Leaders & Laggards in our International Equities Portfolio

**This is an extract from the Market Matters Morning Report from 8 July. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more

The MM International Equities Portfolio returned over 10% in FY20 despite the huge level of volatility that played out globally, however there was a large variance across positions in the portfolio, or in other words, massive divergence between our leaders and our laggards. https://www.marketmatters.com.au/new-international-portfolio/

Not surprisingly, the leaders were squarely in technology which has shown to be incredibly resilient as the significant drop-in interest rates and acceleration in the use of technology as the world increased its evolution has created the perfect backdrop for tech. While we are bullish US tech names, we do believe the time to increase weight to some Value names is approaching

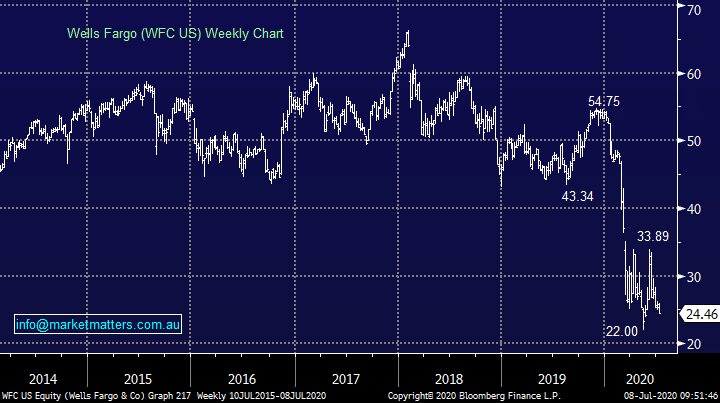

1 Apple (AAPL US) $372.69

MM’s position is sitting up ~90%, clearly a fantastic contributor to the portfolio. Apple at one point was a business that made no money, now it’s extremely profitable and trading on a forward P/E of 29x growing earnings at 10-20%. It’s very hard to question the momentum in the stock and while we wouldn’t be surprised to see the stock take a rest in the short term, we remain bullish AAPL.

MM remains bullish Apple medium-term, but we are becoming slowly cautious short-term.

Apple Inc (AAPL US) Chart

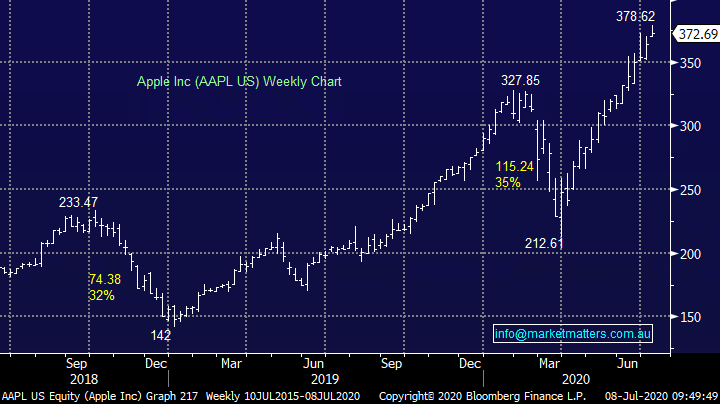

2 The Trade Desk (TTD) $450.71

MM’s position in TTD is sitting up ~70% however we can’t take full credit for it. A good client held the stock which prompted more investigation from MM. As advertising moves from traditional media to online / streaming channels, TTD has as incredibly strong solution to take advantage of this tectonic change in advertising spend. I covered TTD in a video some month ago – 6 stocks we’re happy to buy – click here

MM remains bullish TTD

The Trade Desk (TTD US) Chart

2 The Trade Desk (TTD) $450.71

MM’s position in TTD is sitting up ~70% however we can’t take full credit for it. A good client held the stock which prompted more investigation from MM. As advertising moves from traditional media to online / streaming channels, TTD has as incredibly strong solution to take advantage of this tectonic change in advertising spend. I covered TTD in a video some month ago – 6 stocks we’re happy to buy – click here

MM remains bullish TTD

The Trade Desk (TTD US) Chart

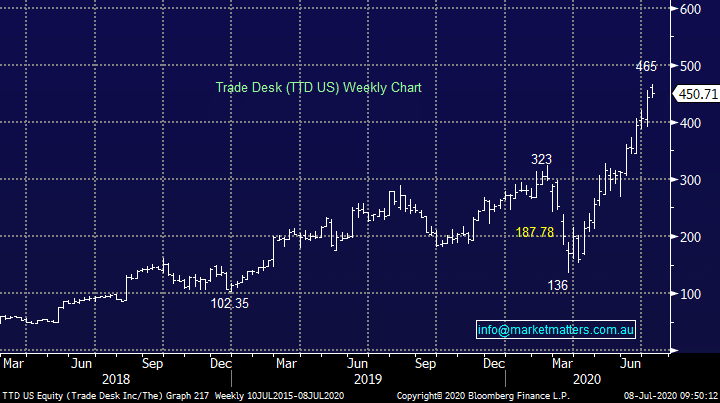

3 JP Morgan Chase (JPM US) $92.32

US banks are struggling under the vice of low interest rates and the economic hit from COVID-19. The provisioning that has been taken from the likes of JPM has been huge and this is hurting profits. Credit card liabilities are a problem for JP as was the decline in Oil prices. MM’s position is currently down ~30% and given our more positive expectation around stimulus and economic outcomes leading into an election, we will give the position room to improve.

MM remains bullish JPM

JP Morgan (JPM US) Chart

3 JP Morgan Chase (JPM US) $92.32

US banks are struggling under the vice of low interest rates and the economic hit from COVID-19. The provisioning that has been taken from the likes of JPM has been huge and this is hurting profits. Credit card liabilities are a problem for JP as was the decline in Oil prices. MM’s position is currently down ~30% and given our more positive expectation around stimulus and economic outcomes leading into an election, we will give the position room to improve.

MM remains bullish JPM

JP Morgan (JPM US) Chart

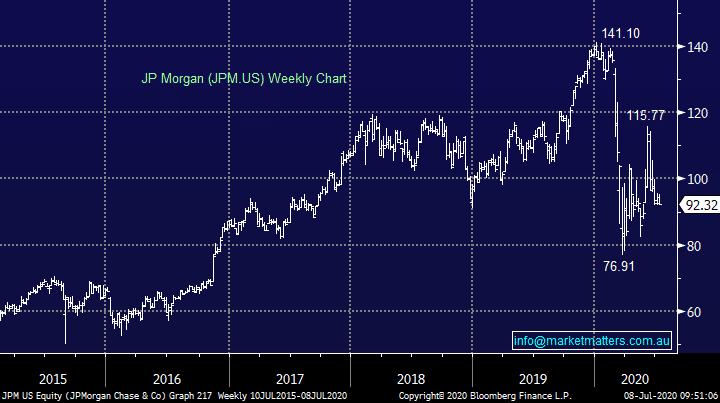

4 Wells Fargo (WFC US) $24.46

WFC has been hit by similar problems however they’ve also had the double whammy of a fraud scandal thrown into the mix. Tellers were creating savings and checking accounts on behalf of customers (without their knowledge) to pick up a sale incentive. While Warren Buffet’s Berkshire Hathaway remains WFC’s no 1 supporter with 8.4% of the stock, I’m sure this year’s performance has tested Mr Buffets patience, just as it has MM’s.

The position is currently down a painful ~50% and while hindsight says we should have cut this sooner, our positive stance around banks globally means we’ll hold for now.

MM is neutral WFC

Wells Fargo (WFC US) Chart

4 Wells Fargo (WFC US) $24.46

WFC has been hit by similar problems however they’ve also had the double whammy of a fraud scandal thrown into the mix. Tellers were creating savings and checking accounts on behalf of customers (without their knowledge) to pick up a sale incentive. While Warren Buffet’s Berkshire Hathaway remains WFC’s no 1 supporter with 8.4% of the stock, I’m sure this year’s performance has tested Mr Buffets patience, just as it has MM’s.

The position is currently down a painful ~50% and while hindsight says we should have cut this sooner, our positive stance around banks globally means we’ll hold for now.

MM is neutral WFC

Wells Fargo (WFC US) Chart