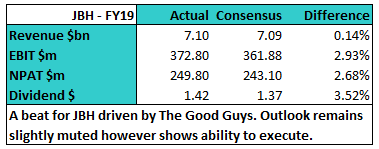

JB defies the retail gloom and tops expectations (JBH, BEN)

WHAT MATTERED TODAY

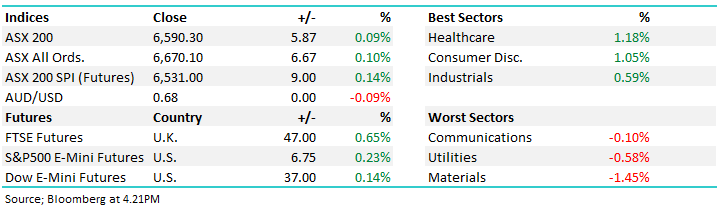

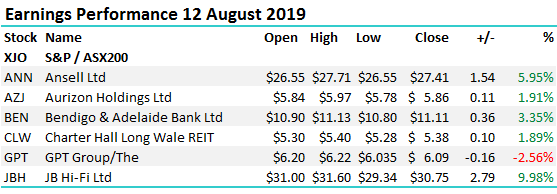

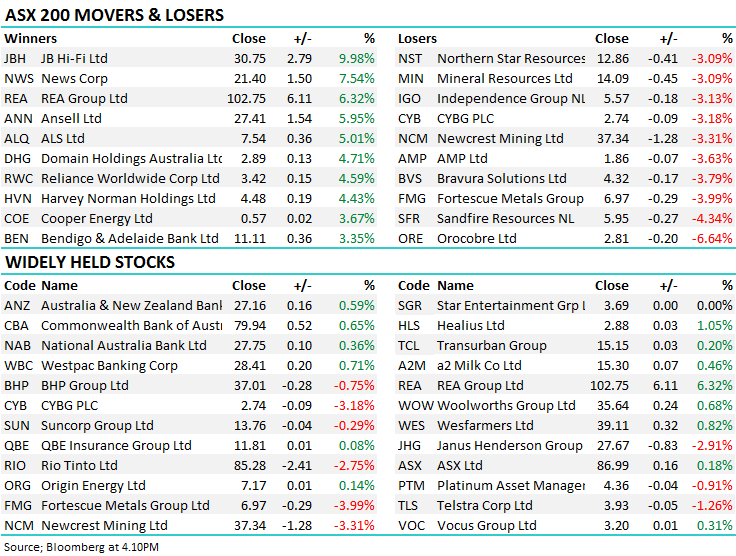

A reasonable day for local stocks with the market overcoming much of the early weakness to end the session largely flat, the Health Care sector was best on ground, while the Materials provided most weight. Reporting steps up a gear this week, with ~50 companies out with results - 7 of them reported today.

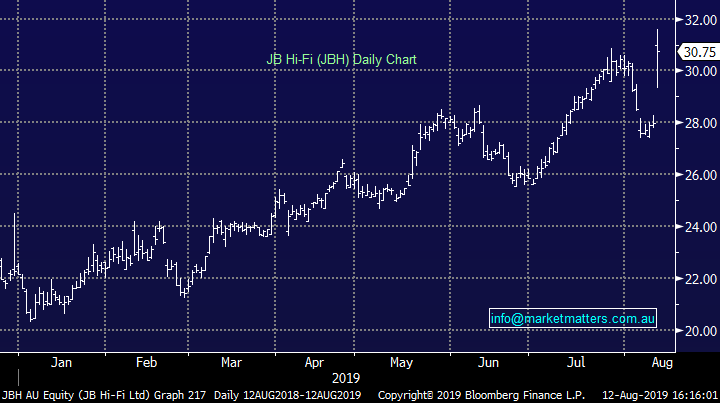

JB Hi-Fi (JBH) did well today after reporting FY19 numbers, trading up by 9.98% at the close. While they produced reasonable top line sales growth (+4.1%), the big improvement came from better margins across the business as competitive pricing pressures eased from the end of 2018 and a number of their efficiency programs started to reap benefits. Harry covers the result below however it was a decent one given the tough environment.

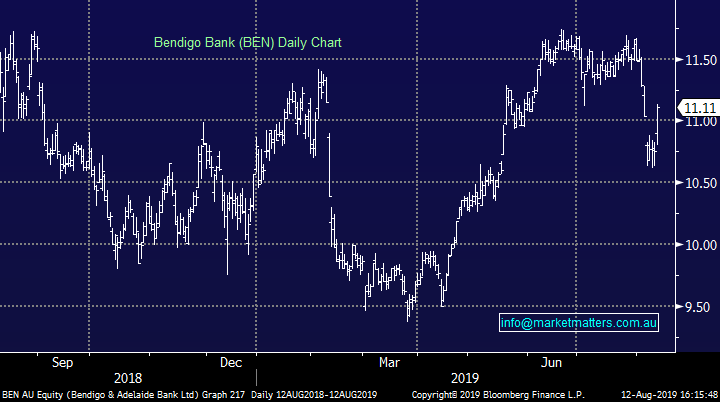

Bendigo (BEN) was also out with their FY19 result which was slightly better than the downbeat market expectations, however the trends remain muted at best for regional banks generally and some form of consolidation / corporate activity is the only real reason to remain positive on the sector.

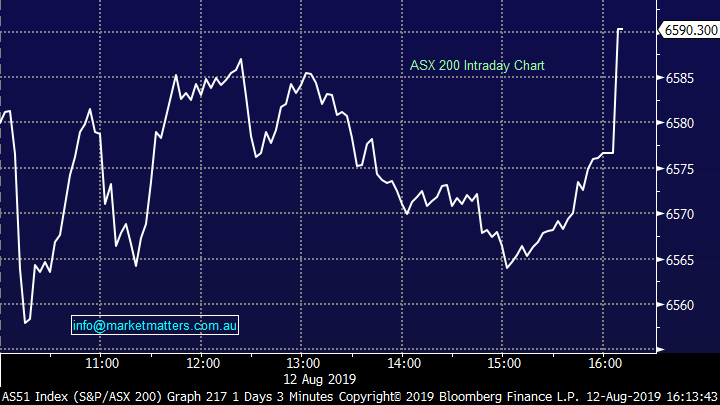

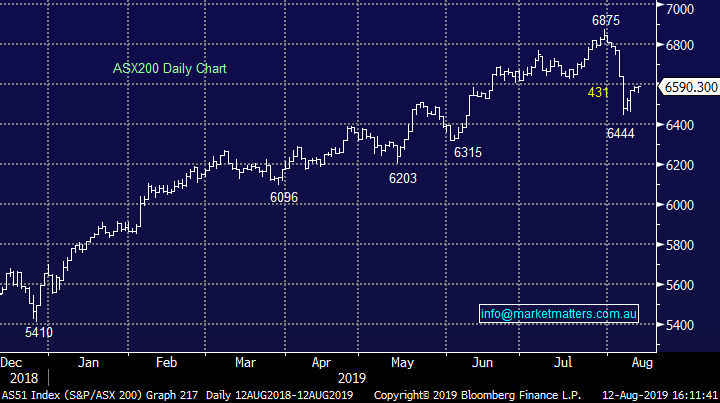

Overall, the ASX 200 gained 6pts today or +0.09% to 6590. Dow Futures are currently trading up 40pts / +0.15%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Reporting: Kicks up a gear this week with 7 companies having reported results today with another ~40 odd out over the week. Of particular interest we have: Challenger Group (CGF) reporting tomorrow along with Magellan (MFG), Pact Group (PGH) & Tabcorp (TAH) report full year numbers on Wednesday (CBA goes ex-dividend that day) while NAB also provide a trading update, Thursday is a huge day with the ASX, CWY, IVC, QBE, TLS, WHC & WPL of particular interest while Healius (HLS) & Newcrest (NCM) are out on Friday.

For a full list, click here & I’ll back in the morning with First Reactions…click here for past episodes.

JB Hi-Fi (JBH) +$2.79 / 9.98% to $30.75: Crashed through to a new 52-week high early in the session today, rallying on a better than expected result at the full year announced this morning. The consumer goods group saw profit rise 7% despite the tough retailing conditions, surpassing market expectations.

The result was driven by The Good Guys improving profit margin which rebounded from a steep decline in FY18. In fact The Good Guys accounted for more than half of the 7% rise in profits for the full year. The Australian JB division held firm with a small 3% rise in EBIT with the online push helping support sales growth. JB NZ performed well, reducing the EBIT loss by more than 30% however this remains a small contributor to the group’s numbers.

JBH has a reasonably strong balance sheet so the profit beat also drove a dividend beat which shareholders have welcomed. The outlook was a little mixed here. The company gave a July 2019 sales update which showed a steady rate of growth compared to July of 2018, albeit off a low base there, FY20 guidance was given for sales to be “circa $7.25 billion,” which was marginally below consensus at $7.295b however if JB can continue to keep costs under control it may mean another beat at the profit line.

Overall, a good start to reporting season for the retailers which many expected to find it tough this time round, given the slow retail sales momentum and lack of inflation anywhere in the market. The outlook seems on the conservative side given how well JBH is executing both online and instore. There could be some benefits seen if/when they bring in the BNPL partner. Still though, it’s on a reasonable multiple below 14x with ~4.5% ff yield and some decent execution.

JB Hi-Fi (JBH) Chart

Bendigo Bank (BEN) +$0.36 / +3.35% to $11.11: At the top line income fell by 1% from the first half to the 2nd while expenses increased by 6% over the period on a cash basis. That expense growth was expected given higher regulatory costs, but it wasn’t expected to be that high. Credit quality was fine and their tier 1 capital was okay at 8.9%. The dividend was kept at 35cps, taking the full year payout to 70cps fully franked putting it on a yield of ~6.3%, which is the reason to hold the stock.

Bendigo Bank (BEN) Chart

Broker moves;

• Alliance Aviation Downgraded to Hold at Ord Minnett; PT A$2.60

• James Hardie GDRs Upgraded to Buy at UBS; PT A$23.80

• A2 Milk Co Upgraded to Hold at Morningstar; PT A$13.60

• REA Group Upgraded to Neutral at JPMorgan; PT A$90

• Austal Downgraded to Neutral at JPMorgan; PT A$3.60

OUR CALLS

No changes today across the portfolios.

Major Movers Today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence