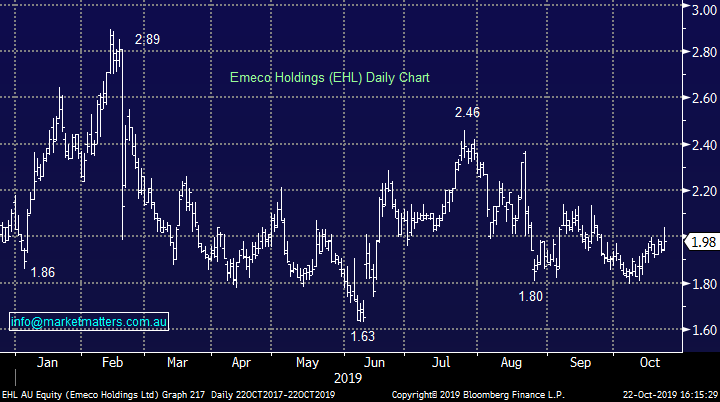

Iron ore helps the market edge higher (WHC, SAR, COH, EHL)

WHAT MATTERED TODAY

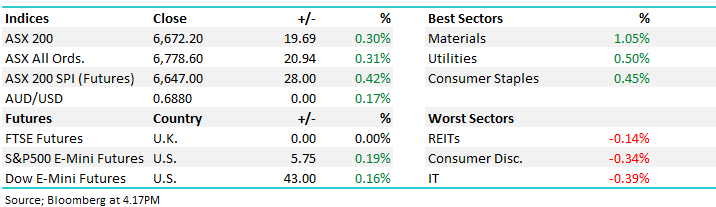

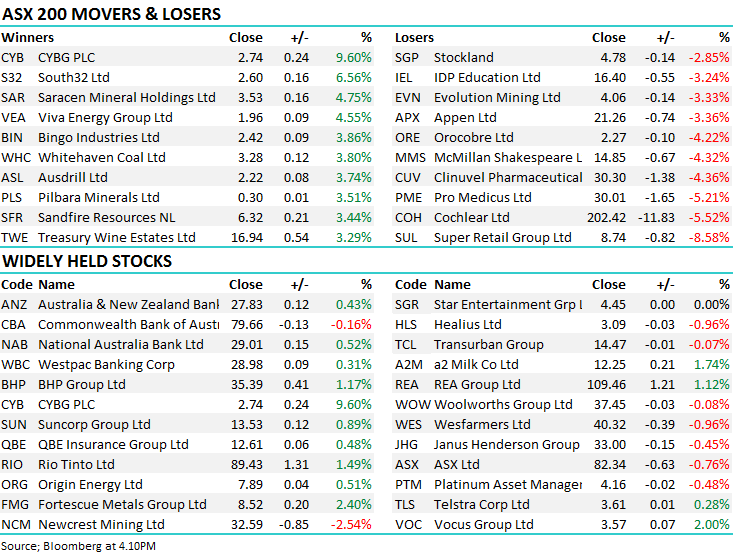

A choppy start to trade this morning before the market found its groove and traded higher, the recently beaten up resource stocks the main driver as money flowed back into Iron Ore names in particular, Fortescue (FMG) up +2.4% while RIO added +1.49%. Golds were down again as money flows out of precious metals – our previously discussed concern around the sector playing our, although we sill hold positions in NCM & EVN that are starting to bite. Saracens (SAR) out today with a good 1Q update, we cover that along with a good update from Whitehaven Coal (WHC) below.

At a sector level today, the Materials offered most support adding a reasonable +1.05%, while the IT sector dragged again, although less so than previous sessions off by 0.39% - although Wisetec (WTC) didn’t trouble the scorers today with the trading halt in place. Asian markets were marginally up or down but not a large influence while US Futures were positive

Overall, the ASX 200 closed lower today, off -51pts or -0.77% to 6684, Dow Futures are trading down -31pts/-0.12%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Quarterly Production Reports…The September quarterly production reporting is keeping things ticking over at the moment - today alone we’ve seen the following companies update:

Orocobre (ORE): -4.22% on a 10% fall in production vs the June quarter with lithium prices less than half of levels seen in pcp.

Saracen (SAR): +4.75%, out with lower than expected cost guidance alongside production annualized above the top end of guidance. Saracen are set to pay their first dividend this financial year…more on this one below

Gold Road (GOR): -0.49%, despite guiding to the higher end of the range for production while costs are set to fall as production ramps up.

Oil Search (OSH): -0.35%, missed with revenue falling 5% from the previous quarter with lower oil price and production.

Independence Group (IGO): +2.56%, earnings surged along with copper production. Costs climbed but the company maintained guidance.

Whitehaven (WHC) +3.8%; one of the better resource stocks that reported today trading to a one month high. The miner saw coal production up 22% in the quarter thanks for the most part to the Narrabri mine where production doubled vs pcp. The outlook commentary from Whitehaven was also upbeat. Coal prices have been in reverse over the last few years with the average price received for both thermal and met coal falling around 30% in the year. Now the company is seeing lower seaborne thermal coal as high cost producers are forced to cut back, while signs of life appear in demand from China. The met coal side is a little more subdued with the trade war impacting demand.

