Landslide – a Boris Johnson cover

WHAT MATTERED TODAY

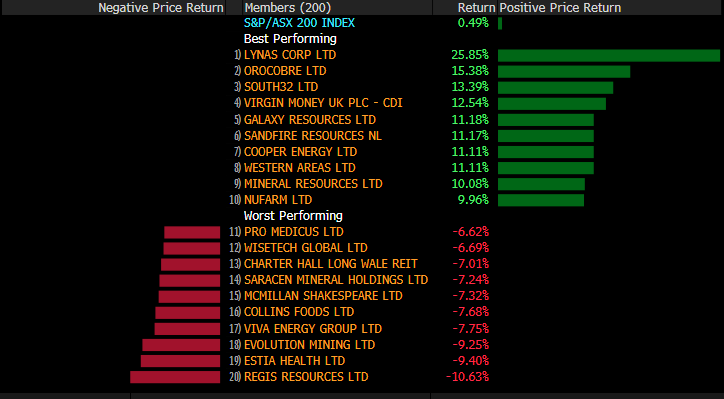

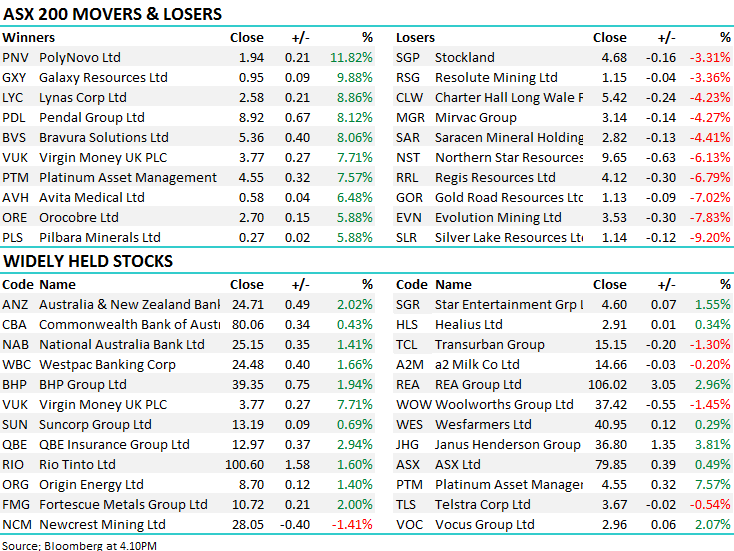

A positive day for the local market, but probably not as bullish as a lot of traders were expecting today given the double whammy of good news. Firstly reports suggest a first stage trade deal has been agreed upon from both China and the US. And secondly, Boris Johnson looks to have won a healthy majority in the UK election despite articles during the week that the election would be a tighter affair. Both of these issues have been hanging over the market of late and equities took an interesting turn when both were resolved. Resources and energy were well bid over all as the global growth trade is on. Dr Copper in particular caught a bid, Oz Minerals (OZL) closed 4.87%. Gold however took a hit given the deflationary effect of lowering trade tariffs coupled with a positive move in the AUD, notably Evolution (EVN) –7.83%. A number of financials were well bid, particularly those leveraged into the UK market – Virgin Money (VUK) +7.71%, Pendal (PDL) +8.12% and Janus Henderson (JHG) +3.81% caught our eye. We own both PDL and JHG in the Growth Portfolio.

Although stocks closed in the black, the market was probably less positive than expected and a lot of that comes down to the bullish move in the Aussie dollar. Although US bonds were sold off and the Aussie 10-years mostly held their yield, the AUD finds a buyer in the risk on trade given our exposure to resources. The AUD closed around 1.5% higher than 4PM yesterday, enough to keep some pressure on the general equity bidding of the ASX. All-in-all the ASX200 closed just 22ps/+0.33% higher for the week.

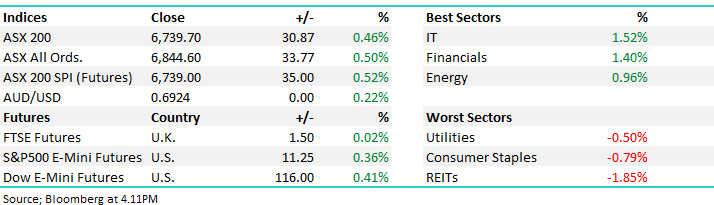

At a sector level the risk on areas did best, IT was well supported however the Financials also had a day in the sun. On the flipside, it weas clear that interest rates sensitive sectors couldn’t find any love, particularly the real-estate stocks that fell nearly 2% as a group. Overseas, US Futures were higher while Asian markets were particularly strong.

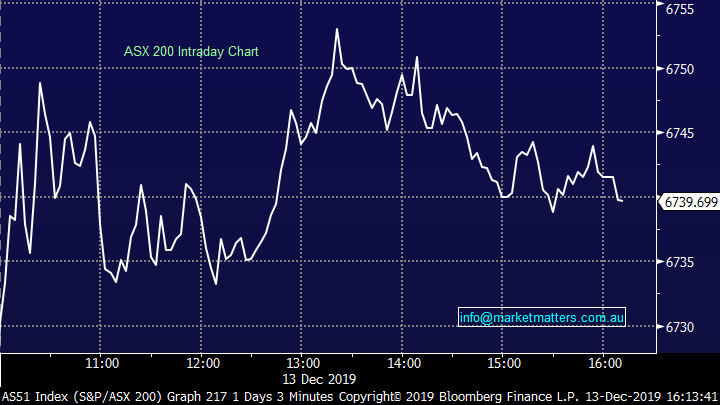

Overall, the ASX 200 closed up +30pts or +0.46% today to 6739, Dow Futures are trading up 116pts/0.41%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Sectors this week:

Stocks this week:

BROKER MOVES;

- Wisr Rated New Buy at Moelis & Company; PT 20 Australian cents

- Perseus Cut to Neutral at Macquarie; PT A$1.05

- St Barbara Cut to Neutral at Macquarie; PT A$2.60

- Regis Resources Cut to Neutral at Macquarie; PT A$4.50

- Pilbara Minerals Cut to Underperform at Macquarie

- OceanaGold GDRs Cut to Neutral at Macquarie; PT A$2.80

- New Hope Raised to Neutral at Macquarie; PT A$1.90

- Beach Energy Cut to Underperform at Macquarie; PT A$2.40

- Charter Hall Group Raised to Buy at UBS; PT A$12.50

- Charter Hall Group PT Raised to A$12.80 at Morgan Stanley

- Appen Raised to Buy at Bell Potter; PT A$27.50

- Afterpay Ltd Rated New Sector Perform at RBC; PT A$30

- Zip Co. Rated New Outperform at RBC; PT A$4.40

- Oil Search Cut to Hold at Morgans Financial Limited; PT A$7.82

- Charter Hall Retail PT Raised to A$4.10 at Morgan Stanley

OUR CALLS

No changes to the portfolios today.

Major Movers Today

Have a great weekend

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.