Will the RBA actually cut interest rates?

The ASX200 continued its grind higher yesterday advancing another 20-points to make Decembers plunge towards 5400 almost feel like a distant memory. The market is now well above the highs of December and less than 2% from Novembers high having retraced 44% of last year’s 963-point / 15% correction from the August 6373 high. The MM view of a 2019 high around 5950 - 6000 may get challenged sooner rather than later - it feels to me like fund managers are being forced into buying this current strength (FOMO) given most managers had a very tough year performance wise in 2018.

When we put things into perspective markets usually bounce ~50% after they have completed a decent correction so this is nothing out of the ordinary. Standing back / looking bigger picture, in our view the decline was aggressive but it’s now completed, however the bounce from the December low is showing signs of exhaustion. The short term technical picture is slowly starting to go from amber to red: The monthly range is becoming extended i.e. if we remove the 2 extreme outliers from 2018 the average monthly range was ~260-points, this January we’ve already enjoyed a 283-point advance.

MM remains in moderate “sell mode” looking to increase our cash levels from the current 17% in the MM Growth Portfolio.

Overnight US markets were strong following solid results from Goldman Sachs and Bank of America, plus the survival of Theresa May in the UK helped steady the equities ship – the ASX200 has continued to pick the US very well over recent weeks. Reporting in the US tonight will be interesting with Morgan Stanley along with Netflix out with results. Netflix is up +30% in the first two weeks of the new year after raising prices on their 58 million subscribers in the US.

The other snippet from last night that caught my eye came from Blackrock, the world’s largest asset manager showing net outflows for the quarter, the first time since 2016 taking their overall FUM to just under $US6 trillion.

ASX200 Index Chart

US stocks were trading up ~200-points at 7am this morning following the good start to the US earnings season, however tapered off slightly into the close. Financials the main driver while the Tech names underperformed.

MM is looking for choppy range bound trade in 2019, with a marginal upside bias - a “best guess” eventual target for the Dow around 26,500.

US Dow Jones Index Chart

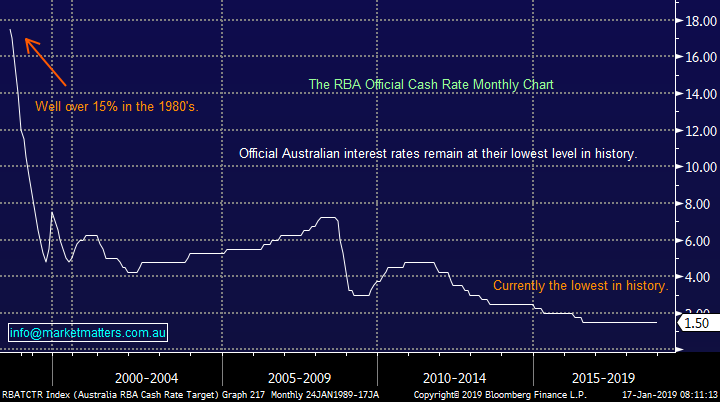

The interest rate conundrum

We witnessed an almost perfect “about face” last year from most of the market on interest rates with the start of 2018 all about rising interest rates / bond yields on the back of bullish economic & stock market predictions, while the second half focussed on a looming recession and hence falling bond yields – interestingly both scenario’s led to aggressive sell offs in stocks who appear to like things just as they are i.e. we’ve been in a sweet spot for assets for almost a decade and changing dynamics = more volatility.

The below map shows how economists see major central banks altering interest rates in 2019 ; 3 quick takeout’s:

1 – The market is expecting Australia to cut rates with a falling housing market undoubtedly having a huge impact here.

2 – The US Fed is expected to continue its path of raising rates.

3 – Most of the Emerging Markets are expected to maintain their current levels.

Bloomberg Central Bank Outlook

The futures market is targeting a cut in local rates next year but we question whether trimming things further from the already lowest in history 1.5% will have any impact. The housing market which is scarring many is not falling because of interest rates, it’s been an engineered policy decision by bureaucrats who are now scarred they’ve gone too hard too fast – wouldn’t be the first time!

