Magellan (MFG) raises capital alongside a good result

Stock

Magellan (MFG) $59.83 as at 13/08/2019

Event

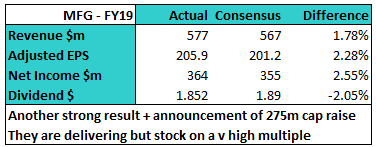

High flying Magellan released FY19 results today + announced a $275m capital raise. The results were strong, which they needed to be given the lofty heights of the current share price however as is becoming MFG custom, they beat already high expectations. Underlying profit was a 2% beat, pretty much the same quantum across the other metrics.

Average funds under management increased 28% during the period to $78.5bn – a big number, with performance of most funds tracking ahead of their benchmarks, although John Seviors’ Airlie Funds, their recent acquisition managed just a 3.8% return for the year versus the ASX which was up 11.5% in accumulation terms.

MFG talked up their approach to more partnerships in the future which is the reason for the capital raise, priced at $55.20, a 6% discount to the dividend adjusted last traded price. Its fully underwritten by Macquarie. The funds will be used to launch a new ASX listed fund, fund a new retirement product and seed new investment strategies. The raise makes sense with the stock on nearly 30x FY20 earnings versus its longer term average of 17x.

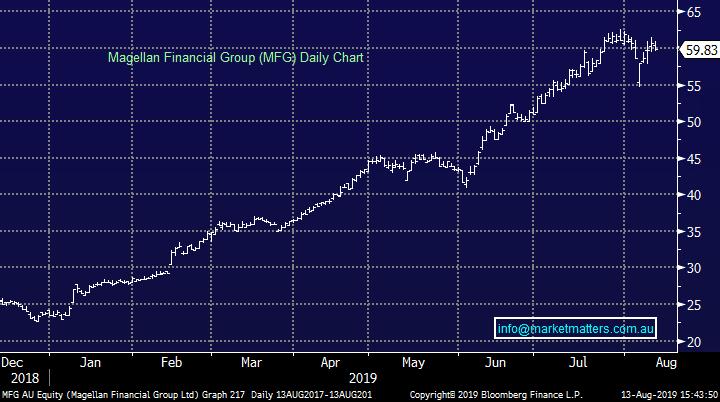

Magellan (MFG) Chart

Average funds under management increased 28% during the period to $78.5bn – a big number, with performance of most funds tracking ahead of their benchmarks, although John Seviors’ Airlie Funds, their recent acquisition managed just a 3.8% return for the year versus the ASX which was up 11.5% in accumulation terms.

MFG talked up their approach to more partnerships in the future which is the reason for the capital raise, priced at $55.20, a 6% discount to the dividend adjusted last traded price. Its fully underwritten by Macquarie. The funds will be used to launch a new ASX listed fund, fund a new retirement product and seed new investment strategies. The raise makes sense with the stock on nearly 30x FY20 earnings versus its longer term average of 17x.

Magellan (MFG) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook