Local market grinds higher but financial services are left behind (BIN, AMP, IFL)

WHAT MATTERED TODAY

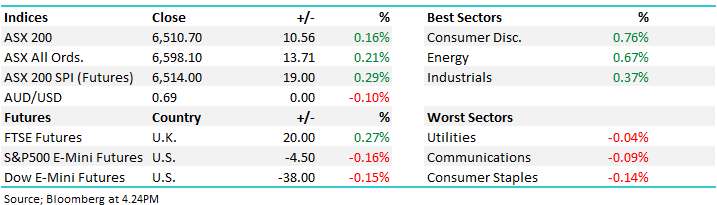

The ASX was looking strong again today, staging a recovery from early lows to trade higher for the 6th session running –the ASX200 is now up 271pts since the close on the 14th of May. Today’s move was carried by consumer discretionary names spurred on by RBA Governor Lowe’s comments pointing to more aggressive easing, as well as suggesting to the incumbent Liberals that the government should look at stimulating the employment market – hoping to drive an increase in discretionary spend. Interest rate futures have just about priced in a 25bps cut to interest rates at the RBA’s next opportunity in two weeks.

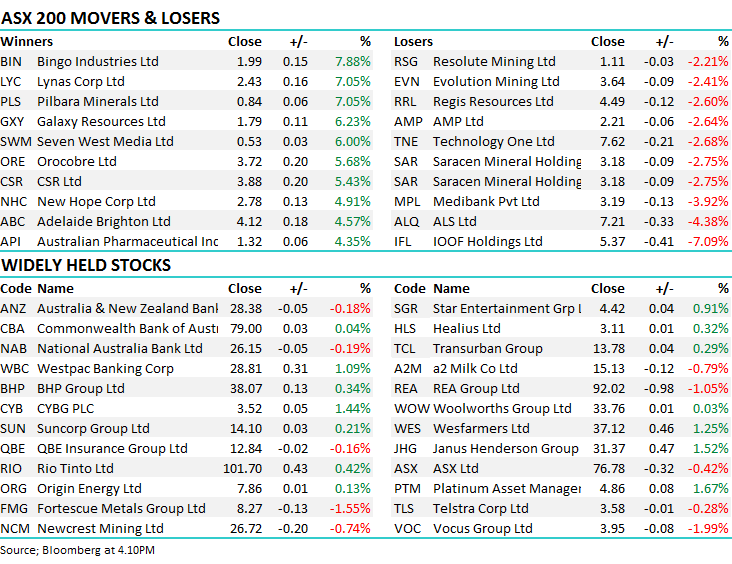

Construction leveraged names caught a bid today despite 1Q construction numbers showing a -1.9% drop for the quarter. This was better than forecasted, and was an improvement on last year’s 4th quarter where construction activity fell -2.1%. Bingo (BIN), a stock we own in the Growth Portfolio, was best on ground as a result of the numbers, adding +7.88% today.

Westpac (WBC) added another 1% today, up over 13% since the election result, well outperforming the other 3 big banks – not really a surprise given how WBC underperformed its peers in the lead up.

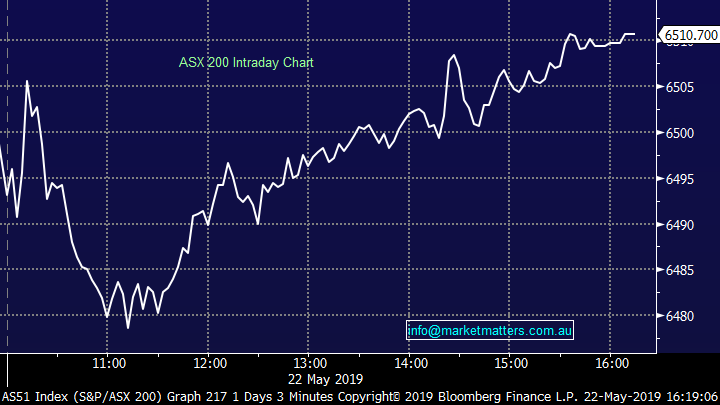

Overall today, the ASX 200 added +10 points or +0.16% to 6510. Dow Futures are trading down -38pts / -0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks we hold on the move: A few stocks we hold were on the move today. Waste Management company Bingo (BIN) +7.88% to test $2.00 again before closing at $1.985 – the best performer in the ASX 200. Emeco (EHL) bounced back from weakness yesterday on no new news to finish up +4.15%, back up above $2 while some buyers have re-emerged in the Lithium space with Orocobre (ORE) + 5.68% along with Pilbara (PLS) which is not in the portfolio up by +7.05%. Clearly some money going back up the risk spectrum into areas that have interesting dynamics at play.

Bingo Industries (BIN) Chart

IOOF (IFL) -7.02%: were hit hard today after saying that APRA had provided formal directions relating to a show cause notice earlier in the year. As means of brief background, IOOF’s Super Trustee business is an APRA regulated entity, and ARPA had concerns around its operations. IFL now has until June 2019 to APRA’s demands. They were also the target (along with AMP) of a bearish note out from UBS on the traditional platform providers, claiming that their earnings derived from platforms could drop more than 30% in the next five years. UBS reckon that structural changes in Wealth Management, pressure for lower fees and more players in the market is a clear headwind, and the established players should be trading on a single digit P/E. We have no interest in IFL, however we have mused that AMP will be an interesting turnaround story at some point.

IOOF (IFL) Chart

Broker moves:

· IOOF Holdings Downgraded to Sell at UBS; PT A$5.05

· IOOF Holdings Downgraded to Sell at Citi; PT A$5

· Chorus Downgraded to Neutral at Forsyth Barr; PT NZ$5.65

· Investore Property Raised to Outperform at Forsyth Barr

· Investore Property Cut to Neutral at Macquarie; PT NZ$1.71

· ALS Downgraded to Sell at Deutsche Bank; PT Set to A$6.57

· Stockland Upgraded to Outperform at Macquarie; PT A$4.48

· Computershare Upgraded to Neutral at Macquarie; PT A$17

· Computershare Upgraded to Neutral at JPMorgan; PT A$16.50

· Super Retail Downgraded to Sell at Morningstar

· JB Hi-Fi Upgraded to Buy at Goldman; PT A$30

· Harvey Norman Upgraded to Neutral at Goldman; PT A$3.85

· James Hardie GDRs Downgraded to Outperform at CLSA

· Bluescope Downgraded to Neutral at Goldman; PT A$14.05

· Corporate Travel Rated New Outperform at Credit Suisse; PT A$30

· AMP Downgraded to Sell at Citi; PT A$1.90

OUR CALLS

We bought Flight Centre (FLT) and Whitehaven Coal (WHC) in the Income Portfolio today.

Have a great night

Harry, James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.