We could follow many and write pages on this subject but the end conclusion will remain the same - 1.5%, or 1%, in our opinion will have no meaningful impact on the Australian economy with the exception perhaps of offering a shot in the arm for confidence which admittedly is sometimes what’s needed.

While a downturn in the local property market is having a detrimental impact on consumer spending initially taking over 1% from growth, this is not yet pushing us into recession. For Australia to finally experience the “big R” China probably needs to keep slowing which would put pressure on commodity prices – this is obviously a possibility, especially with the Trump factor lurking in the wings, however it’s not the ‘base case’ in our view.

If China holds together, maintains stimulus and the US / China trade negotiations are settled, the RBA will not cut rates in our view

RBA Official Cash Rate Chart

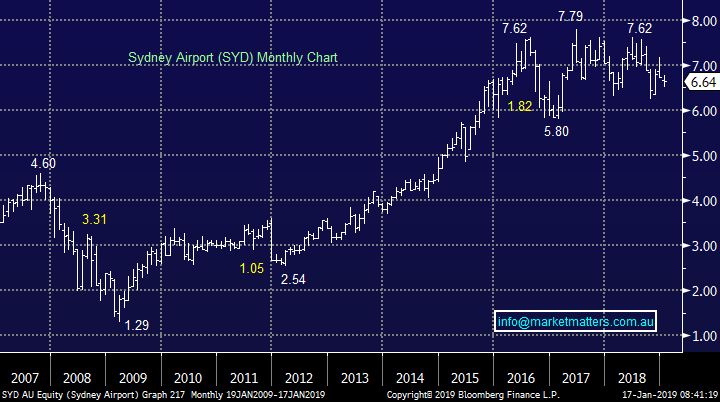

However what matters the most to MM is what stocks will perform the best in 2019 due to the RBA’s actions, or perhaps their inaction. Over the last year the “yield play” stocks like Transurban (TCL) and Sydney Airports (SYD) have essentially trod water hence putting in a better performance than the underlying ASX200 which has been weak. That implies that lower rates have been factored into market / pricing of these sort of stocks.

If we’re wrong and current market pricing is right what stocks would benefit? Property is the obvious one, however the main beneficiaries we think would have commercial / office exposure rather than residential given residential has a higher degree of emotional bias connected to it plus retail landlords would still struggle. Transport and utilities generally do well while infrastructure would rally from here - stocks generating overseas earnings would also benefit from the decline in currency.

Unfortunately, our view remains that they won’t cut rates which goes against current pricing / positioning by the market, and for that reason we can see no exciting risk / reward in the stocks / sectors that would benefit from lower rates.

However, markets are fluid and unlike last year where our view was for rates to track higher, our view this year that rates will stay largely flat means we’re now open minded to buying these stocks if good risk / reward presents itself.

Sydney Airport (ASX: SYD) Chart

Conclusion

Overall, we remain in “sell mode” at current levels, looking to increase cash to buy future weakness.

We do not believe the RBA will cut rates in 2019 or 2020 unless the economy deteriorates markedly.

However we doubt rates will go up and will consider buying the “yield play” stocks if a suitable / risk reward opportunity presents itself.

Overnight Market Matters Wrap

- The Dow and broader S&P 500 edged higher overnight, with help by the financial sector as investors embraced solid earnings by Goldman Sachs and Bank of America. Locally we expect Macquarie Group (MQG) to outperform the broader market today.

- Earlier, European markets were mixed in the wake of the widely anticipated Brexit vote failure in the UK, with both the German and French markets up 0.4%-0.5% respectively, with the UK market 0.5% lower. Overnight UK PM, Theresa May’s government has survived a no-confidence vote in the wake of the Brexit defeat.

- The March SPI Futures is indicating the ASX 200 to open 12 points higher, testing the 5850 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/01/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.