IT stocks start the week on the front foot, A2 Milk turns sour (A2M, GMA)

WHAT MATTERED TODAY

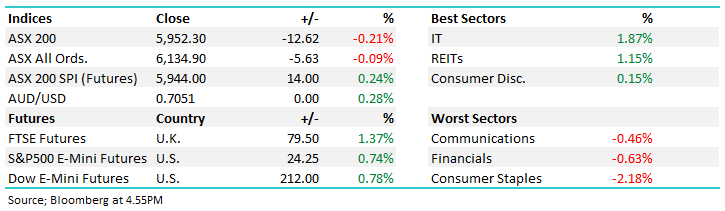

The market started the week off on the back foot today, although it was hardly a disaster given the strong rally we saw on Friday led by the influential banking sector. Best on ground today were the IT stocks which fits our view that it’s a sector primed for some near term outperfomance (hence our overweight stance) while the banks gave back some of Friday’s explosive rally, but not worryingly so.

Property remains in the spotlight and was strong again today, we can’t help but think buying some of these high-quality REITs at big discounts to the value of their assets should yield decent returns. The market is clearly negative retail exposed companies, however I found myself walking through Warringah Mall on the weekend pondering the future of such a facility. One trend I see time and time again in the market is investors become too bullish at the top and too bearish at the low. For those that think retail malls and the like are not dead, then Vicinity Group (VCX) and Scentre Group (SCG) are two ways to play it. Perhaps we’ll review this sector again in the Income Note this week.

Asian markets were higher today, Japan the best of them up by +1.32% while US Futures also rallied during our time zone.

By the close, the ASX 200 was off -12pts / -0.21% to 5952. Dow Futures are trading up +212pts/+0.78%

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

A2 Milk (A2M) -11.42%: shares hit today as the company talked down sales for the first half on the back of weaker daigou demand. Daigou sales are “a significant portion of infant formula sale in Australia & New Zealand” where local buyers export stock to China. While it hard to put a figure on diagou sales, A2 Milk is confident that demand for its products in China remains strong and the issue is logistical given direct sales continue to perform well.

At the full year result, A2 Milk flagged a weak first half on concerns pantry destocking would see lower demand and as a result, they did not provide guidance. The company now expects revenue of $NZ 1.8-$NZ 1.9b with EBITDA margins of 31%, a 10% miss at both the revenue and EBITDA lines. A2 has done almost the reverse of the rest of the market – shares performed well into the selloff but have underperformed since, particularly since the soft full year result. We suspect it continues to underperform here.

A2 Milk (A2M) Chart

Emeco (EHL) 5.06%: The stock rallied today, and it now looks like the shortfall shares have been taken care of. When stocks have large shortfalls during a capital raise, the overhang of selling can last a week or so, it looks to MM like the pressure on EHL is likely gone which sets up a good chance of a rally from current levels.

IOOF (IFL) 1.94%: We covered IFL in a recent MM Income Note – click here – talking about the prospect of the stock rallying once the shortfall shares have cleared. Last week, the stock price remained little changed on decent volume implying buyers and sellers were well matched. Like EHL, it looks to MM like the shortfall shares may have worked through and the stock could rally from here.

Boral (BLD) +5.83%: strength to strength for Boral – up to a 6 month high today on announcing Ryan Stokes and Richard Richards have been nominated to the board – Ryan being the MD and CEO of Seven Group Holdings (son of Kerry), and Richards being the current Seven Group’s CFO. We have noted Kerry’s interest in Boral a number of times over the past few months, and today cements the relationship with related parties of Seven Group now holding 19.9% of BLD shares on issue. It pays to have a wealthy supporter on the register – I can certainly picture a scenario where Seven Group takes Boral off the boards.

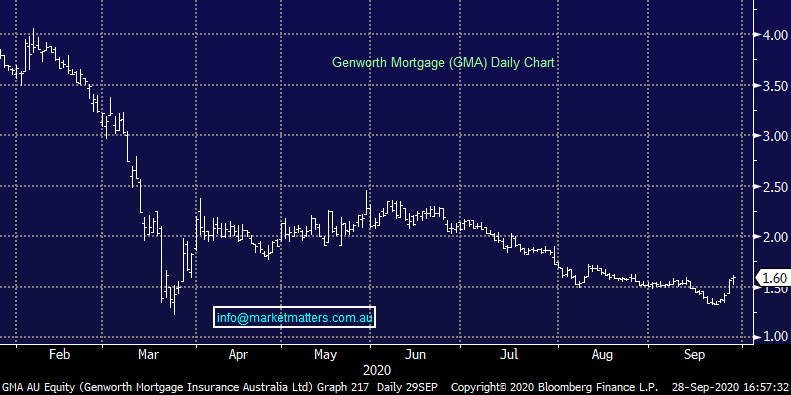

Genworth (GMA) +2.24%: The announcement last week around the availability of credit for the banks is bullish for Genworth. More demand for loans with higher LVR’s will increase the demand for mortgage insurance, which is obviously positive for such a provider like GMA. We looked at this for the Income Portfolio last week however unfortunately GMA is no longer in the ASX 200. This is a very cheap stock (trading 0.5x book) and a way of playing a ‘less bad’ outcome in domestic housing.

Genworth (GMA) Chart

BROKER MOVES

· Suncorp Raised to Outperform at Macquarie; PT A$11

· Iress Raised to Buy at Morningstar

· Medibank Private Raised to Neutral at Goldman; PT A$2.59

· Nearmap Rated New Buy at Jefferies; PT A$2.60

· Webcentral Grp Ltd Raised to Speculative Hold at Bell Potter

OUR CALLS

No changes today

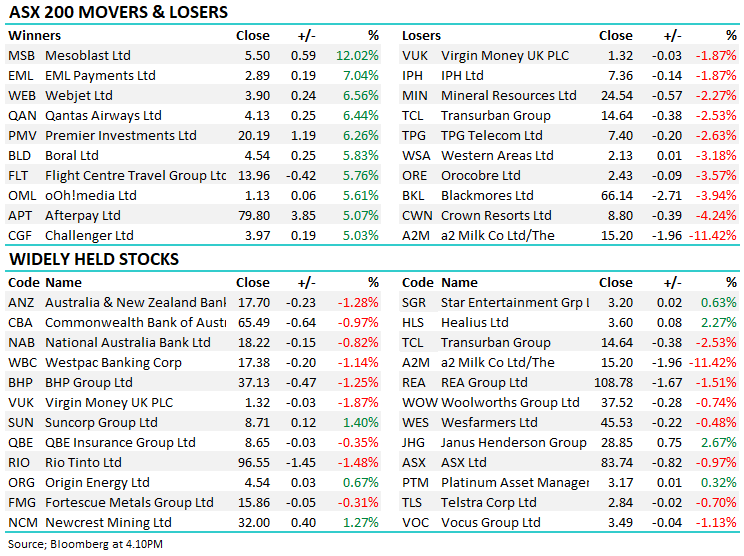

Major Movers Today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.