It’s not a stock market, but a market of stocks

Another attempt and another fail by the market today to break out of this frustratingly long trading range – now well into its 12th week between 5629 and 5836 – today the early high was 5792 set at 10.16am before a wave of selling buffeted the index before the midday low…it simply can’t back up solid days with sustained buying the following session, however we are seeing a lot of stock specific volatility – the old saying that it’s not a stock market, but a market of stocks is ringing very true at the moment.

Worth reiterating though, the mkt will break out at some point, and with volatility priced so low traders will be forced to scramble and moves will be amplified. We speak with a lot of trading desks around the mkt both here and in Asia and this theme is a known known, but it’s still hard to counter + active fund managers are being so squeezed by low cost passive funds they simply can’t afford to buy cheap protection. Anyway, it’s easy to comment on risk after it’s played out, rather than thinking about it ahead of time – at MM we’ve always tried to do the latter and sometime this can drag on for longer than we think - however it’s still a relevant concern for us, hence our high cash levels at the moment.

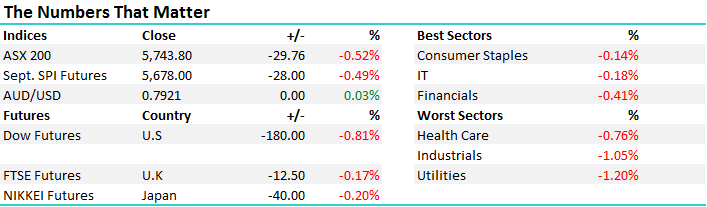

All the sectors were in the red today, the best in a relative sense was the staples down -0.14% while a weaker than expected result from Transurban dragged down the Utilities’ - an overall range of +/- 70 points, a high of 5792, a low of 5722 and a close of 5743, off -30pts or -0.52%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Transurban (TCL) – this is a stock we’re negative on, more in terms of the macro backdrop given the likehood of higher interest rates than anything in terms of how the company is progressing, however todays result was met with some selling after they missed slightly in terms of earnings. Dividend guidance of 56cps showed growth of +8.7% on pcp however it still puts the stock on a yield of around 4.7% unfranked in a rising interest rate environment. In simple terms, that yield looked better when Aussie 10 years were yielding 1.8%, but less so now we see a yield around 2.62% and that trend will continue as yields creep up. The stock closed down -1.84% at $11.72 today.

Transurban Daily Chart

James Hardie (JHX) - had a tough day after delivering a fairly mixed outlook. Again, this is a stock we’d avoid given headwinds in terms of the US building sector as rates rise and housing cools. Wage growth remains sluggish in the US despite good jobs data and so, we simply sit back and conclude there are better places to be invested. We have no interest in JHX. The stock closed down -5.79% today at $17.90

James Hardie Daily Chart

Elsewhere, IOOF (IFL) had a great session after beating expectations with earnings of $169m v $160m expected and a better dividend – the stock up + 6.05% to close at $10.70. SCA Property (SCP) was another out today with results and we like to keep a handle of trends here even though we don’t own the stock.

As a reminder, they own 75 grocery-anchored neighbourhood and sub-regional shopping centres in AUS, with WOW contributing 34% of gross rent and Coles 10%. In short, SCP has maintained pretty high occupancy in its portfolio and is still generating positive rental growth as well as sales productivity despite the challenging retail environment. This provides good read through for RETAIL REIT landlords.

SCA Property Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here