Janus Henderson loses a CEO and AUM (GMA, RIO, JHG)

WHAT MATTERED TODAY

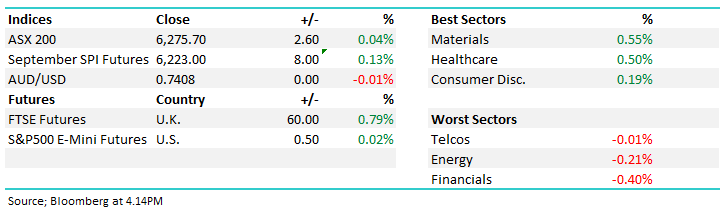

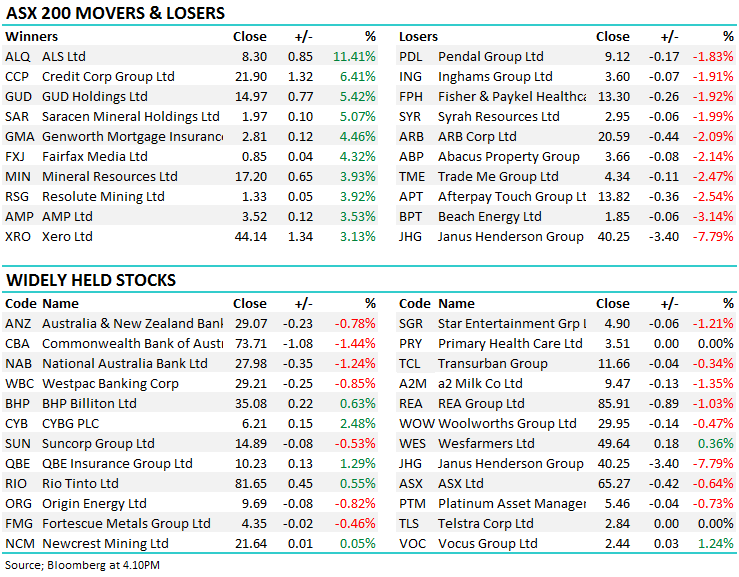

It was all up to the material stocks today to offset weakness amongst the financials and drag the market out of its early slumber as reporting season continues to ensure volatility at the stock level. As hard as they tried it was still to not enough to see the market finish up on the day, although BHP up +0.63% and RIO up +0.55% were two bright spots while AMP has started to find a few buyers adding another +3.53% to finish at $3.52. Janus Henderson (JHG) gave a 2Q update that the market snubbed sending the stocks down -7.79% by the close, a combination of weak performance, higher than expected outflows and a smaller than expected buy back conspiring against the global asset manager – we cover in more details below. On the flipside, Genworth (GMA) was strong, adding +4.46% today to close at $2.81 on re-confirmation of guidance while laboratories business ALS (ALQ) flagged a 28% increase in profit and rallied 11.41% to top the leader board today.

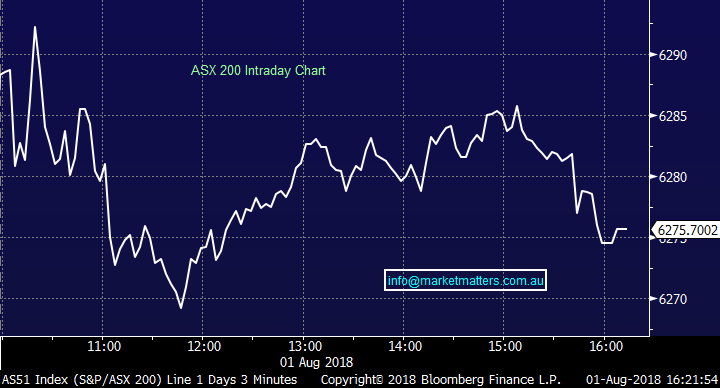

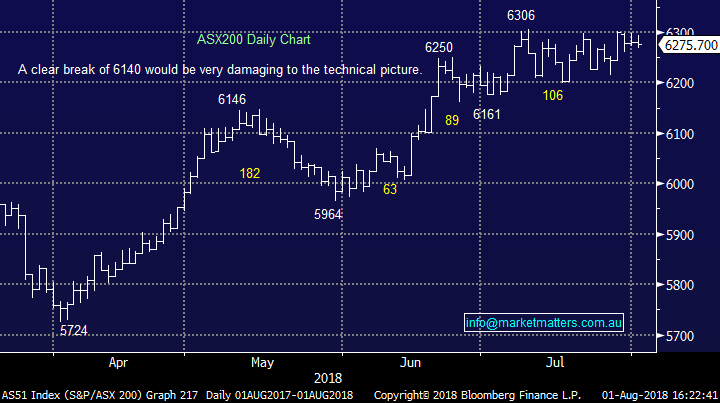

Overall, the ASX200 lost -4 points today or -0.07% to close at 6275 – Dow Futures are currently trading +23pts. We remain mildly short-term bullish the ASX200 while the index holds above 6250, neutral between 6250 & 6140 and bearish on a break of 6140.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

