Macquarie cracks $100, NBN issues hamper Telstra, December a good month for equities (TLS, MQG, BTT, DOW, NAN)

WHAT MATTERED TODAY

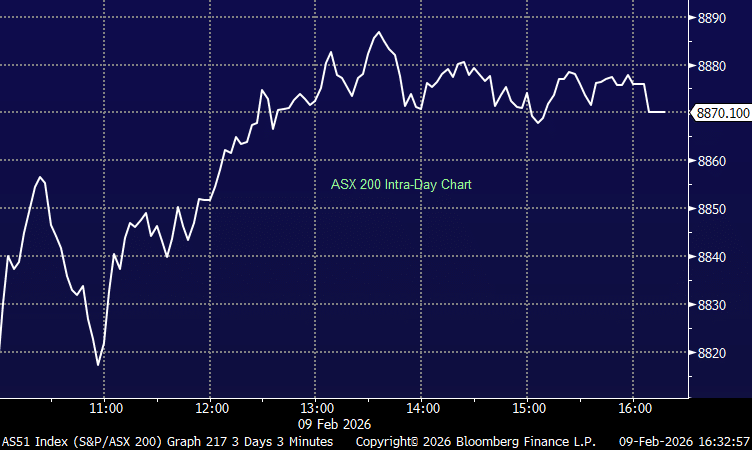

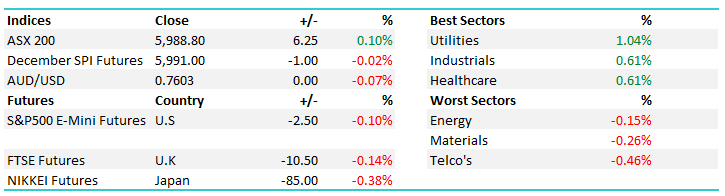

The market was bid up strongly early on today however weakness crept in throughout Asia and we saw the local index tickle up against key resistance just above 6000 for the ASX 200. It simply feels like the current momentum in the mkt simply isn’t strong enough to see it punch through with any real force and sustain above the 6000 milestone. Given price action today, we may well see the market track lower in the short term (~5860 downside target) before winding up again for another test on the upside. We’re now approaching the back end of November so worthwhile looking at stats for December, a typically bullish month for equities;

- The average gain for December since the GFC is an impressive +2.5%, with only the one negative year in 2011.

- However this only tells half the story, in 3 out of the 8-years we formed a low mid-month before rallying strongly over 6% - in 2011 we rallied 5.8% from the start of December before losing all the gains.

- The lows for December were at the start of the month 4-times and mid-month 4-times - in the anomaly of 2011 when the market was in “correction mode”, unlike today, the ASX200 rallied strongly initially which I have counted as “start of the month”.

- In 6 out of the 8 years the high for December was in the last few days while in 2010 it was on the 23rd, only in the unusual 2011 was the high early on the 5th.

- The average gain by Commonwealth Bank (CBA) during December, since the GFC, is +4.1% i.e. banks often regain their bid tone.

So, thinking about the above stats we clearly need to be positioned for more strength into the back end of the year, however it’s also worth noting that so far this November has only given us a -2.25% correction, less than half of the average since the dark days of the GFC. With only 3 trading days left this month it would appear that 2017 is potentially going to become an outlier from a statistical perspective. Overall, we remain bullish the ASX200 targeting a significant break over 6000 in 2017 / 2018 but a short-term correction down towards the 5860 area offers the best risk / reward buying opportunity.

