Janus Henderson lose CEO and AUM

Stock

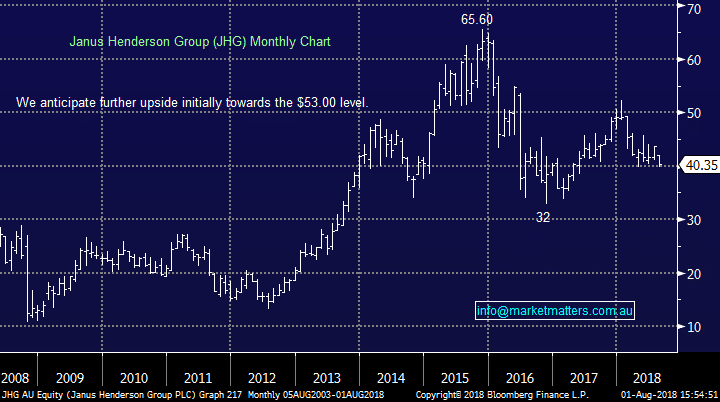

Janus Henderson (JHG) $40.35 as at 1/8/2018Event

Global asset manager Janus Henderson reported their first half result this morning which also included the departure of co-CEO Andrew Formica. The result disappointed the market particularly around outflows and while the market wasn’t expecting inflows, Janus has struggled to stem the flow of money heading for the door. FUM fell 2.7% on an annualised basis in the quarter, in line with the previous quarter and it looks as though this trend will continue as performance was hard to come by in the quarter. The announced buy-back also didn’t garner any love from investors. Janus announced a $100m on market buy-back, which is ~1.5% of stock on issue but fell well short of many market pundits looking for a number closer to 2-3% of stock. On the positive side, the cost out program following the Janus & Henderson merger is progress ahead of expectations with the non-staff operating expenses expected at the lower end of the 12-14% guidance range – but not much else to write home about! Janus Henderson (JHG) Chart