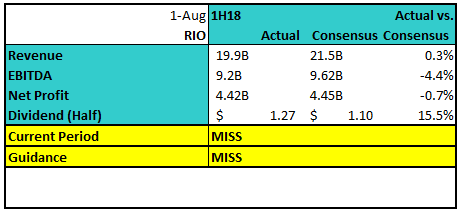

Reporting is now the main game in town and we had a few across the ticker today, with RIO Tinto just out. A quick run through the numbers however more to come tomorrow morning; All up a miss from RIO on most metrics bar the dividend and the buy back of a $1bn in the UK is a positive but probably not enough of one given the stock has run hard into these results. All up, I think this is a miss

RIO Numbers

One holding in the Income portfolio reported this morning, we had this to say in today’s Income Report:

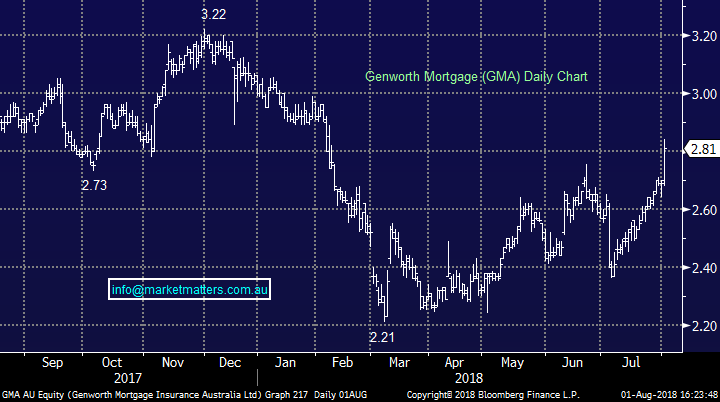

Mortgage Insurer GMA is the first stock in the MM Income Portfolio to report earnings (out this morning) and the result may have looked like a car crash for those new to the stock, however it was ‘less bad’ than the market was positioned for and the stock is currently trading up ~3% at $2.77 at time of writing. They reported a decline in earnings of around 50% yoy with new issuance written of A$10.3b, which was down 21% y/y – both as per expectations. Importantly, they re-confirmed their prior guidance (which the market liked) and their dividend remained stable at 12cps (including a 4cps special), putting it on a yield of 8.66% plus franking , or around 12%. This is a capital return story with the company having excess capital on their balance sheet given weakness in sales. Genworth closed at $2.81, up 4.46%.

Genworth (GMA) Chart

Broker Moves; reporting season adjustments playing from the brokers, with Creditcorp and Orocobre upgrade following positive updates, while Regis’ pain continues post a disappointing result. McGrath also saw some support following their EGM where guidance was confirmed yesterday.

· ARQ Group Ltd (ARQ AU): Raised to Buy at Bell Potter; Price Target A$3.75

· Credit Corp (CCP AU): Raised to Positive at Evans and Partners; PT A$22.36

· McGrath (MEA AU): Upgraded to Hold at Bell Potter; PT A$0.38

· Orocobre (ORE AU): Upgraded to Buy at Baillieu Holst Ltd; PT A$5.17

· Regis Resources (RRL AU): Cut to Underperform at RBC; Price Target A$3.75

· Reliance Worldwide (RWC AU): Rated New Neutral at Credit Suisse; PT A$5.70

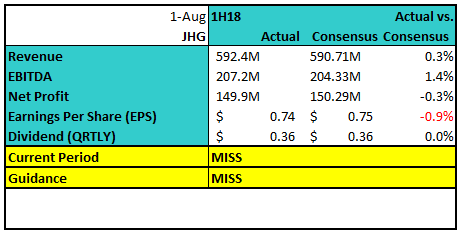

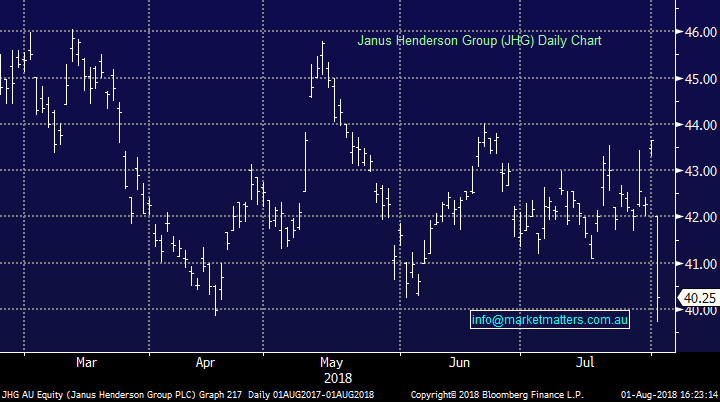

Janus Henderson (JHG) $40.25 / -7.79%; Global asset manager Janus Henderson reported their first half result this morning which also included the departure of co-CEO Andrew Formica. The result disappointed the market particularly around outflows and while the market wasn’t expecting inflows, Janus has struggled to stem the flow of money heading for the door. AUM fell 2.7% on an annualised basis in the quarter, in line with the previous quarter and it looks as though this trend will continue as performance was hard to come by in the quarter. The announced buy-back also didn’t garner any love from investors. Janus announced a $100m on market buy-back, which is ~1.5% of stock on issue but fell well short of many market pundits looking for a number closer to 2-3% of stock.

On the positive side, the cost out program following the Janus & Henderson merger is progressing ahead of expectations with the non-staff operating expenses expected at the lower end of the 12-14% guidance range – but not much else to write home about!

Janus Henderson (JHG) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here