Whitehaven Coal (WHC) Chart

Saracen Minerals (SAR) +4.75%: SAR was out this morning with a good set of 1Q production numbers plus they reaffirmed full year production guidance for 350,000 to 370,000 oz. 1Q gold production came in at 96,324 oz on an all-in sustaining costs/oz of A$964. For the full year they still expect an all-in sustaining costs/oz A$1,025 to A$1,075. They announced an inaugural dividend policy to apply from FY20, targeting a payout equal to 20-40% of NPAT, subject to a few conditions being met which includes reaching and maintaining a minimum cash balance of A$150m

A good set of numbers this morning for the gold producer and shares have bounced as a consequence, up more early on however still managed to trade in the black against a weak gold sector, Newcrest (NCM) down -2.54%, Evolution (EVN) down by -3.33%

Saracen Minerals (SAR) Chart

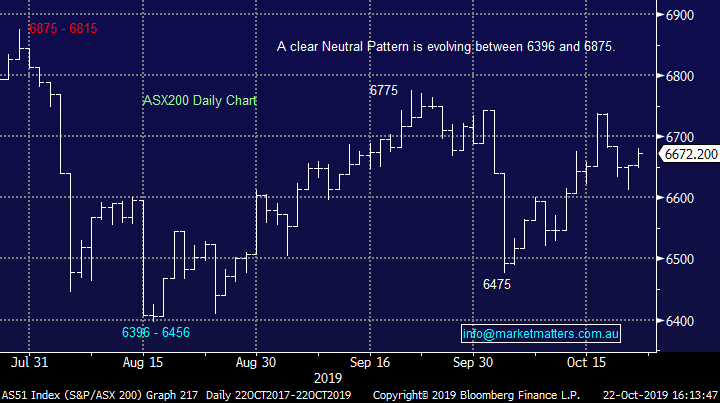

Cochlear (COH) –5.52%; Out today re-confirming FY20 expectations for net income A$290million to A$300 million , market expectations were currently at $297m however COH is a company where the market tends to expect beats. They said growth is expected to broadly continue across the business in FY20, the market already penciling in ~10% earnings growth. COH is an example of the higher value stocks we have no interest in at present.

Cochlear (COH) Chart

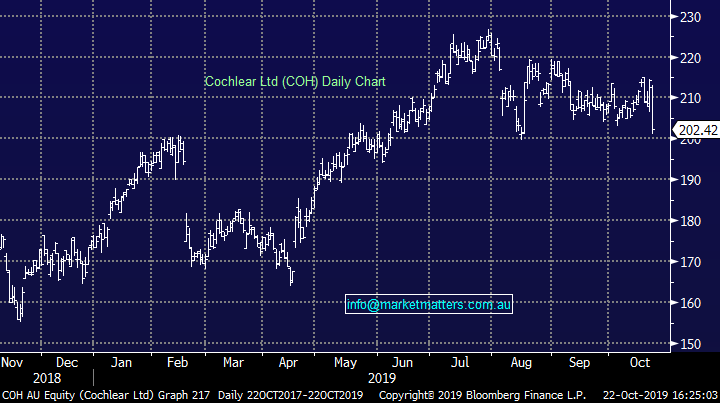

Emeco (EHL) +1.8%; Had to address media speculation this morning about a proposed acquisition of BGC Contracting with EHL coming out saying what they always do – they are looking, but its one of many they are running the ruler over and nothing is advanced to warrant disclosure. We own EHL in the Growth Portfolio.

Emeco (EHL) Chart

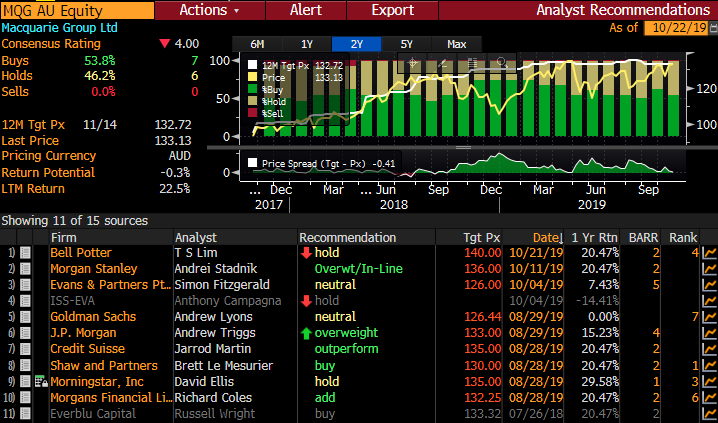

BROKER MOVES; Bells have generally been very bullish on Macquarie (MQG), the most bullish on the street however today they cut their rating to HOLD, although retained the $140 PT. Macquarie closed today at $132.89, off just a marginal -0.19%.

Elsewhere…

· Stockland Cut to Underperform at Macquarie; PT A$4.46

· Stride Property Cut to Neutral at Macquarie; PT NZD2.41

· Goodman Property Cut to Neutral at Macquarie; PT NZD2.22

· Argosy Cut to Underperform at Macquarie; PT NZD1.38

· Precinct Properties Raised to Outperform at Macquarie

· Amcor GDRs Rated New Underperform at Jefferies; PT A$12

· Syrah Cut to Sell at Canaccord; PT 40 Australian cents

· St Barbara Raised to Sector Perform at RBC; PT A$3.25

· St Barbara Raised to Buy at Argonaut Securities; PT A$3.09

· Brambles Raised to Buy at Goldman; PT A$14.10

· Macquarie Group Cut to Hold at Bell Potter; PT A$140

· Sonic Healthcare Rated New Hold at Jefferies; PT A$30.25

OUR CALLS

No changes today, although Boral (BLD) continues to look interesting here

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.