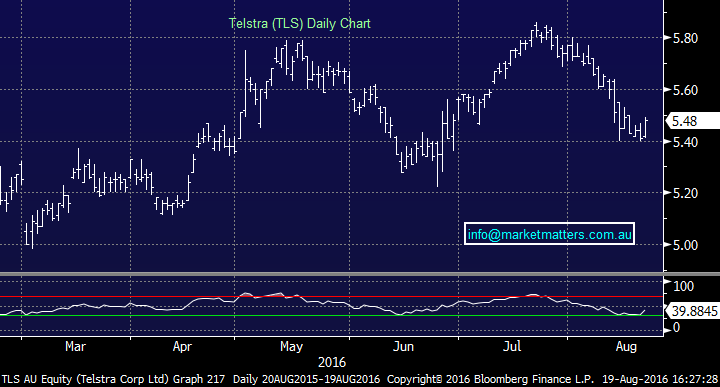

Telstra (TLS) looks like it’s finding some yield support at current levels…Oversold on the daily and potentially bouncing.

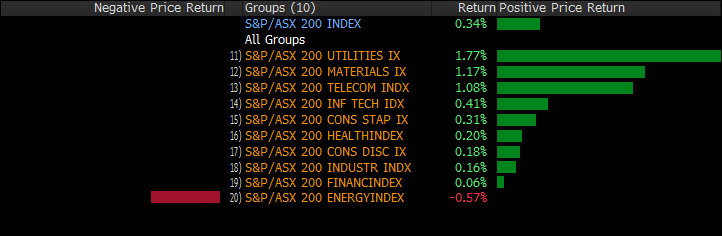

Sectors

Source; Bloomberg

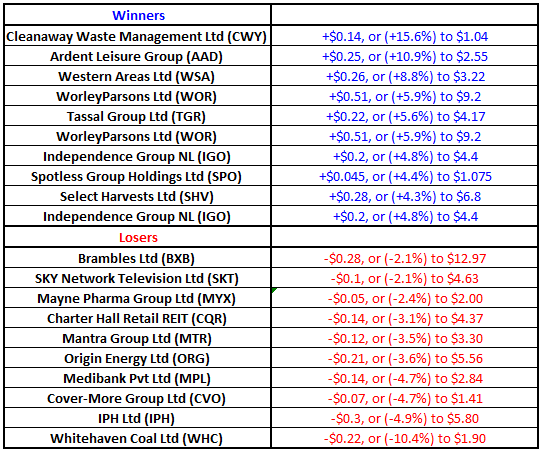

ASX 200 Movers

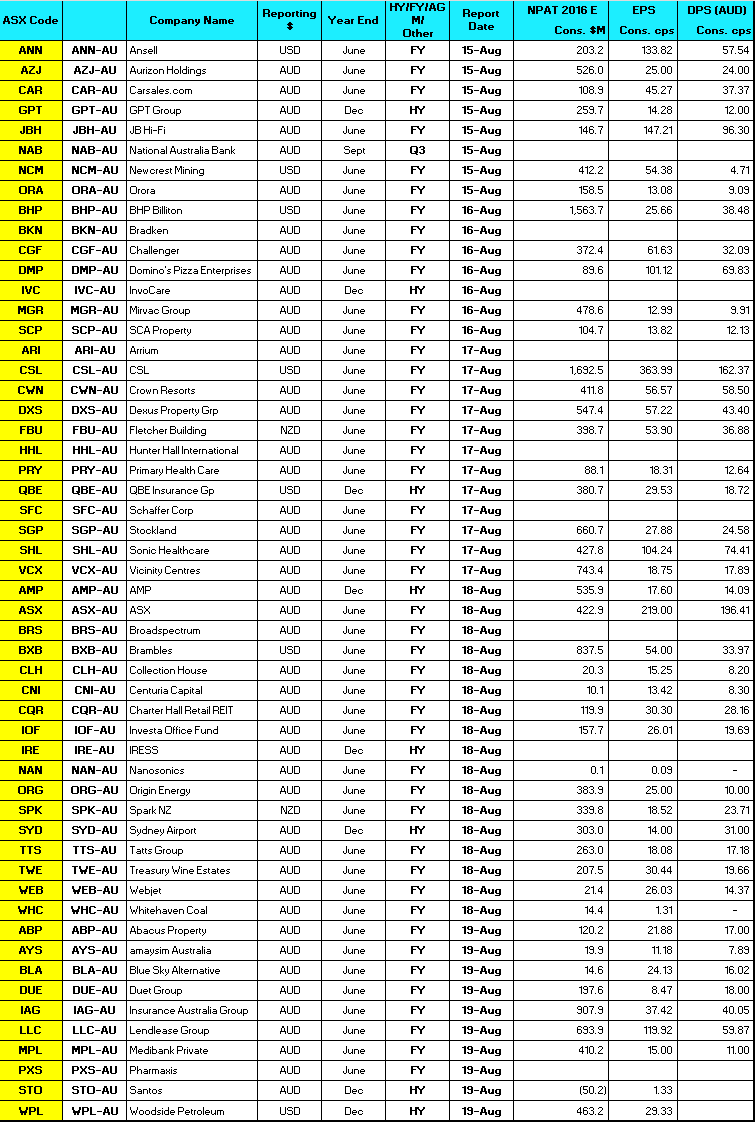

Reporting this week

NPAT = net profit after tax (consensus numbers)

EPS = earnings per share (consensus numbers)

DPS = dividend per share (consensus numbers)

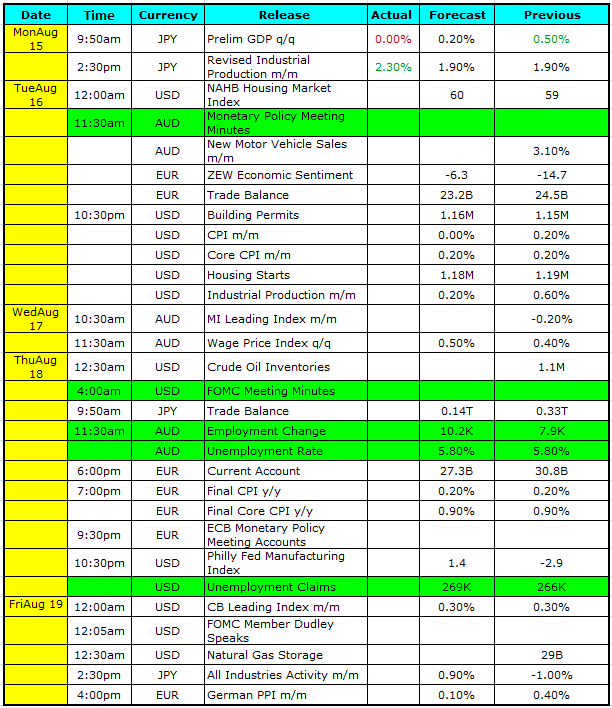

Select Economic Data – This week; Stuff that really Matters in Green

What Matters Overseas

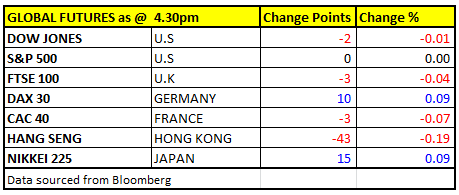

FUTURES are flat – Dudley speaking tonight will be interesting….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/08/2016. 5:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here