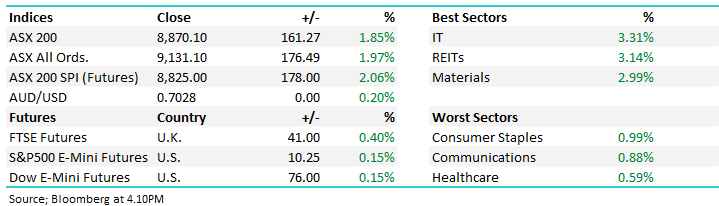

On the mkt today, most buying was focussed on the Utility stocks which added +1.04% while on the flipside, Telstra led the Telco’s into the red. A range on the mkt today of +/-31 points, a high of 6009, a low of 5978 and a close of 5988, up +6pts or +0.10%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

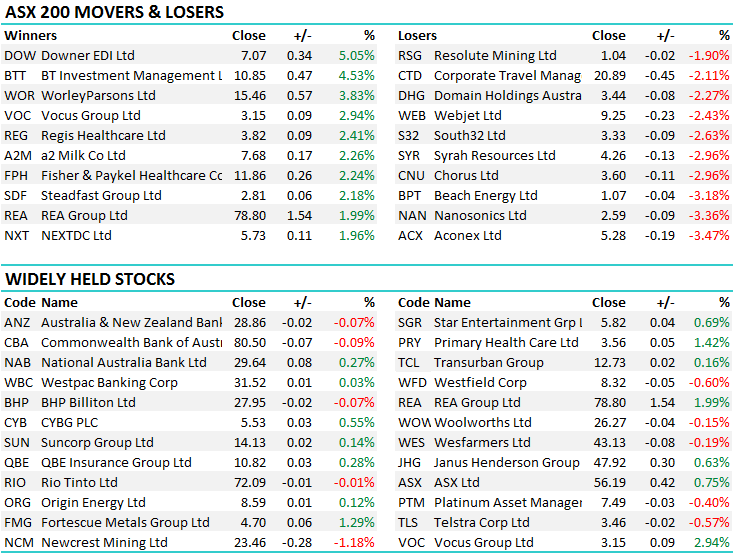

TOP MOVERS

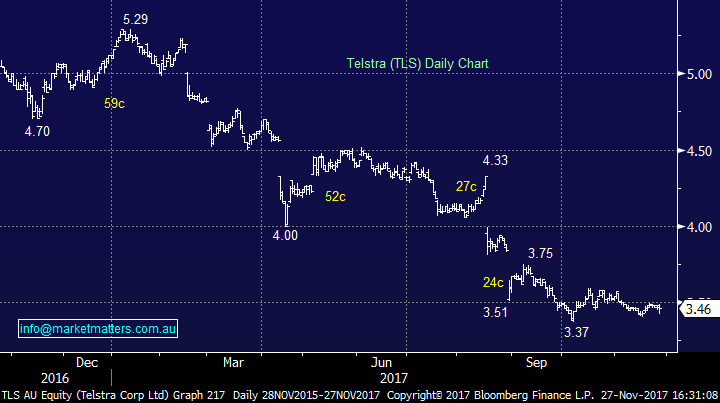

1.Telstra (TLS) – Was up early however made an announcement around lunchtime saying that NBN Co has delayed the HFC NBN rollout due to service issues. Basically, this is one part of the NBN rollout and it’s a bit hard to work out actual impact on earnings. The HFC part is about 15% of NBN activations so it will impact NBN payments on that side, however TLS will get to retain the customer longer which probably offsets that to some degree. TLS themselves working out the details and the initial share price reaction (down) versus the reaction when cooler heads prevailed (up) probably tells the story. The mkt continues to hate TLS however the obvious question becomes, who’s left to sell the stock that hasn’t already??? The stock was 2c lower today on news that could potential impact earnings by a few % . To me, the sellers are simply drying up here.

Telstra Daily Chart

2. Macquarie (MQG) – traded and closed above $100 today for the first time ever which got some press , as it should, however MQG at $100 is still reasonable value trading on ~14.3x forward and likely to yield around 5%. The last time MQG were at these lofty levels pre-GFC was in 2007 when it traded at $97 before hitting a $14 low amid grave concerns around its viability. It’s now a very different business than the pre-GFC leveraged transactional model that ripped fees from each stage of the investment lifecycle. MQG is the largest infrastructure fund manager in the world with huge leverage to the infrastructure megatrend that we’re clearly seeing globally. Importantly, the proportion of transactional based earnings is down – and the proportion of re-occurring revenue is up making future earnings more predictable – similar trend playing out in the broking game which creates some short term pain but the model is better for all…We like MQG, we were too fussy on our entry around ~$92 in the last pullback and didn’t get set which is frustrating but life! What’s even more impressive is MQG has taken out the $100 market even in the face of $US weakness. Stock up +0.87% today to $100.20

