Magellan to raise capital for future growth after reporting strong result (MFG, CGF)

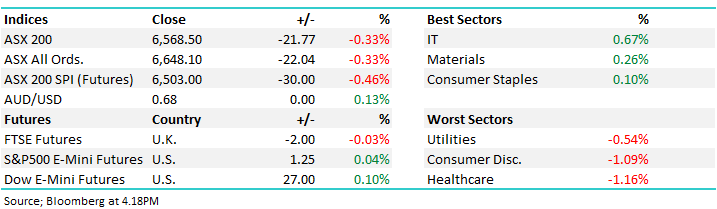

WHAT MATTERED TODAY

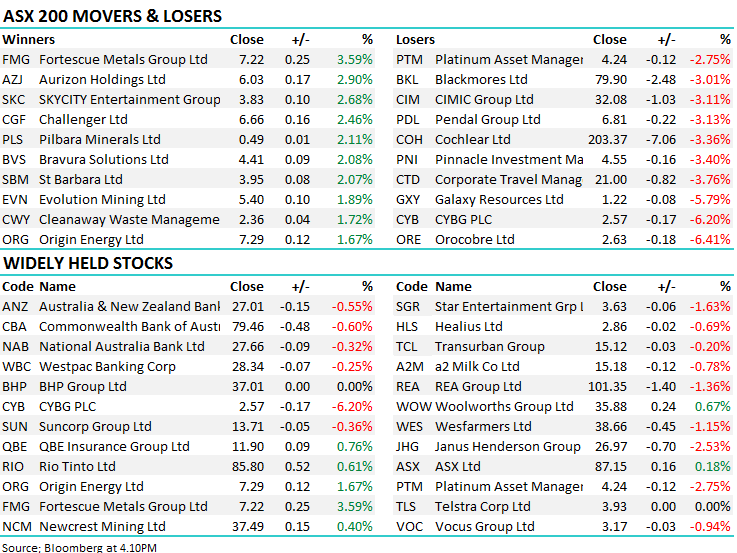

Negative leads from overseas had the ASX on the back foot early however buyers stepped into the fray and bought stocks into weakness pushing the index up near parity in morning trade, but alas, the strength failed and the market drifted into the close to finish about 20pts down – not a bad effort really given the US market was off ~1.5% overnight.

Reporting was headlined by Challenger Financial (CGF) and Magellan (MFG) today, both covered below while MFG also announced a capital raise. That weighed on the other fund managers in the sector withPendal (PDL) down -3.13% and Janus (JHG) also down by -2.53% testing new lows again.

When a sector member halts to raise capital which MFG have done today, managers who don’t want to increase their sector weighting will sell other names to fund the purchase of new shares, generally getting a discount in the new offer. MFG is a particularly thin stock to trade and getting set in size can be hard, so demand for this raise was very strong. Funds typically don’t carry a lot of cash hence market calls are a relative proposition , and today we’ve seen selling pressure across most diversified financials to fund the MFG placement. In terms of JHG specifically, a test of the recent low is now happening, ideally it goes and makes a new low where it finds support. On 7x FY20 earnings versus MFG on 28x the divergence is huge.

Around the region today, Asian markets were down, Hong Kong the worst of them losing ~1.4% as political activism continues to bubble away causing further flight cancelations, the Australian PM the latest to ask the HK Chief Executive to listen to protesters. There was also an incident in Sydney just near our office where a man stabbed a woman and was apprehended by passers-by – no doubt a lot on the news tonight about that with some dramatic footage captured.

US Futures were up for most of our session however have just rolled over to be trading marginally lower.

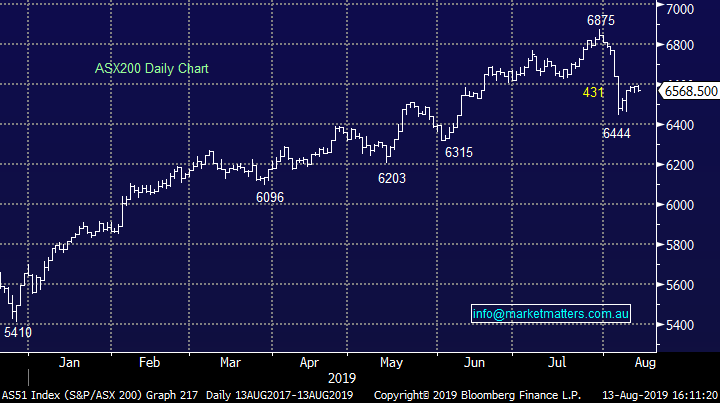

Overall, the ASX 200 lost -21pts today or -0.33% to 6568. Dow Futures are now trading down -44pts /-0.18%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

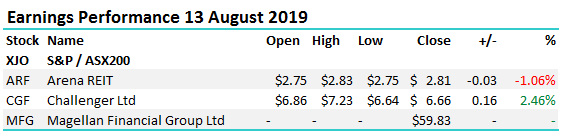

Stocks today…Some confusion on the below table in the last few days, most likely because the open / high / low price feeds were incorrect. This has now been fixed. The table looks at the day only share price performance of companies that have reported during the session – let me know if still not clear and we can amend. (MFG in trading halt today so no trade).

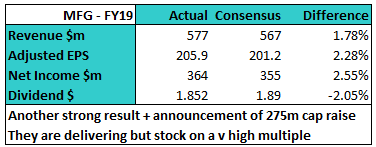

Magellan (MFG) -trading halt; released FY19 results today + announced a $275m capital raise. The results were strong, which they needed to be given the lofty heights of the current share price however as is becoming MFG custom, they beat already high expectations. Underlying profit was a 2% beat, pretty much the same quantum across the board.

Average funds under management increased 28% during the period to $78.5bn – a big number, with performance of most funds tracking ahead of their benchmarks, although John Seviors Airlie Funds, their recent acquisition managed just a 3.8% return for the year versus the ASX which was up 11.5% in accumulation terms.

MFG talked up their approach to more partnerships in the future which is the reason for the capital raise which is being done at $55.20, a 6% discount to the dividend adjusted last traded price. Its fully underwritten. The funds will be used to launch a new ASX listed fund, fund a new retirement product and seed new investment strategies. The raise makes sense with the stock on nearly 30x FY20 earnings versus its longer term average of 17x. We’re meeting with MFG first thing tomorrow morning.

Magellan (MFG) Chart

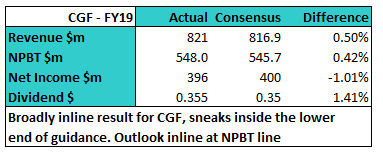

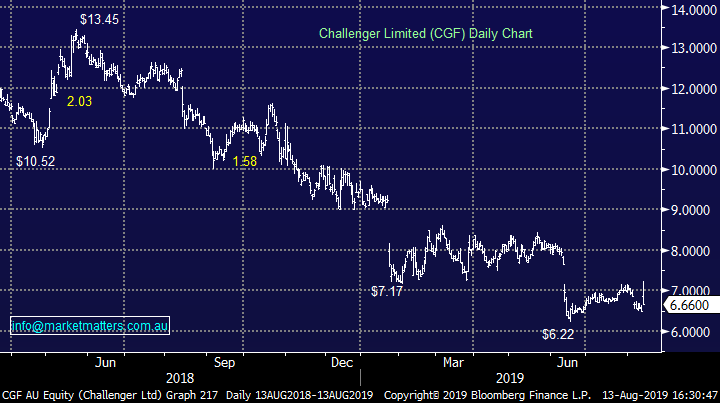

Challenger Group Financial (CGF) + 2.46%: Shares in the annuity businesses have traded higher today with an inline result enough to please the market's downbeat expectations – although early buying tapered off into the afternoon. The result saw normalized net profit before tax sneak in to the bottom end of guidance, marginally below consensus expectations.

Shares in Challenger have been under pressure with lower interest rates reducing the appeal of annuity products. Their pre-tax profit did manage to edge higher in FY19, however on today’s guidance, it is expected to be down in FY20. NPBT guidance was given as $500m-$550m – a 10% spread from top to bottom and the higher hurdle of guidance in line with the FY19 result. On a statutory basis, Challenger looks a little worse for wear with the company taking a $88m negative investment experience hit. They were able to hold the dividend, as many expected and have guided to a flat payout amount for next year. The outlook remains muted, and sales growth seems to be slowing.

Challenger (CGF) Chart

Broker moves;

- Amcor GDRs Rated New Neutral at UBS; PT A$16.15

- Aurizon Cut to Underperform at Macquarie; Price Target A$5.28

- Australian Finance Cut to Hold at Morgans Financial; PT A$2.30

- Contact Energy Downgraded to Neutral at Goldman; PT NZ$8.40

- JB Hi-Fi Downgraded to Equal-weight at Morgan Stanley; PT A$28

- JB Hi-Fi Upgraded to Hold at Bell Potter; PT A$28.50

- Ansell Downgraded to Neutral at Credit Suisse; PT A$28

- Teranga Gold Rated New Buy at Eight Capital; PT C$10

- NRW Holdings Upgraded to Buy at Citi; PT Set to A$2.65

- Cochlear Downgraded to Neutral at Goldman; PT A$212

- Cooper Energy Upgraded to Outperform at RBC; PT A$0.70

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.