Is National Storage (NSR) an M&A target?

NSR +2.99%: I had a chat with Livewire Markets today about M&A ticking up which is a function of low rates, excess liquidity and cashed up private equity, three key ingredients. They asked for a few M & A targets and aside from Crown (CWN) which we think will attract a higher bid, National Storage (NSR) is another M&A candidate in MM’’s view. We covered the rationale for this in early April, and the stock is down marginally since then, however it still stacks up.

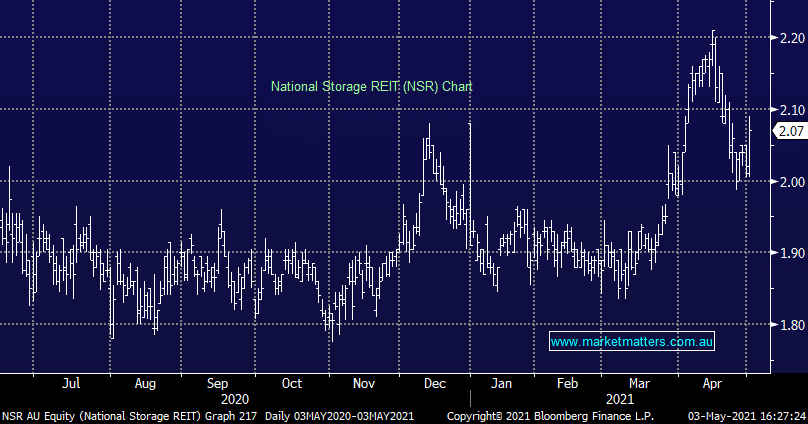

A little over a year ago, the owner of around 200 storage assets in Australia & New Zealand was the subject of a 3 way takeover tussle, with 2 bidders offering $2.20 per share while a 3rd, the Large US listed Public Storage went in hard at $2.40. The deal looked like getting done however along came COVID and the extreme market volatility saw the bid pulled. Now there’s talk of a revitalised bid and private equity firm Blackstone is also being thrown into the mix.

Abacus (ABP) is also a player in this game, they own Storage King and have made it clear that self-storage is an area of focus for them. They also own 9.9% of NSR, although we doubt they will actually make a full tilt at the company, it’s more an opportunistic position.