IVE Group (IGL) shares paying healthy dividends

IVE Group (IGL) +0.48%: Full year results today confirmed a solid year for the integrated marketing business as they navigated through some external challenges (higher input prices), the integration of new businesses, the expansion of some facilities and finally the transition to a new CEO just ahead of these results.

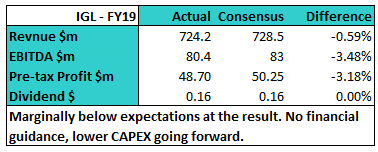

While the FY19 financial metrics were a slight miss in terms of market expectations (only 2 analysts cover), the stock was seemingly priced for a weaker outcome. Revenue was $724.2m, a slight miss on the $730m expected by the market, however it showed growth of 4.1% ton FY18, some of which came from acquisition while +2.4% cycled organically. Group pro-forma NPATA came in line at $37.5m versus market expectations of $37.1m. No guidance was provided although they did reduce capex expectations resulting in a likely improvement in free cash flow. They announced a dividend of 7.7cps FF for the half, taking the full year payout to 16.3cps fully franked.

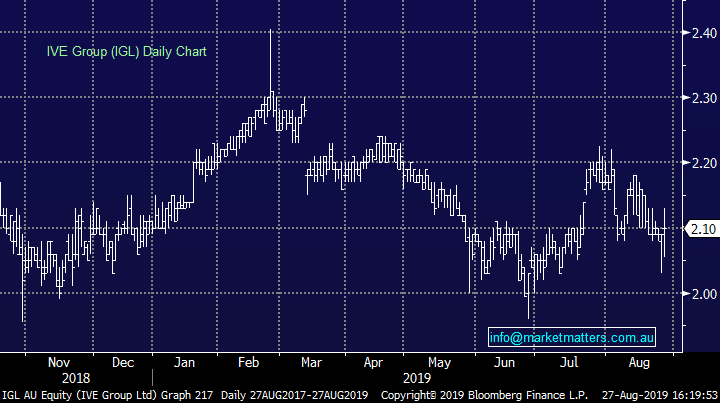

IVE Group (IGL) Chart

IVE Group (IGL) Chart