Kogan misses delivery (KGN, ILU)

WHAT MATTERED TODAY

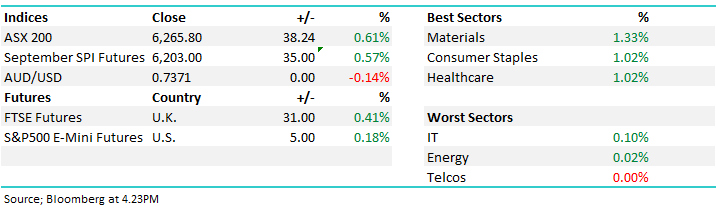

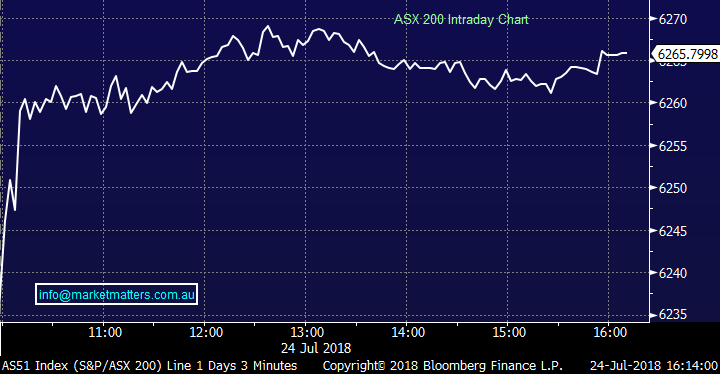

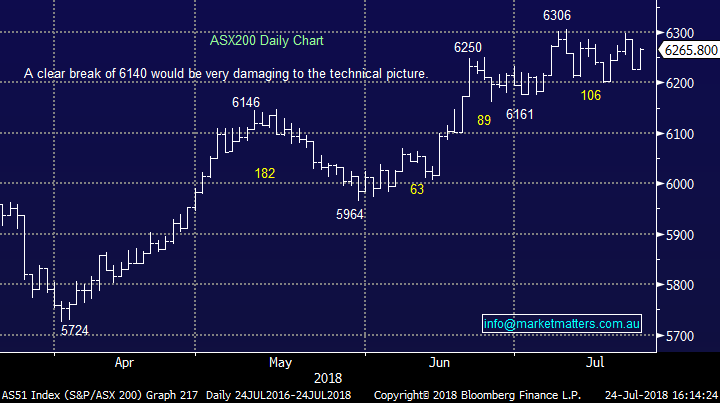

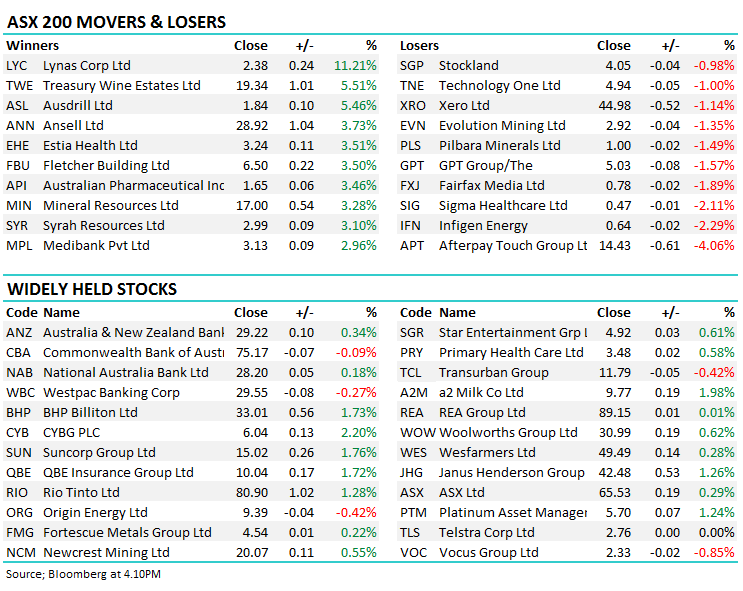

Today was the 13th trading session where the index oscillated within a 100 point trading range, upside resistance sitting at ~6300 on the XJO with support at ~6200 – the market simply feeling like its treading water as resources perform one day and banks the next with a coordinated thrust remaining elusive. A positive move on the US Futures this morning courtesy of a strong earnings beat by Google (Alphabet) saw our market outpace the futures print (+17pts) early on, and despite some selling in the banks from early highs, there was enough strength elsewhere to offset. Kidman Resources (KDR) was strong adding 7.05%, a frustrating move given we’ve contemplated the switch from ORE in recent times however stayed on the sidelines given the relative underperformance in the sector. Looking elsewhere, some of the go-too stocks of the past few months came back into vogue, Treasury Wine Estates (TWE) for instance was up strongly (5.51%) while A2 Milk (A2M) also enjoyed a good session rallying from early weakness, adding 1.98% to close at $9.77.

QBE Insurance copped an upgrade from Citi last week with the broker slapping a buy and $11.20 PT on the perennial underperformer, the stock was up smalls as a result however added another +2% today thanks to rising bond yields in the US overnight. We’ve remainder patient on this stock for some time now, however the tailwinds continue to build…

Overall, the ASX200 added 38 points today, or +0.61 % to close at 6265. We remain neutral here, with the trigger to turn more bearish at 6140 on the XJO.

Our Primary Contributor James Gerrish is on Sky Business at numerous times throughout the trading week. This morning he focussed on the Kogan (KGN) update which was out before the market opened, along with the Iluka (ILU) production numbers. Click here to view (or hit the image)

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; the benefits of a broker rating to a small cap was on show today as encryption technology company Sentas rallied 6% on an upgrade from Bell Potter. Other broker news was muted.

- Hastings Technology Metals (HAS AU): Rated New Buy at APP Securities

- Mayne Pharma (MYX AU): Upgraded to Hold at Bell Potter; PT A$0.84

- Senetas (SEN AU): Upgraded to Buy at Bell Potter; Price Target A$0.13

- Western Areas (WSA AU): Upgraded to Buy at Argonaut Securities; PT A$3.40

Kogan.com (KGN) $5.84 / -11.78%; online retailer Kogan appears to have hidden a small miss to FY18 earnings within this morning’s quarterly cash flow & trading update announcement. The company released unaudited figures for the financial year, implying revenue to be $404mil and EBITDA just shy of $24mil, while the market was looking for $415mil and $27mil respectively. Although EBITDA is expected to grow 90% for the year, it still represents a ~10% miss to expectations, and as we have seen in the past, growth companies are stung by the market when results fall short. Coupled with the miss, the announcement was light on detail however more commentary and clarity is expected in next month’s full year result.

We remain cautious of Kogan, however the market is heavily discounting the company over fears of Amazon’s competition. We see the full year result as a short term risk, however we see upside in the stock if they continue to execute their strategy well, and the Amazon impact is lower than expected. Kogan shares have also been under pressure recently after it was leaked that founder Ruslan Kogan & CFO David Shafer were unsuccessful in offloading a large sum of shares before selling $42m worth at a deep discount to the market.

Kogan.com (KGN) Chart

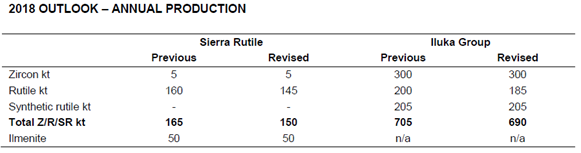

Iluka (ILU) $11.29 / +1.62%; Mineral Sands miner Iluka released their 2Q production numbers, and while production was strong, much of the numbers were driven by pricing tailwinds. ILU is producing strong free cash flow given a work down in stockpiles and that’s helping them pay down debt. The negative part of the update was guidance which missed by ~2%.

Key points from Shaw & Partner’s very good resources analyst Peter O’Connor…

· Sales revenue up strongly – 1H revenue was up ~21% YoY despite lower sales volume (3%) and adverse currency rate (2.4%) suggesting that underlying commodity price trend was favourable and the expectation is for further gains in 2H.

· Selling price trend still up – Average selling prices (ASP) increased in 1H;

- zircon price (excluding concentrate) up 47% from first half 2017

- first half rutile price up 20% from first half 2017, second half 2018 rutile price increase of 14%

· WC unwind still .. Sales volumes continue to exceed production in line with the working capital unwind of the company’s large (although now declining sharply) inventory position. YTD sales (Zircon + rutile + synthetic rutile) of 438kt was well ahead of production at 351kt – similar trend in JQ as well.

· Cash position higher, almost back to net cash. Net debt reduced further to $34 million, from $183 million at 31 December 2017, reflecting strong free cash flow in the first half of $226 million (annualised FCF yield of ~10%) and payment of $69 million for the 2017 final dividend. This level of FCF is well ahead of our expectations.

The outlook for Iluka remains positive with commodity price tailwinds driving earning’s higher. Production outages from RIO and increasing demand have meant realized zircon prices rose 21%, and rutile prices up ~10% over the half. We like Iluka, and although prices are beginning to incentivise other suppliers, demand is still outweighing supply and should do through 2019. We are looking for further weakness before considering a buy in ILU.

Iluka (ILU) Chart

Mineral Resources $17.00 / 3.28%; A stock that triggered on a technical scan this morning and had a good session today – while we’re reluctant to buy strength, this one looks great on the charts for run to new highs…

Mineral Resources (MIN) Chart

OUR CALLS

We sent an alert out today to buy Healthscope (HSO) around $2.20 however the stock spiked after we sent the alert up to $2.27and we were not filled. Cimic (CIM) was a buy below $47 and it did not trade there today. We’ll continue to update out views / actions on both stocks. Generally, a ‘buy around’ alert such as HSO would imply +/- 1% implying $2.22.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here