LendLease (LLC) abnking on construction recovery

Lend Lease (LLC) +1.39%

A particularly messy result even to LLC standard given they’re in the middle of offloading their engineering business. The core business posted a $96m profit for the year however they also realised a $406m loss on the outgoing business which included $368m in exit costs. Those figures were largely pre-guided in an update to the market in July, so the focus of the market today was on the outlook and progress on the sale. COVID has certainly had an impact on the business in the 2H20 – focussing on the core business, EBITDA took a 62% hit, posting a $65m loss in the second half as COVID delayed transactions and productivity. While the impact is ongoing, the development pipeline grew to $113b as governments look to invest in construction to reboot economies – the main reason we own the stock. The balance sheet is in good nick with gearing under 6%. As for the engineering business, the deal is set to be completed in the current period with the proceeds split into multiple payments over the 12 months. The recovery from early weakness today encouraging.

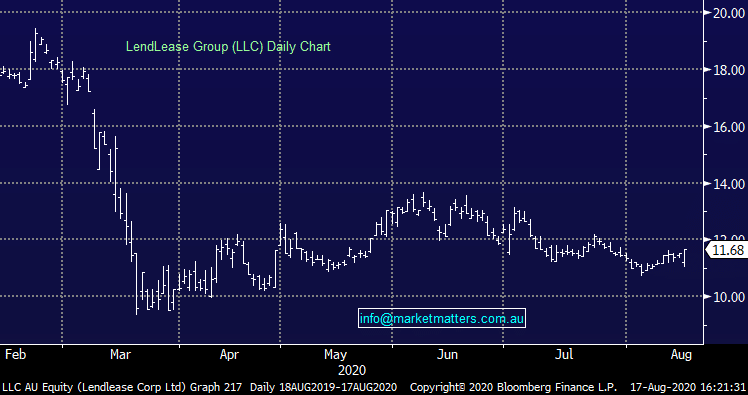

Lend Lease (LLC) Chart