Market bounces back strongly post Trump!

What Mattered Today

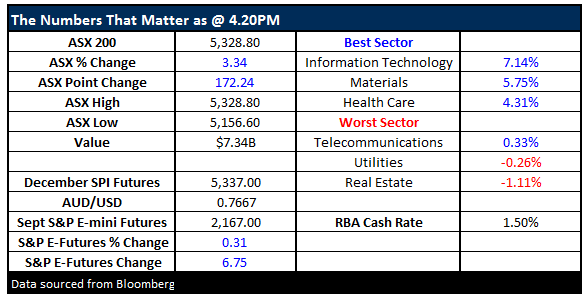

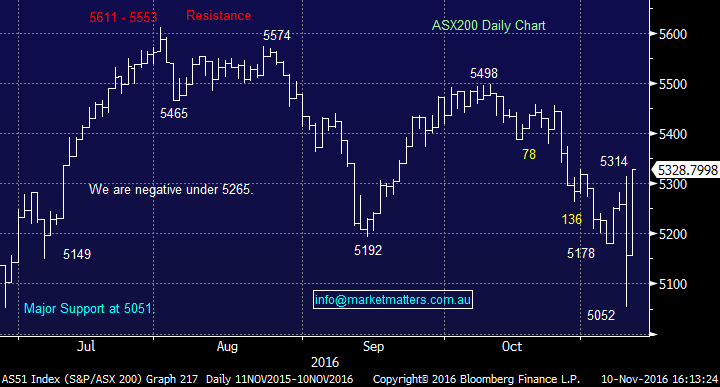

Yesterday the market had a high of 5314 before selling off in pretty spectacular fashion to a low of 5052 – a BIG 5% range…..before the positive reaction in the States overnight has seen a very strong bounce in our market today – which now sees the market higher than it was pre-Trump! A lot of volatility beneath the surface but in aggregate, the market is actually up +2.5% for the week. A remarkable effort really and now focus is clearly on what the economic ramifications of a Trump presidency might be.

In the haze of yesterday afternoon's action we penned some thoughts on what might actually play out, suggesting that in terms of the ‘Trump Policy Suite’ his plans to increase spending, particularly on Defence and Infrastructure, halve the company tax rate for corporate America, introduce a series of tariffs to protect local jobs and be more liberal overall in terms of spending – could be very stimulatory. The other important aspect is that Trump’s a businessman, he’ll be business friendly which could be supportive of the market.

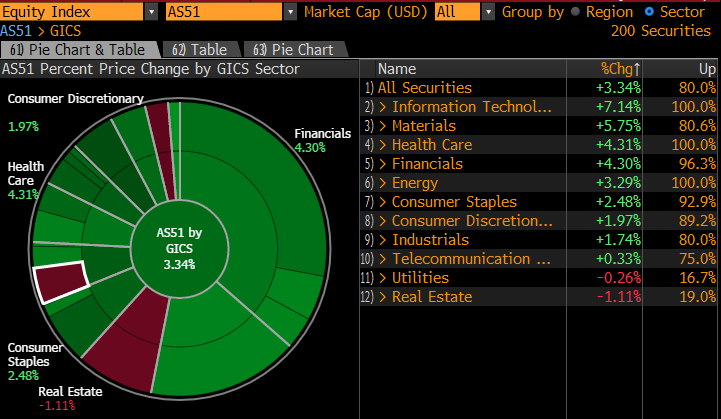

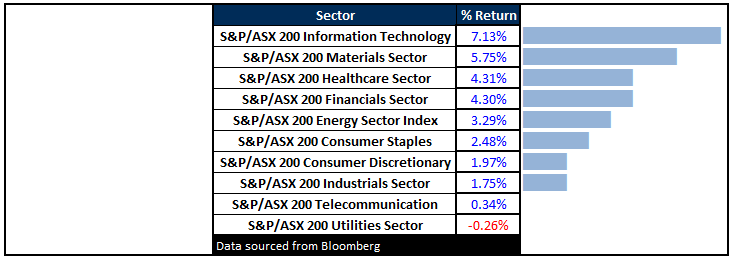

That view has clearly played out overnight with investors chasing sectors that could be the likely beneficiaries. In the US, we saw Winners: Financials +4.3%, Healthcare +3.1%, Industrials +2.6%, Energy +1.7% and Materials +2%. Losers : Consumer Staples -1.5%, Real estate -2.5%, Technology -0.6% and Utilities -3.5% and that theme has also played out here, but with material stocks chiming in more than they did overseas.

