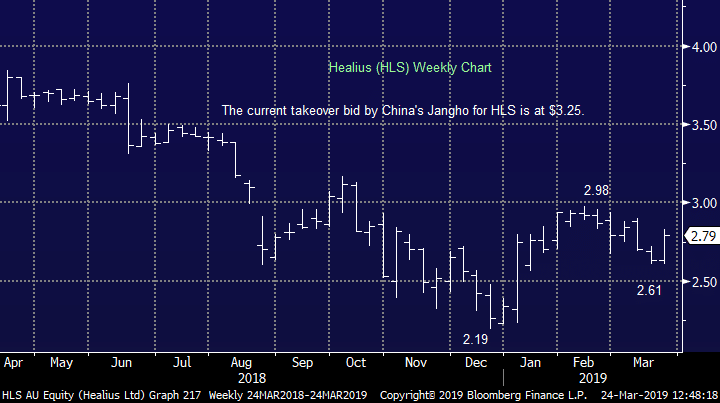

Is there value in the share price for takeover target Healius (HLS)?

The old ‘Primary Healthcare’ runs medical centres and pathology units and the stock has had an interesting 12 months, cutting earnings guidance and falling substantially but copping a takeover bid along the way , and rallying. 3 key points:

- Healius have a very good asset base that is not generating the earnings it should. While they’re not ‘cheap’ on an estimated P/E of 18x for FY19, it’s the asset base and the earnings potential of that asset base that is important.

- Their largest shareholder, Chinese based Jangho lobbed a takeover offer at $3.25 per share in early January which was rejected – described as opportunistic, undervaluing the business.

- After the stock pulled back by ~12% Market Matters bought the stock for two reasons. 1. The belief that the bid from Chinese suitor Jangho at A$3.25 has more credibility than the market was pricing in 2. If another bid didn’t eventuate, HLS was already in a turnaround phase, cutting costs and improving earnings.