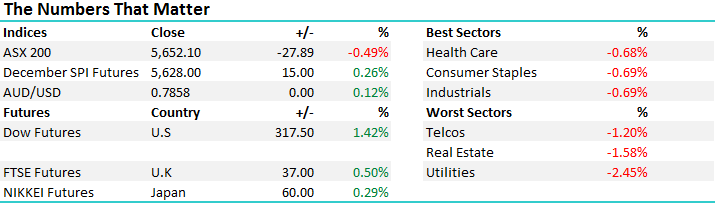

Local stocks yet again fail to follow the global positive lead – CYB, STO, RRL

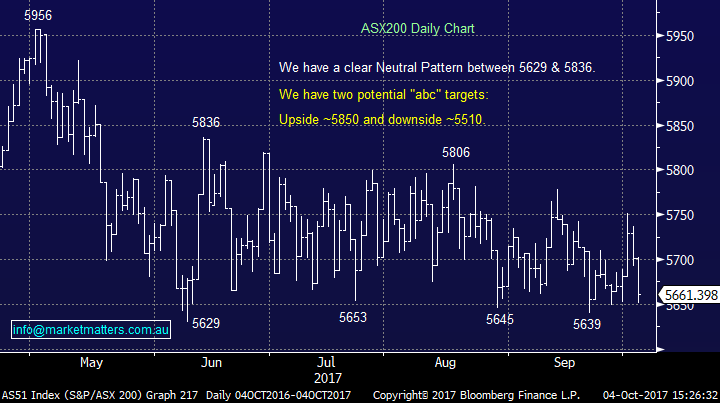

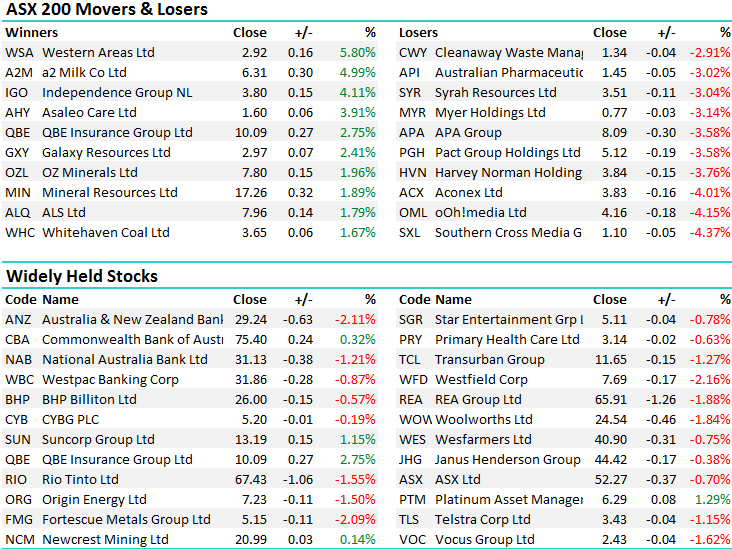

This morning, the futures market was indicating an open ~15-points higher for the ASX200, but the big selling returned to the futures market early in the day and we found ourselves down over 40-points / 0.7% by midday. Today’s selling was broad based with particular weakness in the banks / financials, energy, retail / supermarkets and the iron ore sector with a relief bounce for insurance stocks catching the eye on the upside. While the aggressive futures selling persists, it’s hard to envisage our market managing anything but relatively small counter-trend bounces and a thrust under 5600 feels like just a matter of time.

Overall, today’s weakness comes as no major surprise to MM as we are targeting a break to the downside from the current 20-week trading range between 5629 and 5836 with our ideal target a test of the psychological 5500 area.

Today we sent out 2 alerts which were filled in the market plus we are still working a sell order in CYBG Plc (CYB) to sell half our holding at $5.30, these are explained later in the report. Our cash position in the MM Growth Portfolio is now at 14%.

The ASX 200 had a range of +/- 51 points, a high of 5702, a low of 5651 and a close of 5652, -49 points / -0.87%

ASX 200 Intraday Chart

ASX 200 Daily Chart

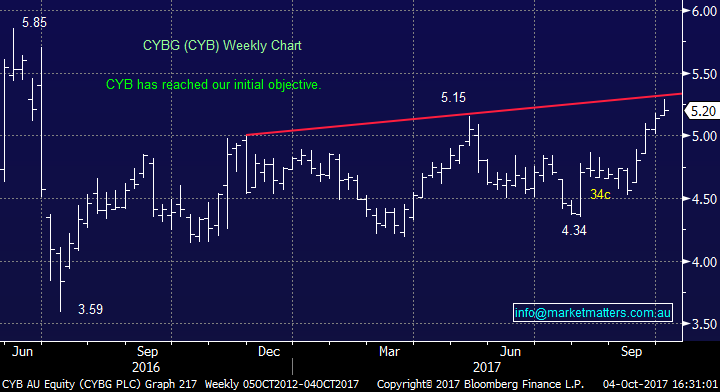

1 CYBG Plc (CYB) $5.21

We remain overall bullish CYB, but are comfortable taking profit on 50% of our position recently at our initial target around the $5.30 level, at this stage we do not envisage lowering our sell level.

CYBG Plc (CYB) Weekly Chart

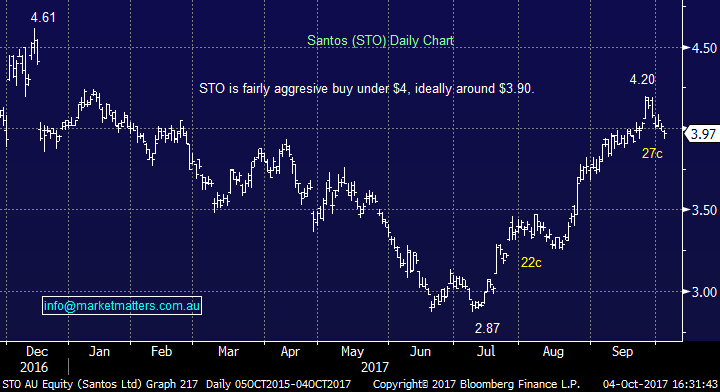

2 Santos (STO) $3.97

Today Santos fell into our buy area, identified last week around the $3.95 area. We have allocated 3% of our portfolio to STO at $3.95, eventually targeting close to $4.50, plus we may consider averaging the position ~$3.75.

Santos (STO) Daily Chart

3 Regis Resources (RRL) $3.65

Today we dipped our toe into the water and allocated 3% of the MM Growth Portfolio into RRL around $3.66. We are looking for a ~10% rally which may coincide with some short-term weakness in equities – RRL will often move in an opposite direction to the overall market.

Regis Resources (RLL) Weekly Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/10/2017 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here