Source; Bloomberg

The other important aspect is around the yield play. Infrastructure, property and the like, were sold here today which continues to fit with our current thinking. There will be a time to BUY these names again, the likes of Sydney Airports (SYD), Transurban (TCL) etc, however, we’re not there yet.

The key takeout it would seem is that overall Donald Trump sounds like one big fiscal stimulus leading to higher interest rates and inflation.

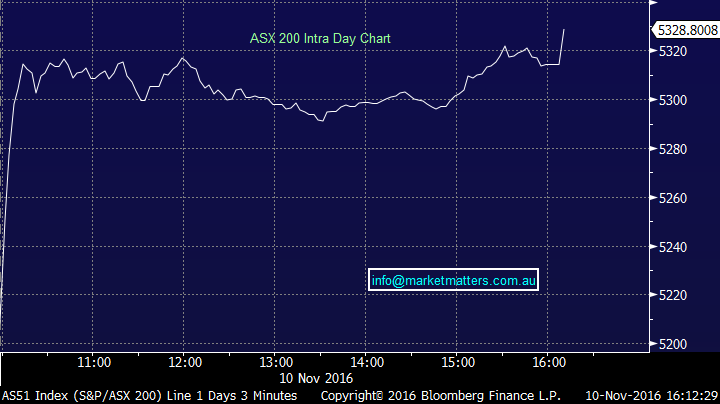

On our market today, we have a very positive session with a range of +/- 121 points, a high of 5328, a low of 5207 and a close of 5328, up +172pts or +3.34%. Another BIG value day on the ASX with $7.34bn

ASX 200 Intra-Day Chart – ASX strong then closes on the highs

ASX 200 daily chart – a massive range

Sectors

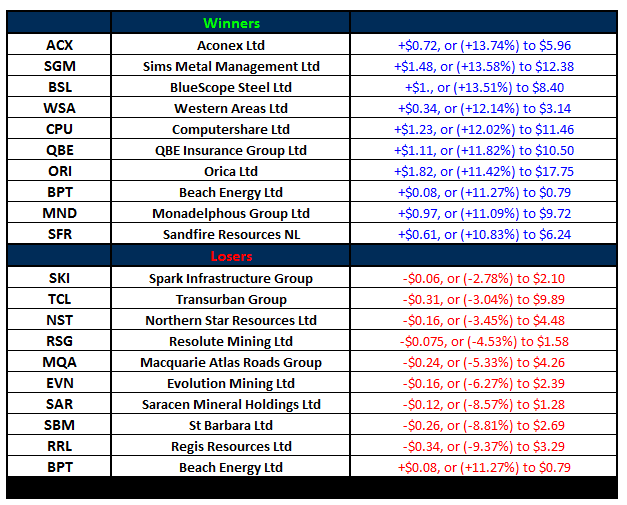

ASX 200 Movers – RISK on again with the typical risk stocks leading the charge today while the GOLD names saw yesterday’s gains wiped off.

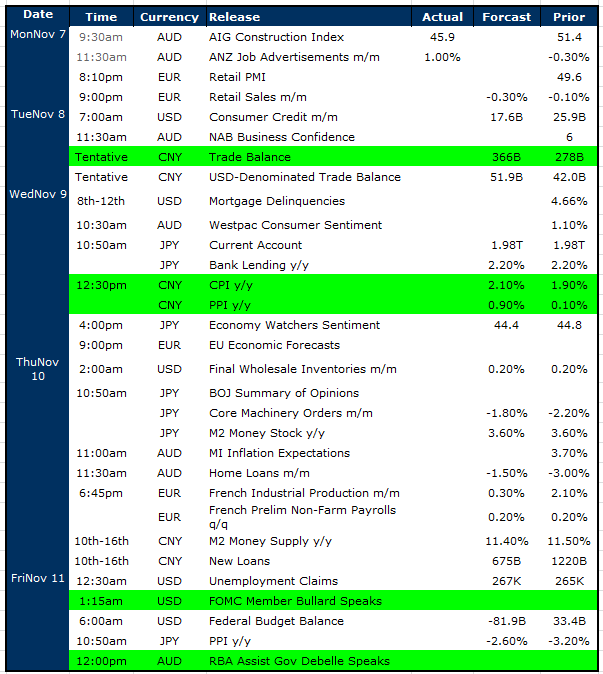

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

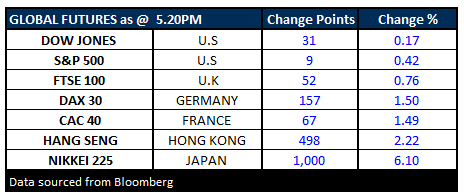

FUTURES higher…

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/11/2016. 5.20PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here