Will the best performers keep running? (EML, CSL, ELD, ANN, VOC)

Before we get into today’s note, I just wanted to share an exert of an email we received yesterday from a subscriber. We often get positive emails that we don’t share, although we also get the odd negative one when a stock we suggest doesn’t work out, however this one typifies why Market Matters exists, why we do what we do, and it simply put a massive smile on my face. With so much negativity about the advice space in the media, some warranted, some not, as a subscriber to Market Matters you can rest assured will simply write what we see and try hard to add value each day.

Hi Team, Thanks for a great and profitable service over the last year or so—don’t ever stop!!! Happy Belated New year to all. I have been running my own SMSF portfolio for many years, but became disillusioned with the “advice”/newsletter/broker industry in general and sold the lot and replaced everything with my own system picks just after Trump was ushered in. Since then I’m happy to say I’m 45% up (excluding all the nice dividends) with low risk stocks , and my “old experts” portfolio would have shown maybe 10% growth for the period...I have you MM guys to thank for quite some of that—so thanks. Cheers Paul

The ASX200 enjoyed a reasonable recovery following the market carnage on Tuesday when the potential economic implications of the coronavirus sent investors running for the exits. Not surprisingly Wednesday was pretty much a role reversal of Tuesday with the gold sector noticeably weak while the banks, IT and healthcare stocks led the recovery. Unfortunately we feel the coronavirus epidemic may have further to play out with 132 already dead and over 6000 infected, it feels too early to become optimistic conversely the market is rapidly becoming resilient to the day to day negative news flow.

An interesting statistic crossed my desk last week which almost perfectly “rang the bell” on the January rally – figures from CBA showed that in Q3 of 2019 the amount of money tied up in margin lending increased by over 50% from levels where it had remained for almost 3-years, in other words people are leveraged long which can create short-term acceleration on the downside if / when a pullback unfolds, plus importantly now some “hot money” has finally entered the market further advances may encounter selling.

At this stage MM’s preferred scenario is the correction of the 2020 blockbuster rally from below 6700 has further / longer to unfold, however a break of this week’s low will have us donning our buyers hat, not panic selling into the weakness.

MM remains bullish the ASX200 while it holds above 6930.

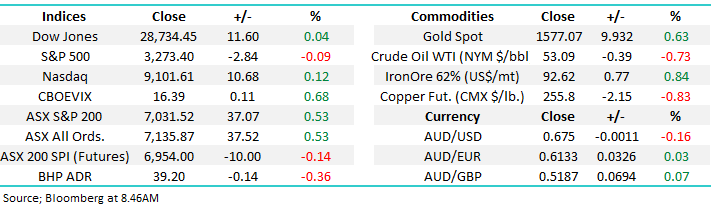

Overnight, the US Federal Reserve kept rates on hold as expected, although stocks traded back from earlier highs, the Dow Jones was up more than 200pts before ending the session flat, while the SPI futures are suggesting a 10pt decline on open.

Today we’ve looked at 5 of the best performers over the last month to see if they can maintain their momentum – statistically buying strength in the stock market pays off, especially during results.

ASX200 Chart

US stocks have recovered over 50% of their recent losses but on balance we continue to feel the risk / reward favours another leg lower in the correction of the 17% advance from their October swing lows.

MM is still looking for lower levels before considering buying opportunities.

US S&P500 Index Chart

Yesterday saw Hong Kong stocks whacked almost 800-points / 2.8% illustrating the relative isolation of the concerns around the coronavirus and of course how bad things could become for stocks if its spread accelerates globally.

MM still likes Asian stocks into current weakness.

Hong Kong’s Hang Seng Index Chart

As we touched on in yesterday’s afternoon note “confession season” (just before reporting season) regularly produces some landmines on the stock level and to-date 2020 is no different, over the last 5-days we’ve seen CIMIC (CIM) -16%, Downer EDI (DOW) -18.2%, and now Treasury Wines (TWE) -28.6%; this is one of the reasons we trimmed our Pact Group (PGH) position yesterday, you never know when a great opportunity might be about to present itself at this time of year.

Wednesday saw Treasury Wines (TWE) crushed over 25% following the pre-release of their 1st half result, it was a shocker, EBITS collapsed 26% with falling volume and priceand that’s before the board even considered the implications of the coronavirus. These numbers combined with lower guidance for the next few years ahead puts the stock firmly in the too hard basket for MM – the technicals might look interesting but in this case the fundamentals do not support being a hero at this stage.

MM is neutral at best TWE.

Treasury Wines (TWE) Chart

The likelihood of an interest rate cut by the RBA next week were almost totally dashed after the consumer price index (measure of inflation) rose by 0.7% for the December quarter although interestingly the bond market continues to tread water eventually looking likely to break to the upside in the weeks / months ahead i.e. lower rates still look on the cards in 2020.

MM remains bullish the Australian 3-year bonds i.e. short term lower yields.

Australian 3-year Bonds Chart

Evaluating the 5 best ASX200 stocks over the last month.

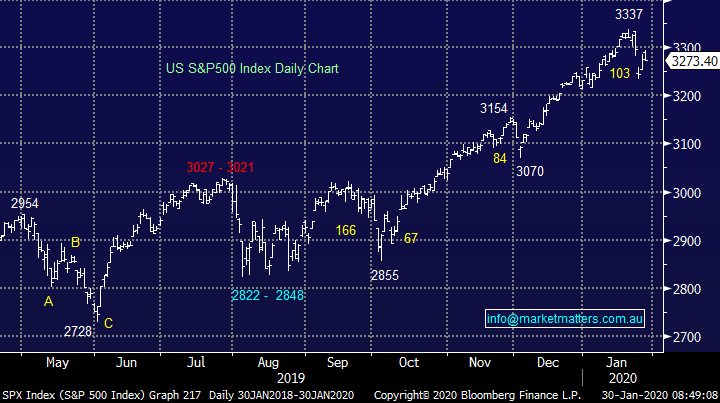

Overnight Apple rallied ~3% to fresh all-time highs as it reported better than expected revenue of $US91.8bn, the worlds largest company now has a remarkable market cap in excess of $US1.4trillion. To put this into context, the entire Australian share market has a value of A$2 trillion, which is about the same when translated back into USD terms.

We remain bullish Apple and continue to be buyers of pullbacks as opposed to sellers of strength, similar to the overall market.

MM remains comfortably long Apple in its International Portfolio.: https://www.marketmatters.com.au/new-international-portfolio/

Aftermarket in the US, we’ve also seen Microsoft beat and rally +2%, Tesla rally +6%, while Facebook has fallen by -6%.

Today we have looked at 5 of the last months superstars, all of whom have rallied over 10%, to see if anything looks to have the potential to at least in part emulate Apple. As we mentioned earlier statistically buying strength/ stocks making fresh all-time highs is a better investment strategy than buying companies in reverse whose shares have fallen say 10%.

NB We have not included any gold stocks due to the obvious impact of the coronavirus.

Apple Inc (AAPL US) Chart

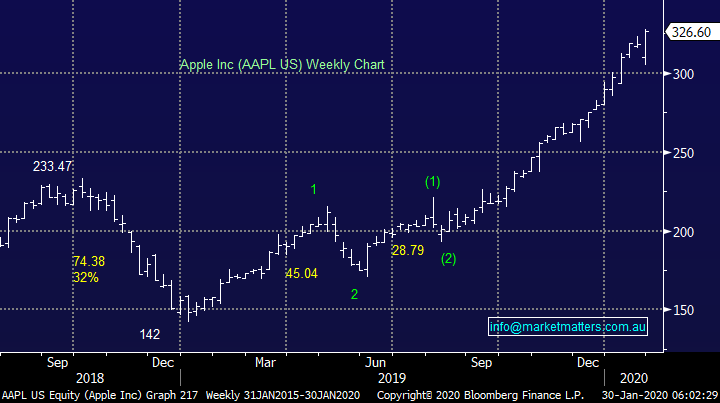

1 EML Payments (EML) $5.24

Payments solution provider EML has rallied almost 12% over the last month adding to the excellent gains of the last year, helped by its addition to the ASX200. For subscribers who aren’t familiar (knowingly) with the business it operates in 3 main areas: EML is the largest global player of gift cards, it offers reloadable cards often used by bookmakers and lastly it offers virtual secure account numbers for payments between businesses.

The stocks rallied on the back of strong organic growth and strategic acquisitions sending Q1 revenue up 35% to over $23m with guidance pointing to annual growth of ~40%, hence its Est P/E for 2020 of 54x is not too scary. We like the business but the stock appears to experience a pullback of ~15% every month or so hence chasing strength doesn’t feel logical.

MM likes EML ~$4.50.

EML Payments (EML) Chart

2 CSL Ltd (CSL) $316.09

CSL is arguably Australia’s largest stock market success story and it continues to rally gaining almost 13% over the last month, probably getting a tailwind from the coronavirus outbreak. This is a wonderful business which we underestimated when we took profit too early in 2019, the question now is where to go long – the current Est P./E for 2020 of over 45x is on the rich side but the business keeps delivering. They also employ very conservative accountancy practices around their substantial R&D spend which is laying the foundation for future earnings growth.

Since the stock bottomed in late 2018 its had 4 pullbacks of 5-8%, we feel it makes sense to be patient at this point in time.

MM likes CSL into its next 5-8% correction.

CSL Ltd (CSL) Chart

3 Elders (ELD) $7.28

Agribusiness Elders (ELD) has enjoyed a return to the winners enclosure in January gaining almost 13% following a tough few years. The obvious question being is ELD a weather assisted turnaround story or are we just witnessing an easy of the bushfires relief rally, a combination of the two is our likely feeling. We like backing an Australian farming businesses but clearly they come with a number of risks and we would only be considering with clear stops in place.

MM is bullish ELD with stops below $6.70 i.e. 8% risk.

Elders Ltd (ELD) Chart

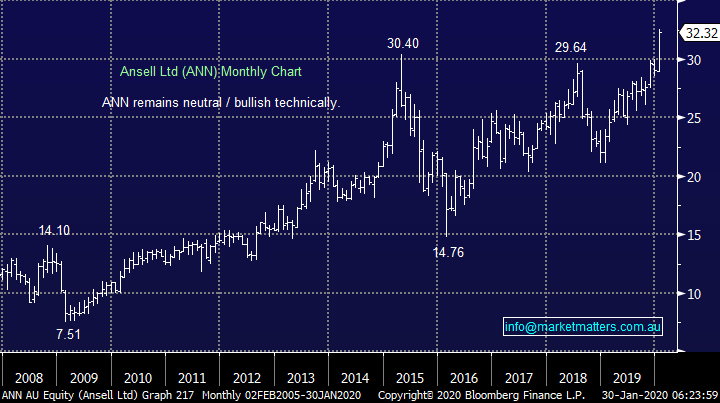

4 Ansell (ANN) $32.32

Ansell (ANN) has broken out to fresh all-time highs this month gaining over 10% in the process, overall its no great surprise considering the company makes the likes of face masks, gloves and protective suits i.e. its one company that should benefit from the coronavirus breakout. However it should be noted that the stock was rallying nicely prior to the issues in China, they’ve just been the icing on the cake.

Cutting costs and a transformation story has assisted the solid but not spectacular earnings growth in recent years, plus BREXIT and US / China trade clarification are big pluses for this healthcare stock, but is this as good as its gets?

We like the stock’s defensive / predictable earnings qualities although growth in the coming years will likely be low / mid-single digits at the earnings line, although it’s not overly expensive trading on an Est P/E for 2020 of 18.7x.

MM is bullish ANN while the stock remains above $29.50.

Ansell (ANN) Chart

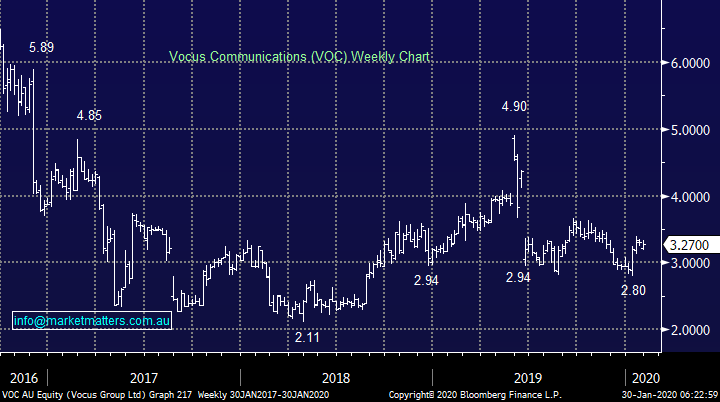

5 Vocus (VOC) $3.27

Lastly telco Vocus (VOC) who has finally rewarded loyal investors with a gain of almost 11% in January on no major company news although the stock is enjoying some meaningful insider buying in 2020 including the CEO buying almost $600k’s worth - that’s real director backing! We feel this $2bn business has been in the proverbial naughty corner for long enough and it’s starting to show some excellent value & risk / reward.

MM is bullish VOC with stops below $3, or 8% risk.

Vocus (VOC) Chart

Conclusion

Of the 5 stocks looked at today zero feel like a sell although the risk / reward is not too exciting on a couple, at todays prices our preferred stocks in order are as follows: Vocus (VOC), CSL Ltd (CSL), Ansell (ANN), Elders (ELD) and EML Payments (EML).

We’d prefer to be buyers into a pullback of the strong trend in the likes of CSL & EML.

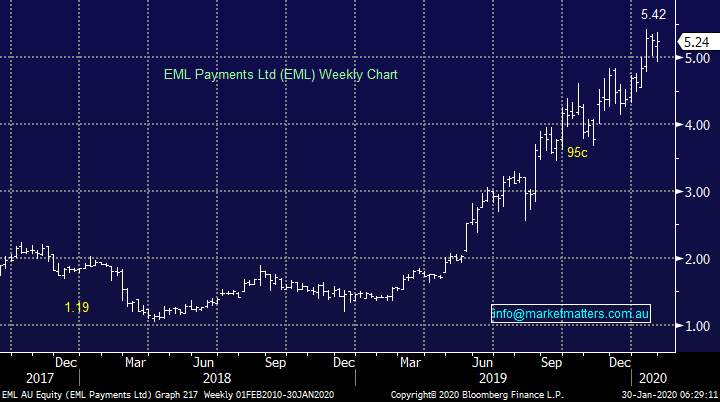

Overnight Market Matters Wrap

- The US equity markets closed little changed overnight, having lost some of its early gains in the last hour of trading. This followed the Federal Reserve decision to leave interest rates on hold, while investor sentiment was boosted by stronger than expected quarterly earnings results.

- Commodities remained muted with Dr. Copper (the highly regarded indicator of global growth) continued lower on concerns of China’s growth being hurt by the growing risks of the coronavirus.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of 0.36% from Australia’s previous close.

- The March SPI Futures is indicating the ASX 200 to open marginally lower towards the 7025 level, with January equity options expiry this afternoon.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.