Macquarie Daily Chart

Macquarie Monthly Chart

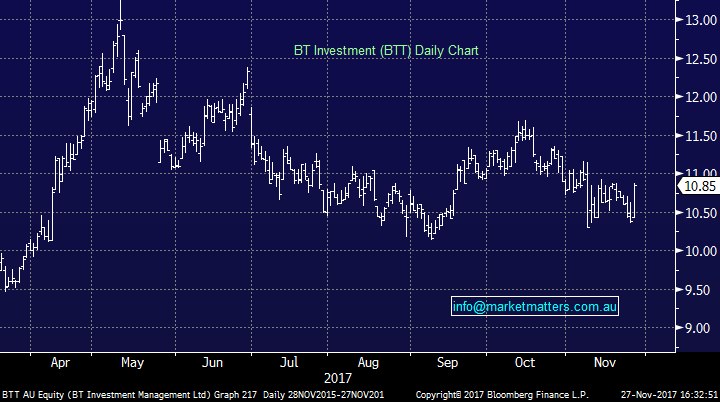

3. BT Investment (BTT) – scorched higher this morning after a positive note out from Bells,….which sent the stock up +4.53% to $10.85. We’ve been in and out of BTT (out now) and the trends are too 50/50 for us at this stage, however improvement in Europe clearly helping. Bells the most bullish house on BTT by a big lick, however consensus price target at $11.91 – pricing about +10% upside from current prices.

BT Daily Chart

4. Downer (DOW) - popped 5.1% today after the contractor increased NPAT guidance to $195mil, a +3% increase - the uplift mostly stems from the costs savings brought in through the $1.2bil acquisition of Spotless group that was completed in August. Spotless’ (SPO) earnings should hit the lower end of guidance at $85mil, impacted by an underperforming contract at the Royal Adelaide Hospital, however the acquisition hasn’t thrown up any other curlies at this stage which is good – the mkt probably factored in a few given the composition of the SPO low margin business. DOW closed at $7.07, the next target is the key resistance level of $7.20, and a break above should lead to fresh new highs of $7.50+.

Downer Daily Chart

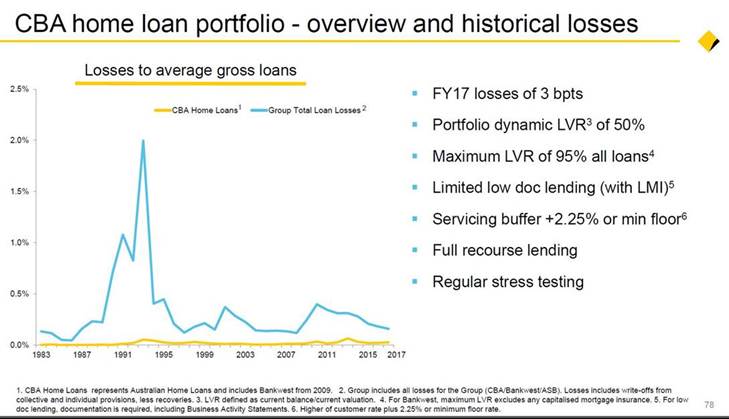

4. House pricesare a national past time in Australia and a BIG risk to the banks apparently , however a good chart outrecentlylooking at the amount of money they have lost in home loans versus business/personal lending. While it makes for interesting discussion, as you can see below, home loan losses don’t change much, spikes in bad debts have been due to business defaulting. So with low rates and under geared balance sheets across corporate Australia, there is little signs of stress.

OUR CALLS

No movements across our portfolios today…although Nanosonics is back on our SELL radar after closing today at 259/260 – right on our key level of support. We’ll make a call on this tomorrow. Assuming we cut it, it will be just the second losing trade in the last 15 closed positions. Not a bad run.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Wednesday or Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/11/2017. 4.00PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here