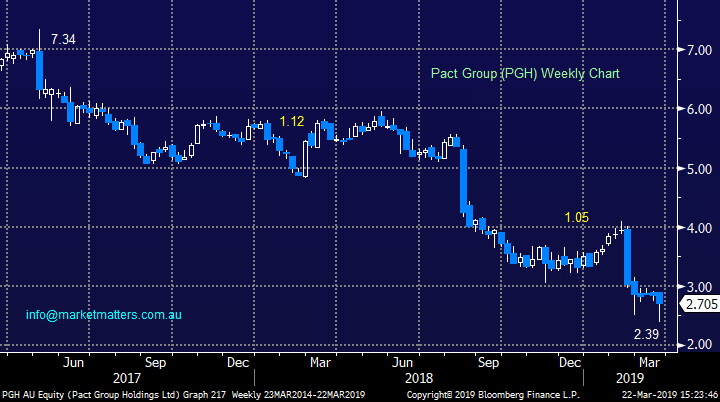

Does the decline in Pact Group (PGH) make it attractive?

Australian packaging business the Pact Group (PGH) has fallen more than 50% in the last 12 months. Weak earnings in a business that has high debt levels is not a good combination. However, what if the market is pricing in too much negativity, what if their debt position becomes manageable? 3 key points;

- PGH is cheap versus the sector and versus itself historically – trading on an FY19 P/E of ~11.3x relative to its long term overage of ~14.2x and a packaging sector globally that trades on ~20.5x forward earnings

- A large sell down of 26 million shares by UBS at a ~9% discount to market – about 7.5% of the company took place last week with hedge funds reportedly taking the line of stock – smells like short covering.

- The short thesis on PGH revolved around their perceived need to raise equity as they approach bank lending covenants, however this stock is controlled by Raphael Geminder and talk of privatisation makes sense. Our opinion is any privatisation would need to be closer to $4