Kogan.com shares volatile despite solid update

Stock

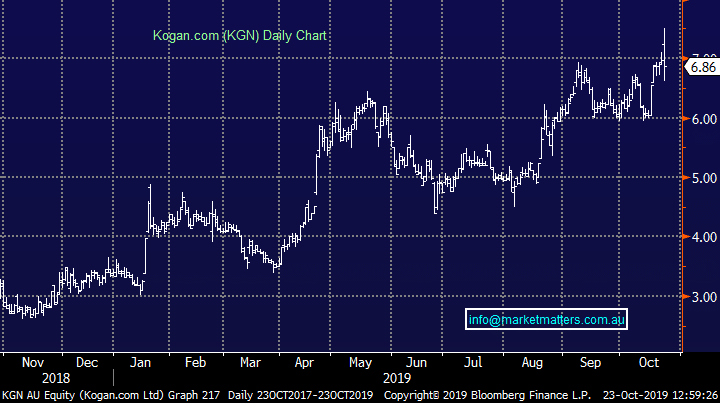

Kogan.com (KGN) $6.93 as at 23/10/2019

Event

Online retailer Kogan is currently trading slightly lower today, despite being as high as $7.50 earlier in the session, 7.5% better than yesterday’s close. The retailer was out with a business update pointing to 16% sales growth and 28% profit growth vs the 1st quarter of FY18 as the company integrates a number of new products to drive revenue and scale.

With the site now attracting more than 1.6m active customers Kogan has launched their own suite of energy, mobile, insurance and more to capture more of the customers spending power. Four new brands that were planned to launch at the end of the year hit the market early including Kogan’s push into personal finances with Money Credit Cards coming online earlier this month. The vertical integration continues, with Kogan Travel partnering with Corporate Travel (CTD) to offer white labelled travel services later this financial year.

The significant growth coupled with prudent cost control has resulted in a strong uptick in profits for KGN however shares trade lower today given the growth already factored in to the company. Retail seems to be at a crossroads at the moment with Super Retail (SUL) out yesterday with a mixed update showing LFL sales growth but at the expense of margins. We have also recently seen Nick Scali (NCK) guide earnings lower.

Kogan.com (KGN) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook