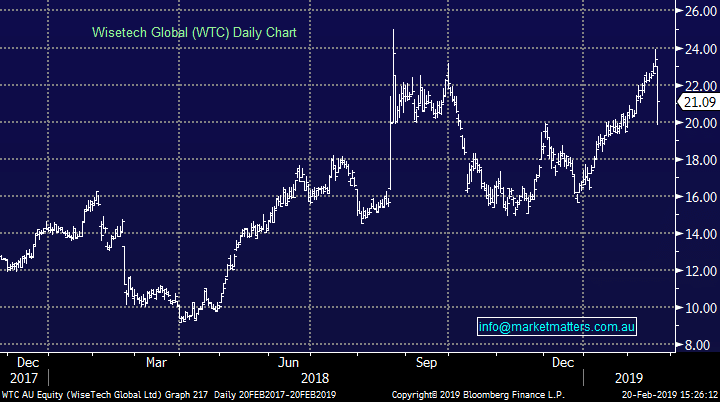

Is Wisetech (ASX: WTC) a wise investment?

Stock

Wisetech (ASX: WTC) $21.10 as at 20/02/2019

Event

Shares in logistic software company Wisetech (ASX: WTC) have tumbled today on a soft half year report. The stock briefly traded back below $20 today, a fall of more than 15% on yesterday’s close before staging somewhat of a recovery to currently trade around -10% for the session. As a reminder, Wisetech’s main product is a logistics platform that allows management of complex logistics transactions across a number of clients and countries.

Revenue for the 6 months was a beat as the tech darling continues to find strong growth levels, however a miss at the EBITDA line has the market concerned which despite showing 52% growth to $48.5m it came in 1.5% below consensus. Guidance was also a big factor in the stocks sell off, with EBITDA guidance for the full year coming in at $102m-$107m, over 7% below the consensus estimates for FY19.

The stock is highly valued, trading on an FY19 PE of around 100x and while earnings are not the driver here, it’s surprising that the stock is only down ~10% on the miss. No doubt the business is doing well, growing organically and through strategic acquisitions, but clearly missing expectations at this stage can be extremely painful for such a high flyer

Wisetech (ASX: WTC) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook